Report Code: 12874 | Available Format: PDF | Pages: 320

Laboratory Developed Tests Market Size and Share Analysis by Type (Chemistry Tests, Immunoassays, Flow Cytometry, Karyotyping, Mass Spectroscopy, Gene Signatures, Microarrays, Molecular Diagnostics), Application (Oncology, Genetic Disorders/Inherited Diseases, Infectious & Parasitic Diseases, Immunology, Endocrinology, Nutritional & Metabolic Diseases, Cardiology, Pediatric-Specific Testing, Hematology/General Blood Testing, Bodily Fluid Analysis, Toxicology), End User (Academic Institutes, Clinical Research Organizations, Hospital Laboratories, Specialty Diagnostic Centers) - Global Industry Demand Forecast to 2030

- Report Code: 12874

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Laboratory Developed Tests Market Overview

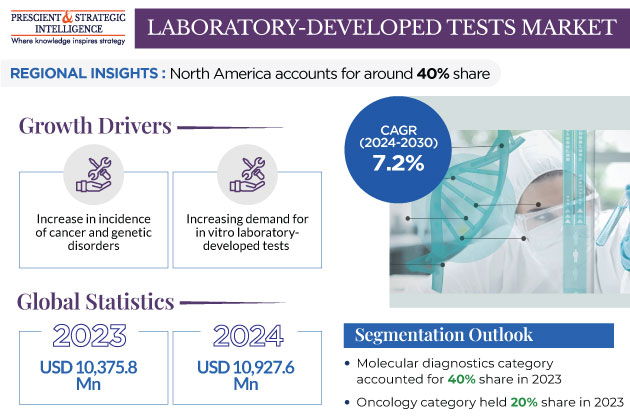

The global laboratory developed tests market generated revenue of USD 10,375.8 million in 2023, which is expected to witness a CAGR of 7.2% during 2024-2030. The growth of this market is mainly driven by the increase in the incidence of cancer and genetic disorders. Moreover, the growth is attributed to the increasing demand for in vitro laboratory-developed tests that are currently unavailable in the market for rare diseases, such as genetic tests and molecular tests; rising demand for personalized medicines, and the fact that these tests do not require any regulatory approval.

- Furthermore, the rise in the funding for research and clinical diagnosis of rare diseases and disorders, such as hematology testing, by various regulatory authorities and the government, propels the market.

- Moreover, these tests are available at lower cost and can aid in developing a wide range of diagnostic tools for various health conditions.

Moreover, due to the advancement in technologies, such as mass spectrometry and microarrays, laboratory-developed tests have evolved since comprehensive authority was granted to the FDA to regulate all devices for in vitro diagnoses in 1976. Some LDTs are now many times complex, available across the nation, able to detect the risk of Alzheimer’s disease and breast cancer; and a lot like other IVD tests under premarket review. COVID-19 has also driven the demand for these tests owing to the massive surge in the number of people being screened at health centers and public places.

Technological Advancement in Testing Industry

- The growing focus on reducing sample volume, lead times, the risks with several technologies, and testing costs has resulted in the development of new technologies, such as advanced chromatography and spectrophotometry.

- The widespread adoption of these techniques provides an opportunity for small- and mid-size laboratories to expand their service offerings and compete with the larger players in the industry.

- These techniques offer high sensitivity, accurate results, reliability, and non-targeted and multi-contaminant screening with low handling time.

- These technological advancements are credited to the intense research development happening in the field of pathogenesis of disease and personalized medicine.

Continuous Research and Growing Use of Personalized Medicine

LDTs play an important role in the development of personalized medicine, which is likely to prove as a promising means of tackling diseases through far-eluded effective treatments or cures. Additionally, 42% of all compounds and 73% of the oncology compounds in the pipeline have the potential to serve as personalized medicines. Moreover, biopharmaceutical companies are strongly focusing on expanding their research and development on personalized medicine. Laboratory-developed tests are used to diagnose illnesses and predict and monitor drug responses, as well as obtaining informatics data needed for complex predictive algorithms.

- Personalized medicine can be used for a wide range of purposes, including diagnosis, prognosis, and targeted therapies for many different types of conditions.

- Further, due to some restrictions in the diagnosis and treatment of complex diseases via traditional approaches, personalized medicine is becoming popular.

- Such approaches are gaining recognition among patients with cancer and immunological disorders as they are based on individuals’ clinical and genetic characteristics.

- The rising demand for personalized medicine is one of the main factors driving the demand for these tests, hence fueling the growth of the market.

| Report Attribute | Details |

Market Size in 2023 |

USD 10,375.8 Million |

Market Size in 2024 |

USD 10,927.6 Million |

Revenue Forecast in 2030 |

USD 16,539.9 Million |

Growth Rate |

7.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By End user; By Region |

Explore more about this report - Request free sample

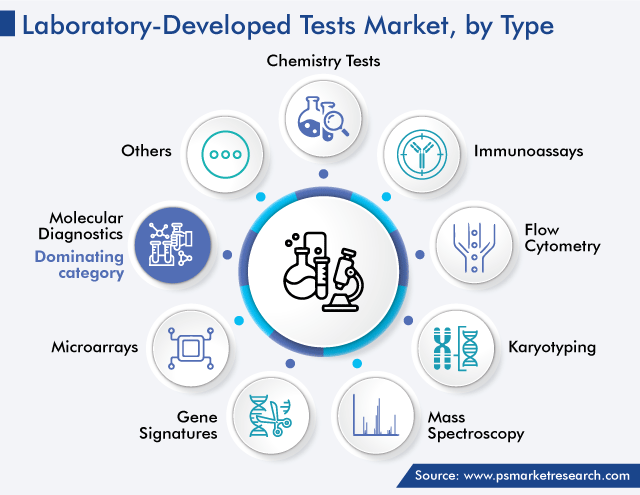

Molecular Diagnostics Category Dominates Market

Based on type, the molecular diagnostic category accounted for the largest share, of 40% in 2023, and it will further maintain its dominance in the future. This is owing to the growth in the elderly population and a surge in the demand for the early detection of diseases. The rise in the prevalence of chronic and infectious diseases and the increase in the need to control healthcare expenditure are also expected to fuel the growth, by boosting the demand for early disease diagnosis and regular monitoring. Moreover, the growing adoption of molecular diagnostics for analyzing biological markers in the genome and proteome and detection of cells’ expressions make the category dominant.

- Furthermore, the increasing pace of the development of genetic therapeutics and the growing research in human genomics propel this category.

- The technological enhancements in molecular tests have made them diagnostic tools for detecting a wide range of genetic diseases.

- For instance, the DRAGEN clinical genomic information system (CGIS) by Edico Genome allows clinical laboratories to create tests based on the sequencing technology quickly, efficiently, and with ease.

Gene signatures will witness the fastest growth over the forecast period. This is owing to the rising cases of cancer globally, especially prostate cancer, and surging adoption of commercialized gene expression tests for its detection. According to a report of the World Health Organization, cancer is the leading cause of death worldwide, accounting for nearly 10 million cases in 2020. Prostate cancer is the most-common cancer in men, affecting 1.41 million people.

Oncology Category Accounted for Largest Share

Based on application, the oncology category accounted for the largest share, of 20%, in the market, due to the rising demand for technically advanced molecular diagnosis methods for the early detection of cancers.

- Cancer is ranked the second-biggest cause of death.

- Therefore, the rising R&D spending in the field of oncology would increase the usage of enhanced tests.

- Additionally, the improvements in the healthcare infrastructure of developing countries have led to the large share of the category.

Moreover, with the increasing prevalence of cancer and the rapid development in cancer diagnosis, the market is undergoing significant growth. For instance, in June 2022, NeoGenomics Laboratories Inc. announced new data demonstrating the clinical potential of its RaDaR assay for the detection of MRDs in breast cancer by its subsidiary Inivata Ltd.

Moreover, the genetic disorders/inherited diseases category is expected to grow with the highest CAGR.

- This will be due to the growing count of people with genetic and inherited disorders, growing awareness of genetic testing for cancer and parental screening, and government support for fast and accurate genetic diagnoses.

- Moreover, there has been a rise in the volume of screening tests to detect abnormalities in newborns.

- It has been estimated that none of the more than 40 non-invasive parental tests are FDA-reviewed, but they are in the market.

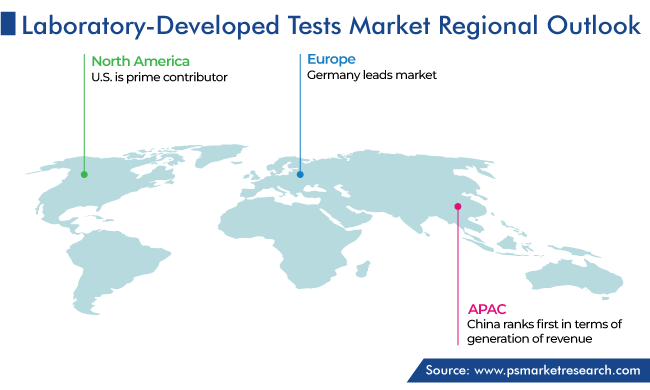

North America Is Prime Revenue Contributor

Geographically, North America occupied the largest share in the laboratory-developed tests market, of around 40%, in 2023, and it is expected to experience a strong CAGR during the projection period. This will be due to the developed laboratory infrastructure and availability of skilled personnel in the region. Moreover, the elevating risk of diseases in the region, existence of reputable healthcare businesses, and robust support for the setup of new R&D facilities bodes well for the market.

- Additionally, the earlier adoption of new technologies here than in other regions, rising prevalence of chronic diseases, and surging geriatric population support this expansion.

- According to the U.S. Census Bureau, the geriatric population is around 56 million, accounting for 16.9% of the country’s population.

- The market for molecular diagnostics in the region is expected to grow at the highest growth rate over the forecast period.

Moreover, key players are developing novel products and getting them approved by the regulators, which in turn, drives the market growth. For instance, in August 2022, Biomerica Inc. launched InFoods, an IBS test. The LDT is performed in a CLIA-certified, high-complexity laboratory facility.

Moreover, Europe is a rapidly growing market due to the presence of numerous contract research organizations and market participants. Additionally, the expansion of the collaborations between governments and LDT providers is responsible for the market progress. The market advance is also attributed to the robust healthcare infrastructure, emergence of new technologies, and rising popularity of precision medicine.

- Germany is showing significant growth in this market.

- This is owing to the increasing spending of the government on healthcare and the rising compliance for advanced technologies among researchers as well as healthcare providers, in part, due to the increasing awareness of early disease diagnosis.

- The market in France is expected to witness notable growth during the forecast period as well.

- This can be attributed to the improving healthcare infrastructure, presence of market players offering enhanced tools for advanced diagnostic techniques, and increasing prevalence of chronic diseases, which is driving the use of molecular diagnosis.

Top Providers in Laboratory-Developed Tests Market Are:

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Illumina Inc.

- F. Hoffmann-La Roche Ltd.

- Siemens AG

- Bio-Rad Laboratories Inc.

- NeoGenomics Laboratories Inc.

- Guardant Health Inc.

- Becton, Dickinson and Company

- QIAGEN N.V.

Market Breakdown

This fully customizable report gives a detailed analysis of the laboratory-developed tests market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Type

- Chemistry Tests

- Immunoassays

- Flow Cytometry

- Karyotyping

- Mass Spectroscopy

- Gene Signatures

- Microarrays

- Molecular Diagnostics

Segment Analysis, By Application

- Oncology

- Genetic Disorders/Inherited Diseases

- Infectious & Parasitic Diseases

- Immunology

- Endocrinology

- Nutritional & Metabolic Diseases

- Cardiology

- Pediatric-Specific Testing

- Hematology/General Blood Testing

- Bodily Fluid Analysis

- Toxicology

Segment Analysis, By End User

- Academic Institutes

- Clinical Research Organizations

- Hospital Laboratories

- Specialty Diagnostic Centers

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws