Report Code: 11602 | Available Format: PDF | Pages: 243

Latin America Wound Dressing Market Research Report: By Type (Advanced, Traditional), Application (Chronic Wounds, Acute Wounds), End User (Hospitals & Specialty Clinics, Home Healthcare, Long-Term Care Settings) - Industry Analysis and Demand Forecast to 2030

- Report Code: 11602

- Available Format: PDF

- Pages: 243

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Latin America (LATAM) Wound Dressing Market Overview

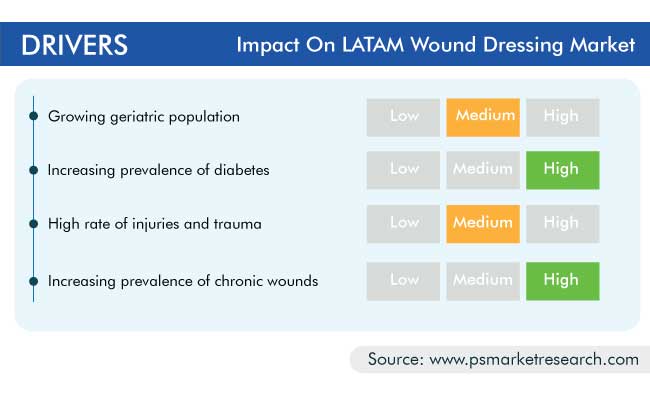

The Latin American (LATAM) wound dressing market was valued at $344.3 million in 2020, and it is expected to witness a CAGR of 5.0% during the forecast period (2021–2030). The major factors responsible for the rising sales of wound dressing products in the region are the growing geriatric population, increasing prevalence of diabetes, high rate of injuries and trauma, and surging prevalence of chronic wounds.

In LATAM, the number of infected patients was rather high in 2020, which strained the countries’ healthcare ecosystem and resources. This was mainly on account of the intensifying demand for healthcare facilities, workers, and, most importantly, medical equipment, devices, drugs, and research studies. LATAM is expected to face slow economic growth in the coming years, along with unfavorable public finances. Due to COVID-19, the manufacturing industry in LATAM has faced several challenges due to the smaller workforces, government mandates for lockdowns, and lower product demand from end users, including for wound dressing.

Although, in 2021, vaccination was made available in the region, due to which the number of infected persons is expected to come down, thereby boosting the economy and helping the LATAM wound dressing industry recover.

Advanced Wound Dressings Hold Larger Share due to Increasing Prevalence of Chronic Diseases

The advanced wound dressing category held the larger share in the LATAM wound dressing market in 2020, and it is expected to retain this position during the forecast period, based on type. This is primarily attributed to the rising need for advanced products for the treatment of wounds and increasing prevalence of chronic diseases in the region.

Due to Rising Prevalence, Chronic Wounds To Witness Higher Product Usage Growth Rate

The chronic wounds category has dominated the wound dressing market in LATAM over the past few years, based on application. Moreover, it is expected to be the faster-growing category during the forecast period in the industry. This would mainly be due to the high prevalence of chronic wounds, such as diabetic foot ulcers and fungating wounds, which are associated with chronic disorders. These wounds take longer to heal and require a more-frequent application of dressings in comparison to acute wounds.

Growing Patient Pool Credited for Largest Revenue Share of Hospitals and Specialty Clinics

The hospitals and specialty clinics category accounted for the largest revenue share in the wound dressing market of LATAM during the historical period (2014–2020), based on end user. Moreover, this category is expected to maintain its lead in the coming years. This is mainly attributed to the higher number of patient admissions at specialty clinics and hospitals because of chronic wounds and wounds caused due to accidents than at other medical facilities.

Improving Healthcare Infrastructure Led Brazil To Market Domination

Brazil was the largest contributor to the LATAM wound dressing market in 2020. Moreover, the Brazilian wound dressing market is expected to witness the fastest growth in the LATAM region during the forecast period, owing to the improving healthcare infrastructure and rising prevalence of chronic diseases. According to the World Health Organization (WHO), in 2020, 8.1% of the total population of Brazil had diabetes. In addition, a number of initiatives are being taken by public and private organizations to raise awareness about wound care in the country, which is expected to positively impact the market.

Shift in Preference from Traditional Products to Advanced Therapies

In LATAM, a shift is being observed from traditional wound dressing products to more-advanced products. Traditional dressings generally involve products that provide “dry” healing, when used for primary dressing, or as supplementary to a primary, moist wound healing product. Whereas advanced wound dressing products accelerate the healing, as well as provide quick comfort and recovery, by facilitating oxygen flow, preventing infections, and providing relief from pain. For example, Coloplast A/S’s Biatain Alginate is a highly absorbent alginate dressing for moderate-to-heavy exuding wounds.

Growing Geriatric Population Boosting Demand for Wound Dressing

The increasing aging population is playing a pivotal role in the advance of the LATAM wound dressing market. As per the United Nations (UN) report World Population Ageing 2019, in LATAM and the Caribbean region, the population aged 65 years and above is expected to rise from 8.7% of the total population in 2019 to 19.0% by 2050. With age, the metabolism becomes slower, which leads to several problems, including reduced skin elasticity, slower collagen replacement, increased risk of skin damage and wounds, and a longer wound healing period, as compared to adults.

Increasing Prevalence of Chronic Wounds also Driving Market

The burden of chronic diseases is growing rapidly in LATAM. According to the WHO, in LATAM, approximately 1.3 million new cancer cases and 666,000 deaths were reported in 2018. Similarly, in 2020, according to the International Agency for Research on Cancer (IARC) data, the number of new cases in LATAM rose to 1.4 million and that of the associated deaths to 713,414. Cancer and cardiovascular disorders often result in chronic wounds that are hard to treat and require extensive care for long periods. Additionally, chronic diseases require surgeries at some point, which also drives the demand for wound dressing products.

| Report Attribute | Details |

Historical Years |

2014-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$344.3 Million |

Forecast Period CAGR |

5.0% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Competitive Benchmarking of Key Players; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Type; By Application; By End User; By Country |

Secondary Sources and References (Partial List) |

American Academy of Ophthalmology; American Academy of Wound Management; American Physical Therapy Association; American Professional Wound Care Association; Centers for Disease Control and Prevention; Centers for Medicare & Medicaid Services; Institute for Health Metrics and Evaluation; International Diabetes Federation; United Nations Department of Economic and Social Affairs; World Health Organization |

Explore more about this report - Request free sample

Market Players Are Involved in Mergers and Acquisitions for Larger Profits

The wound dressing market of LATAM has several major players, such as 3M Company, Integra LifeSciences Holdings Corporation, Essity AB, Smith & Nephew PLC, and Mölnlycke Health Care AB.

In recent years, players in the wound dressing industry have been involved in mergers and acquisitions in order to gain a significant position. For instance:

- In January 2021, Integra LifeSciences Holdings Corporation announced the completion of the previously disclosed acquisition of ACell Inc. and its proprietary, MatriStem UBM technologies. This move will enable Integra to provide more-comprehensive complex wound management solutions.

- In October 2019, 3M Company completed the acquisition of Acelity Inc. and its KCI subsidiaries for a total enterprise value of approximately $6.7 billion, including the assumption of debt and other adjustments. The acquisition is helping the former company expand its medical solutions business and support its strategy of offering comprehensive advanced and surgical wound care solutions.

Some Key Players in Wound Dressing Industry in LATAM Are:

-

Hollister Incorporated

-

DeRoyal Industries Inc.

-

ConvaTec Group plc

-

Johnson & Johnson

-

Smith & Nephew PLC

-

Mölnlycke Health Care AB

-

3M Company

-

Essity AB

-

Paul Hartmann AG

-

B. Braun Melsungen AG

-

Coloplast A/S

-

Techoquimicas SA

-

Beiersdorf AG

-

Integra LifeSciences Holdings Corporation

-

Wright Medical Group N.V.

Market Size Breakdown by Segment

The LATAM wound dressing market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Advanced

- Foam

- Hydrocolloid

- Film

- Alginate

- Antimicrobial

- Hydrogel

- Collagen

- Hydrofiber

- Wound contact layer

- Superabsorbent

- Traditional

- Bandages

- Conforming bandages

- Sticking plasters

- Gauzes

- Sponges

- Abdominal pads

- Fixation tapes

Based on Application

- Chronic Wounds

- Diabetic foot ulcers (DFUs)

- Pressure ulcers

- Venous leg ulcers (VLUs)

- Others

- Acute Wounds

- Surgical and traumatic wounds

- Burns

Based on End User

- Hospitals & Specialty Clinics

- Inpatient settings

- Outpatient settings

- Home Healthcare

- Long-Term Care Settings

Geographical Analysis

- Brazil Wound

- Mexico Wound

- Colombia

- Argentina

- Chile

- Peru

- Ecuador

In 2020, the LATAM wound dressing market valued $344.3 million.

Hospitals and specialty clinics are the largest LATAM wound dressing industry end users.

Brazil currently offers the most-lucrative investment opportunities in the LATAM wound dressing market.

The growing geriatric population and rising prevalence of diabetes, injuries, physical trauma, and chronic wounds are propelling the LATAM wound dressing industry advance.

The competitive landscape of the LATAM wound dressing market is characterized by mergers and acquisitions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws