Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 26.9 Billion |

| 2030 Forecast | USD 42.6 Billion |

| Growth Rate(CAGR) | 8% |

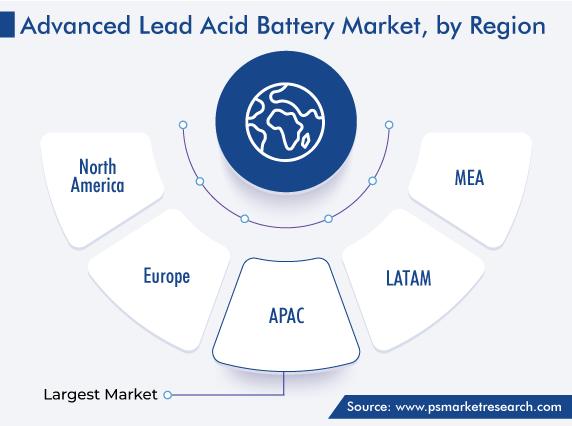

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12580

Get a Comprehensive Overview of the Advanced Lead Acid Battery Market Report Prepared by P&S Intelligence, Segmented by Type (Motive, Stationary), Construction Method (Valve Regulated Lead Acid Battery, Flooded Battery), End-Use Industry (Automotive and Transportation, Energy and Power, Industrial, Commercial & Residential), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 26.9 Billion |

| 2030 Forecast | USD 42.6 Billion |

| Growth Rate(CAGR) | 8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

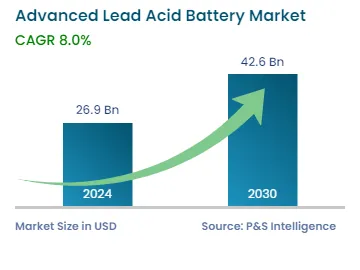

The global advanced lead–acid battery market size stood at USD 26.9 billion in 2024, and it is expected to propel at a compound annual growth rate of 8% between 2024 and 2030, to reach USD 42.6 billion by 2030.

This is because these batteries offer high recycling capabilities, high performance, and cost-effective energy storage, as compared to lithium-ion batteries. In addition, the industry is also boosted because of the extensive demand for these batteries from data centers, whose number is rising rapidly.

Moreover, lead–acid batteries are extensively used as an energy storage solution and these are also widely recycled consumer products in the world. For instance, in March 2022, almost 99% of lead batteries are recycled in the U.S., and almost 130 million lead batteries are recycled every year in the country.

The advanced lead–acid batteries are easy to decompose as compared to other alternative battery storage solutions, and these have a good recycling rate. Globally, almost 86% of the total production of these batteries are used in motor vehicles and the requirement for these vehicles is always growing, due to which government and manufacturing companies of batteries give recycling options to use the batteries’ part to make new ones. In addition, because of the high recycling rate, these types of batteries are always available in the market at a low cost, which consistently drives their demand.

Data centers require high-quality and uninterrupted high-power supply every time because even little disturbances and inconsistencies in power can create a critical scenario. Industry experts suggest that most of the companies with more than 10 employees collect some form of digitized data, and the larger ones utilize data for improving their marketing, transferring it internationally as well. Hence, the growth in data generation is expected to propel the demand for battery storage in data centers.

Moreover, several advanced technologies are being deployed to ensure optimal efficiency and performance of data centers, such as automation, AI, IoT, and the latest versions of uninterruptible power system (UPS) batteries. Valve-regulated lead–acid (VRLA) batteries are the first choice of almost every data center, due to their low cost and high recycling capabilities.

In 2020, 64.2 zettabytes of data were generated, a 314% hike from 2015. Moreover, in September 2022, the Indian data center capacity was 870 MW, which is powered by almost 138 data centers and is estimated to cross over 1,700 MW by 2025. As the volume of data across the globe is growing extensively, the demand for data centers and data storage solutions is also increasing, and simultaneously the requirement for lead–acid batteries is rising.

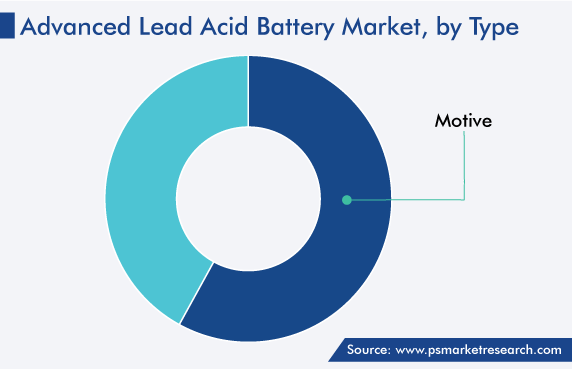

Based on type, the motive category accounted for a larger revenue share, of more than 58%, in 2022, and it is also projected to maintain the same trend throughout the analysis period. This is primarily attributed to the extensive use of motive advanced batteries in the automotive sector because of their high discharge and charge rates. A motive battery provides power to a motor that drives an electric vehicle, such as a forklift truck or golf cart, and powers the accessories of EVs such as headlights. These are also widely adopted in non-electric vehicles such as transport vehicles.

In addition, motive lead–acid batteries are also known as traction power batteries. Further, these are referred to as industrial lead–acid batteries, which provide a steady current for a longer duration.

Whereas, the stationary category is projected to grow at a higher CAGR, of around 8.1%, over the next few years. The growth can be mainly ascribed to the increasing demand for smoothly integrated solar PV solutions, which need battery banks with high capacity. Additionally, stationary batteries are majorly adopted as a standby power supply in the hospital, energy, and other industries. Also, rapid urbanization and government concerns toward solar PV solutions, in which batteries are the main equipment for storage of the generated power, are the key factors driving the growth of the industry.

The VRLA battery category accounted for the largest revenue share, of 66%, in 2022, and it is also projected to grow at the highest CAGR, of 8.2%, in the coming years. This type of battery is also known as the sealed lead–acid (SLA) or maintenance-free battery. VRLA battery is the enhanced version of a semi-concentric sulfuric acid electrolyte battery and does not require any regular addition of water to the cells, which is why, it is mostly preferred in the automotive and industrial sectors. These are also used in applications where a large amount of power storage is needed at a low cost.

Electric vehicles, such as plug-in hybrid electric vehicles (PHEV), hybrid electric vehicles (HEV), and pure battery electric vehicles (BEV), are in high demand, as they enable clean and efficient transportation. In addition, regulatory governmental norms for limiting the global temperature and reducing greenhouse gas emissions are further augmenting the need for these vehicles.

Furthermore, several EV manufacturers, such as Ford Motor Company, Nissan Motor Corporation, and Tesla Inc., are making advanced electric car models. Lead–acid batteries are widely used as a power-generating source in EVs, owing to their high specific energy and energy density. Altogether, the above-mentioned factors indicate that the increasing demand for electric vehicles is expected to boost the lead–acid battery market.

Drive strategic growth with comprehensive market analysis

The European market is expected to grow significantly during the forecast period. This can be due to the high demand and production of vehicles and the presence of the well-established automotive industry in the region. With the increase in automobile production, the need for lead–acid batteries is also rising. For instance, electric cars accounted for around 17% of the automobile sales in 2021 in the region. Also, many leading manufacturers in the region are undergoing product developments to develop advanced batteries and cater to the growing demand.

For instance, in Germany, the number of electric vehicles on road is estimated to exceed 2 million by the end of 2023. With the increase in demand for such automobiles, the requirement for such batteries will be high, as consumers are shifting to more cost-effective and environment-friendly vehicles.

Based on Type

Based on Construction Method

Based on End-Use Industry

Geographical Analysis

The advanced lead–acid battery market size stood at USD 26.9 billion in 2024.

During 2024–2030, the growth rate of the advanced lead–acid battery market will be around 8%.

Energy and Power is the largest end-use industry in the advanced lead–acid battery market.

The major drivers of the advanced lead–acid battery market include the high recycling rate, enhanced performance, low maintenance, and low cost of such batteries, and their rising demand in several sectors such as data center, automotive, industrial, education, and manufacturing.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages