Market Statistics

| Study Period | 2019 - 2030 |

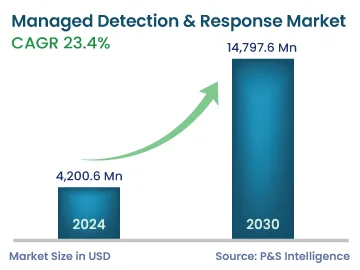

| 2024 Market Size | 4,200.6 Million |

| 2030 Forecast | 14, 797.6 Million |

| Growth Rate(CAGR) | 23.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12809

Get a Comprehensive Overview of the Managed Detection & Response Market Report Prepared by P&S Intelligence, Segmented by Service (Threat Detection, Threat Monitoring, Incident Response/Termination), Security Type (Endpoint, Network, Cloud), Deployment (On-Premises, Cloud), Organization Size (SMEs, Large Enterprises), Vertical (BFSI, IT and ITeS, Government, Energy and Utilities, Manufacturing, Healthcare, Retail), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 4,200.6 Million |

| 2030 Forecast | 14, 797.6 Million |

| Growth Rate(CAGR) | 23.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The managed detection and response market size is estimated at USD 4200.6 million in 2024, and it is expected to advance at a compound annual growth rate of 23.4% during 2024–2030, to reach USD 14,797.6 million by 2030.

The growth can be primarily ascribed to the increasing penetration of IoT and other advanced technologies. Moreover, the growing focus on the real-time monitoring of data and the increasing occurrence of cyberattacks are driving the growth.

Based on service type, threat detection dominates the market, attributed to the rising need to prevent breaches by detecting the indicators early. Threat detection tools are able to identify anomalies, faults, and threats in network traffic. The risks are analyzed rapidly, by adding context to security warnings. Furthermore, the increasing demand for large-scale surveillance systems and the rising incidence of geopolitical instabilities and terrorist activities are propelling the demand for such software. Governments in several nations are also implementing regulations for the protection of devices and data, which is further propelling the market.

Network security holds the major share, owing to the increasing volume of cybercrimes, rising need for the protection of sensitive information, and proliferation of mobile devices. In 2022, more than 4,000 data breaches were reported. Data breaches can cause several serious problems, including asset infringement, reputation destruction, and identity theft.

Therefore, network security becomes important because it protects important and sensitive information. Further, the enhancements in hacking techniques and the burgeoning adoption of the 5G technology are propelling the network security category.

The cloud security sector is growing significantly too, as many SMEs and large enterprise are expanding their cloud-based operations. Additionally, companies are adopting hybridized cloud environments, where cloud security solutions can be easily deployed.

Cloud deployment is contributing the higher revenue, holding a share of 65%, in 2023, because customers can access such solutions with the help of internet, which is quite easy. This deployment mode is used by corporate network managers, mainly in IT-centric organizations, in order to protect devices. In addition, it provides cost benefits, prevents hypercalls, hyperjacking, and DDoS attacks, is easy to implement and scalable, entails low operational costs, and makes it simple for various departments to collaborate.

On-premises deployment is expected to show considerable growth too, because software deployed on on-site systems offers an optimum level of data safety and restricted access. This is especially beneficial for large organizations that have their own IT infrastructure and a lot of dispersed devices and data to maintain.

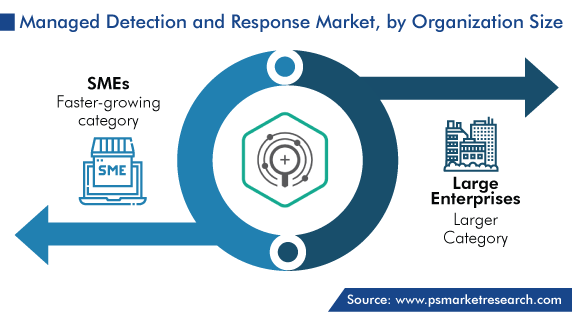

Small and medium-sized enterprises are expected to show the faster growth, attributed to the increasing number of cyberattacks and the rising penetration of several advanced technologies in place of the traditional ones in these firms. A managed detection and response approach ensures the robust safety of SMEs’ valuable assets and guards them against advanced and persistent threats. Thus, various companies are launching such cybersecurity solutions specially for smaller firms. For instance, in March 2023, NTT launched a scalable, cloud-native managed detection and response security service, which will help in improving cyber resilience.

BFSI applications are expected to witness the highest CAGR, of 23.7%, ascribed to the growing count of financial data breaches and other types of cyberattacks, which is driving the BFSI sector’s spending on such solutions. Banks and financial institutions have a lot of customer information, safeguarding which is important, to satisfy customers and comply with governments’ data protection regulations.

Moreover, the rising digitalization rate and the growing trend of online payments through various apps and credit/debit card machines are propelling the demand for these solutions among BFSI firms. Because of cyberattacks, banks and financial institutions suffer the damage of reputation and finances, and they have to spend a lot to get the data back, if it is seized. This makes managed detection and response solutions important here, as the loss of customer data and money can have severe impacts on entire economies.

The market is also growing in the education and training category because universities and other educational institutes deal with several phishing, malware, spam, and DDoS attacks. Additionally, the lack of awareness, existence of unprotected personal devices, and rapid spread of advanced technologies propel the demand for such software in this sector. The usage of MDR helps in protecting employee and student information, enhancing safety, optimizing the efforts and time of IT teams, and reducing risk by minimizing false positives.

Because of the rising threat, the government sector has also started focusing on strengthening its network infrastructure with enhanced IT solutions. Several countries across the world have implemented e-governance initiatives, which, in turn, has led to the fast shift of people to the internet to fill out common government forms and avail of several services. Due to the confidentiality of a lot of information possessed by governments, their websites and databases gain a lot of attention from attackers. Here, MDR’s combination of ML algorithms with big data and behavioral analytics helps minimize the risk of critical information loss.

Fingerprints, security numbers and other demographic and defense-related information are considered critical data. Therefore, among government organizations, the requirement to manage multiple initiatives and threats effectively would drive the adoption of MDR solutions.

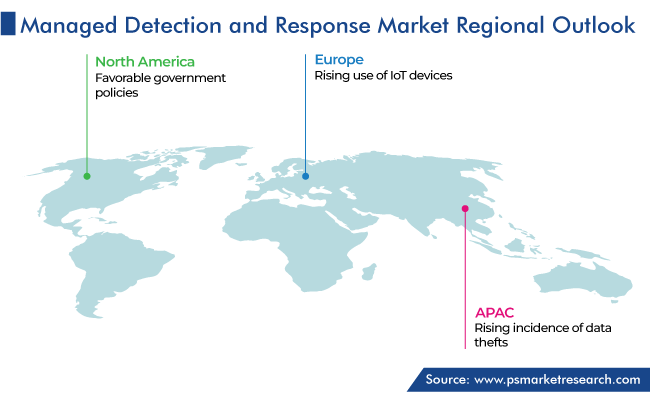

North America has the leading position in the managed detection and response market, and it will hold the same position till 2030, with a value of USD 8.1 billion. This is attributed to the favorable government policies and adoption of advanced technologies for cybersecurity.

In North America, due to the presence of various IT vendors and security breach incidents, the demand for MDR is growing. The rising focus of regional enterprises and governments on digitalization and interconnections leads to major challenges in the protection of critical infrastructure and sensitive data. The increasing severity of internal and external threats and the growing adoption of IoT are further fueling the growth in the region.

The market in the region is also the largest because of a huge number of cybersecurity breaches and the availability of a variety of advanced solutions to safeguard the cyber architecture. A vast range of cyberattacks occur in the region, involving the theft of intellectual and financial property, which has been a perpetual risk factor for large organizations. In addition, cybersecurity professionals are in high demand, which will, in turn, propel the market across the region.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of 23.6%, attributed to the high usage of social media platforms, mobile phones, and the web, in general. Additionally, the government of the country is expected to continue to take several initiatives in the future for offering companies, government agencies, and individuals protection against frauds. One recent example is from May 2021, when the Endpoint Detection and Response Initiative was implemented by President Joe Biden.

Cyberattacks are taking place at an increasing rate, with the rising level of complexity in the IT environment. The existing managed protection service providers face difficulties in adapting to the changing conditions and developing ways of handling new and complex attacks.

Advanced technologies, including ML and behavioral analytics, when incorporated into next-generation cybersecurity services, provide cutting-edge threat protection and rapid responses, by integrating automating intelligent security and real-time contextual awareness, all for a low cost of ownership. Companies are focusing on leveraging AI, pattern recognition, and machine learning to update their set of security rules automatically, in order to effectively protect their cyber infrastructure from vulnerabilities and advanced threats. Machine learning/AI-powered MDR solutions offer insights into security breaches and respond quickly.

Based on Service

Based on Security Type

Based on Deployment

Based on Organization Size

Based on Vertical

Geographical Analysis

The market for managed detection and response services will generate USD 14,797.6 million by 2030.

Threat detection is the largest category in the market for managed detection and response services.

Governments act as a key driver for the market for managed detection and response services, by implementing policies that mandate sensitive data protection.

North America generates the highest managed detection and response industry revenue, while APAC is the fastest-growing market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages