Market Statistics

| Study Period | 2019 - 2030 |

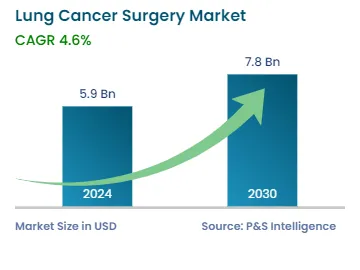

| 2024 Market Size | USD 5.9 Billion |

| 2030 Forecast | USD 7.8 Billion |

| Growth Rate(CAGR) | 4.6% |

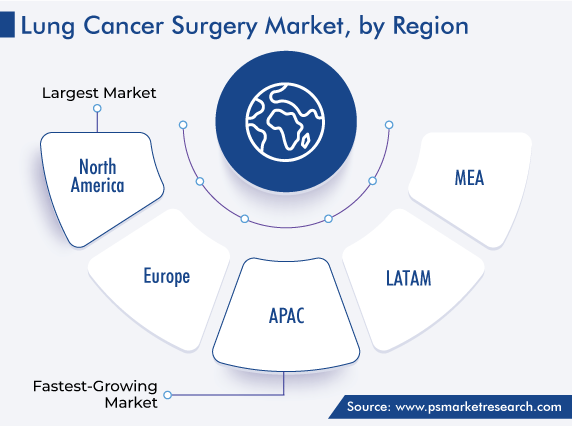

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12555

Get a Comprehensive Overview of the Lung Cancer Surgery Market Report Prepared by P&S Intelligence, Segmented by Surgical Procedure (Thoracotomy, Minimally Invasive Surgeries), Product Type (Surgical Instruments, Monitoring & Visualizing Systems, Endosurgical Equipment), End User (Cancer Hospitals, Ambulatory Surgical Centers, Research Laboratories), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 5.9 Billion |

| 2030 Forecast | USD 7.8 Billion |

| Growth Rate(CAGR) | 4.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The lung cancer surgery market size stood at USD 5.9 billion in 2024, and it is expected to grow at a CAGR of 4.6% during 2024–2030, to reach USD 7.8 billion by 2030. The growth can be primarily attributed to the rising incidence of lung cancers, extensive tobacco smoking trend among youngsters, rising geriatric population, and availability of reimbursements.

Moreover, the growing emphasis on the early diagnosis and treatment of this condition, growing adoption of minimally invasive procedures as well as robotic surgeries, and rising pace of technological advancement in the associated surgeries will propel the growth of the market during the forecast period.

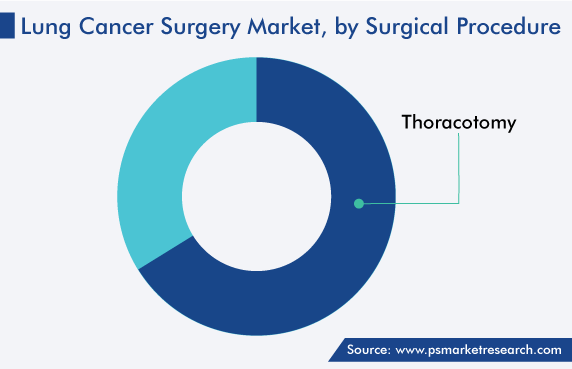

The thoracotomy category accounted for the larger revenue share, of over 62%, in 2022. The thoracotomy category is further divided into lobectomy, sleeve resection, segmentectomy, and pneumonectomy. The growth of the thoracotomy category is majorly attributed to the rising number of such surgeries on lung cancer patients. Surgery is an effective treatment when the tumor is diagnosed before spreading. According to the Journal of Thoracic Disease (JTD), an estimated 222,520 surgical operations for lung cancer are conducted every year. Among the various types of thoracic surgeries, the most common is the lobectomy, which accounts for 68.2% of those conducted, followed by wedge resection, which occupies a share of 18.1%.

Furthermore, the adoption of powered surgical instruments, which offer speedier procedures with their excellent functionality and dependable performance compared to manual equipment, is rising. In addition to that, lung cancer surgeries require high device flexibility and usability, which are provided by the advanced instruments. In order to meet the growing demand for them, the key players are focusing on launching new technologies.

For instance, in May 2021, Olympus Corporation launched the FDA 510(k)-cleared endobronchial ultrasound (EBUS) bronchoscope BF-UC190F, which is the latest addition to its EBUS portfolio of devices for minimally invasive lung cancer detection and staging by needle biopsy. This launch allows the surgeon to reach and sample complex sites, such as the lymph nodes in the mediastinum (4L) and hilum (10R). Thus, the device provides a higher diagnostic yield with greater sensitivity and specificity in lymph nodes ≥5 mm.

Moreover, the minimally invasive surgery category is expected to grow at the higher rate during the forecast period, owing to the increasing usage of these procedures, advancement in their technologies, favorable reimbursement regulations, and growing trend of robot-assisted surgical operations.

The surgical instruments category is expected to grow at the highest rate, of 4.6%, in the market for lung cancer surgeries during the forecast period, based on surgical devices. This can be ascribed to the rising volume of surgeries for lung cancer due to its high incidence and the government support and funding for the same. In addition to that, the advances in surgical instruments considerably increase their versatility and simplify their usage during complex operations.

Moreover, the advent of the powered and tissue-specific endoscopic stapling technology, which offers the advantage of better resource usage, lower cost, and improved clinical outcomes over manual staplers, has revolutionized the field. For instance, in September 2022, Ethicon, a part of Johnson & Johnson Medical Devices Companies, launched the Echelon Circular powered circular surgical stapler for thoracic, colorectal, and gastric surgeries. This stapler enables even compression with its 3D Stapling Technology and allows for gentle handling with its Gripping Surface Technology (GST), both of which work together to minimize the compressive forces on the tissues.

Moreover, in December 2021, the FDA approved Intuitive’s fully wristed, 8-mm SureForm 30 curved-tip stapler and reloads for general, thoracic, urologic, gynecologic, and pediatric surgeries. With 120-degree articulation, a curved tip, and the SmartFire technology, this stapler enables surgeons to better see and address patient anatomy from various angles, as it fits through the 8-mm instrument cannula of the da Vinci surgical system.

The cancer hospitals category accounts for the largest revenue share based on end user, which is mainly due to the growing prevalence of lung cancer. Among all the end users, such as hospitals, ambulatory surgery centers, and research laboratories, hospitals are the preferred medical settings, as they have the most-advanced equipment for precise diagnosis and treatment. This is why the standard of care provided by hospitals is higher, supported by the high public and private funding.

Furthermore, ambulatory surgery centers are expected to register a moderately high revenue growth rate. ASCs are modern healthcare clinics that are focused on offering same-day surgical care, in addition to diagnostic and preventive procedures. Nowadays, patients are preferring these surgical centers as they do not require hospitalization, and patients can return home shortly after the operation.

Moreover, the flourishing number of such centers, increasing adoption of minimally invasive procedures, cost-effectiveness of the treatments provided by them compared to hospitals, and growing trend of outpatient facilities will fuel the growth of the category over the forecast period.

Drive strategic growth with comprehensive market analysis

North America led the market, with a revenue share of 38%, in 2022, owing to the increasing pace of technological advancements in the treatment of lung cancer, growing incidence of this disease in the region, booming trend of tobacco smoking, and surging emphasis on its early screening.

The U.S. market is expected to register the larger revenue share in the North American region, due to the high prevalence of lung tumors, advanced facilities, high awareness regarding the treatment, and high spending by the government and private sector on the advancement of the healthcare expenditure of the country. As per the Lung Cancer Research Foundation, in 2022, approximately 236,740 individuals had lung cancer in the U.S., and 130,180 deaths occurred due to it.

Additionally, market players are focusing in manufacturing better products with the help of various collaborations and acquisitions with regional players and third-party CDMO service providers.

The Asia-Pacific region is expected to witness the fastest growth during the forecast period. This will mainly be due to the rapid enhancement in the healthcare infrastructure of the region, increasing government funding and awareness-raising initiatives, and growing medical tourism industry in emerging economies, such as India and China.

Based on Surgical Procedure

Based on Product Type

Based on End User

Geographical Analysis

The 2024 size of the market for lung cancer surgeries was USD 5.9 billion.

Thoracotomies are preferred in the lung cancer surgery industry.

APAC will be the fastest-growing market for lung cancer surgeries.

Robot-assisted surgeries are the biggest opportunity in the lung cancer surgery industry.

Cancer hospitals hold the largest share in the market for lung cancer surgeries.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages