Report Code: 12791 | Available Format: PDF | Pages: 310

Laminating Adhesives Market Size and Share Analysis by Resin Type (Polyurethane, Acrylic), Technology (Solvent-Based, Water-Based, Solvent-Less), Application (Packaging, Industrial, Automotive & Transportation) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12791

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global laminating adhesives market was valued at USD 3,785.8 million in 2023, and the market size is predicted to reach USD 5,661.9 million by 2030, advancing at a CAGR of 6.0% during 2024–2030. The market is driven by the rapid expansion in the flexible packaging, e-commerce, consumer durable, and pharmaceutical industries, increase in the urban population, and rise in the demand for customer-friendly packaging.

Laminating adhesives are primarily used in flexible packaging. The global packaging industry is growing robustly, as the number of food processing plants and industrial production of all kinds of other stuff are increasing. In recent years, an evolution has been seen in the packaging industry with the industrial sector having adopted flexible packaging. The reasons behind the popularity of flexible packaging are its ease of handling and transportation, low weight, longer shelf life, better printability, and resistance to damage.

As the population is increasing, so is the demand for packaged food, and various consumer goods firms are capitalizing on the growing demand for ready-to-cook snacks, meals, pulses, edible oils, and juices. This is mainly because after the pandemic, the preferences of consumers have shifted from local to branded products, as the latter offer at least some assurance of quality, nutrition, and safety.

These, along with the ease of cooking and convenience of carriage, are the key factors that have contributed to the uptick in the demand for packaged snacks. In turn, due to the increasing demand for packaged food, the consumption of laminating adhesives is rising.

Moreover, the demand for these chemicals is growing in the automotive industry. In a vehicle, adhesive-based lamination allows manufacturers to deliver a soft feel and attractive surface to the interiors, along with catering to varied technical and environmental requirements. They are used in a variety of applications, such as inserts and armrests, door panels, seat back panels and headliners, load floors, pillars and sun visors, and instrument panels.

Another crucial area of application of these materials is the building sector, specifically roofing liners. The rising demand for residential and non-residential spaces, as well as the government investment in infrastructure projects, is propelling the construction market. In turn, the increase in the spending of the building and construction industry will drive the consumption of adhesives and sealants for lamination purposes during the forecast period.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,785.8 Million |

Market Size in 2024 |

USD 3,989.1 Million |

Revenue Forecast in 2030 |

USD 5,661.9 Million |

Growth Rate |

6.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Resin Type; By Technology; By Application; By Region |

Explore more about this report - Request free sample

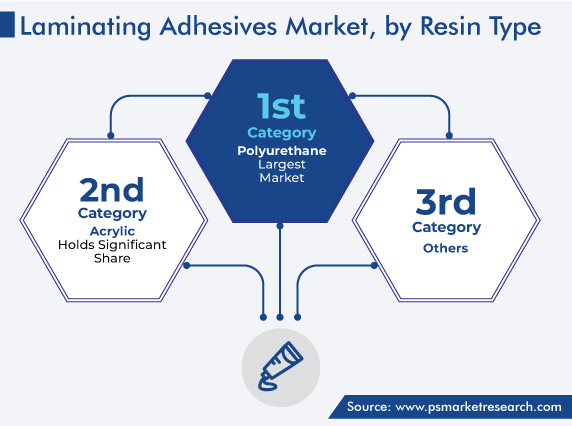

Polyurethane Is Dominating the Market

Polyurethane held the largest share, of 45%, in 2023, mainly because this type of adhesive provides extremely strong adhesion, flexibility, and protection. Polyurethane adhesives also offer cohesive strength, together with flexibility, which makes them tough and durable. Moreover, they bond with substrates on which other kinds of adhesives do not perform and offer tough bonds at low temperatures, for attaining high bond strength.

Adhesives are available in two forms natural and synthetic, both of which have thermoplastic, thermosetting, and elastomeric properties. As they cure, thermoset polymers with good resistance to solvents and chemicals are formed. They are enormously versatile and are available in cured forms, ranging from rigid, extremely hard plastics to extremely soft elastomers, depending on the ratio of the soft and hard resin constituents.

Moreover, acrylic adhesives held a significant share in 2023, mainly because they showcase good adhesion to surfaces such as glass, polyester, metal, bi-axially oriented polypropylene (BOPP), polyethylene (PE), polyethylene terephthalate (PET), and polyvinyl chloride (PVC). Other advantageous features of acrylic laminating adhesives include high peel strength, excellent impact strength, and good resistance to varying temperatures, UV light, and oxidation. They also offer protection from various chemicals, including organic fluids, plasticizers, paints, and detergents.

Moreover, these films are frequently used in protective coatings for automotive parts. Moreover, in graphics and displays, they are applied over the signage to improve durability and provide safety from the elements.

Solvent-Based Adhesives Are Showcasing Substantial Demand Growth

The solvent-based category will show substantial growth, with a CAGR of 6.2%, in the global laminating adhesives market during the forecast period. They are used in various areas, such as packaging, tapes, and medical devices, due to their strong resistance to numerous environmental factors and strong bonding to diverse substrates.

They are a better choice for both porous and non-porous surfaces, to which they offer protected adhesion, after the liquid dries out and leaves only the bonding agent behind. They are also easier to apply to surfaces compared to water-based adhesives. Due to this, solvent-based adhesives are used in application areas as diverse as food packaging, automotive manufacturing, and graphics.

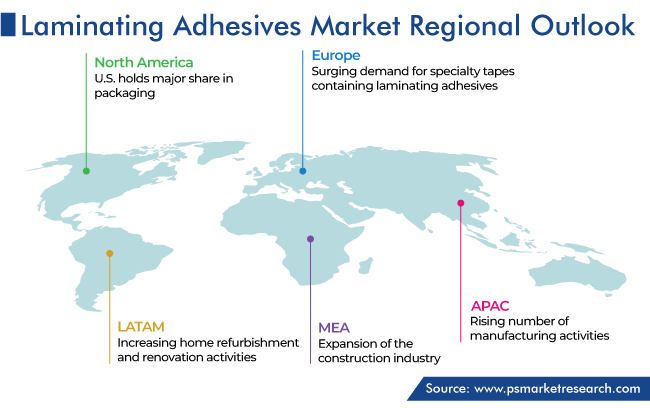

APAC Held Largest Share

APAC held the largest share, of 50%, in 2023. This is mainly because manufacturing activities in China, India, and Japan are growing robustly; thus, the need for flexible packaging is increasing, thereby driving the use of laminating adhesives.

Additionally, the recent advances in adhesive engineering have enabled automobile manufacturers to produce lightweight and fuel-efficient vehicles. The APAC transportation industry is expanding as a result of the rising population, increasing cross-border movement of goods, and surging employment rate. Vehicle production will also rise over time, thus leading to an increase in the demand for laminating adhesives in the automotive industry.

Further, China has the largest electrical and electronics production base globally, with sales of OLED TVs, smartphones, wires, tablets, and cables growing incessantly. As the disposable income of the middle-class population is increasing, so is the demand for electronic products.

Similarly, in India, industries such as electronics, packaging, automotive, and construction are seeing significant growth, which will continue in the near future because of the supportive government policies and growing investments. Thus, the laminating adhesives market has a large opportunity to grow in the coming years in the country.

Moreover, various companies have introduced innovative solvent-free laminating adhesives in India for flexible packaging applications. In the country, the usage of such bonding agents is growing as customers are increasingly investing in laminating machinery that can utilize such chemicals. The country has a substantial share in the sale of this type of adhesives, and the demand for them will rise further with the launch of various new products that are not only greener but also more effective and longer-lasting.

Further, in the coming years, the demand for frozen foods and the supply of processed agri-foods are expected to rise in India, as the government is focusing on the food processing sector, which will raise the packaging demand.

Moreover, North America holds a significant share in the market. In the U.S., the largest end user is packaging. The per capita packaged food consumption in the U.S. has increased in recent years. The robust online retail ecosystem is a major driver for the packaging industry's growth in the region. Due to consumers' busier lifestyles, the adhesives industry in North America will be driven by the rising consumption of convenience packaged foods, such as ready-to-eat meals and beverages drinkable straight from the carton. Cosmetics are another important application for packaging materials and adhesives.

Moreover, the growing construction sector is supporting the growth of related sectors, such as joinery and woodworking, which are major consumers of these adhesives. The U.S. is expected to dominate the market in the region, with the consumption likely to be majorly driven by the booming construction, automotive, and electronics industries. This will itself be a result of the rising demand for premium products from the country's expanding high-income population.

Moreover, in LATAM, the significant factors driving the market are the increasing home refurbishment and renovation, as well as the rising construction activities. Furthermore, the government initiatives promoting sustainable building designs are likely to boost the market growth. Additionally, due to the strict energy efficiency regulations, there is an increase in the demand for rigid foams with strong insulation, particularly in the building and construction industry. Additionally, to limit the emission of VOCs from adhesives and sealants, companies are investing heavily in research and development (R&D) to come up with bio-based, eco-friendly products.

Top Laminating Adhesives Providers Are:

- Henkel AG & Co. KGaA

- 3M Company

- H.B. Fuller Company

- The Dow Chemical Company

- Arkema

- Ashland Inc.

- DIC Group

- L.D. Davis Industries Inc.

- Vimasco Corporation

- Coim Group

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the laminating adhesives market, to offer accurate market estimations for 2017–2030.

Based on Resin Type

- Polyurethane

- Acrylic

Based on Technology

- Solvent-Based

- Water-Based

- Solvent-Less

Based on Application

- Packaging

- Industrial

- Automotive & Transportation

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- U.K.

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The value of the market for laminating adhesives in 2023 was USD 3,785.8 million.

The laminating adhesives industry is propelled by the burgeoning flexible packaging, consumer durable, e-commerce, and pharmaceutical sectors.

Polyurethane dominates the resin segment of the market for laminating adhesives.

The automotive, consumer electronics, packaged food, and pharmaceutical industries generate significant laminating adhesives industry revenue.

APAC is the largest market for laminating adhesives.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws