Report Code: 12885 | Available Format: PDF | Pages: 310

Laboratory Centrifuges Market Size and Share Analysis by Product (Equipment, Accessories), Model Type (Benchtop, Floor-Standing), Rotor Design (Fixed-Angle, Swinging-Buket, Vertical), Use (General-Purpose, Clinical, Preclinical), Application (Diagnostics, Microbiology, Genomics, Proteomics), End User (Hospitals, Biotechnology & Pharmaceutical Companies, Academic & Research Institutions) - Global Industry Growth Forecast to 2030

- Report Code: 12885

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Laboratory Centrifuges Market Size & Share

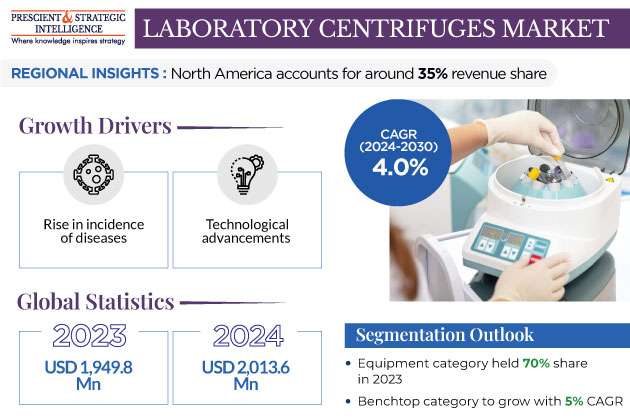

The global laboratory centrifuges market size was USD 1,949.8 million in 2023, and it is expected to reach USD 2,541.2 million in 2030, with a growth rate of 4.0% during 2024–2030. This is attributed to the rise in the incidence of disease, technological advancements, increase in R&D activities, and surge in the number of biopharmaceutical, pharmaceutical, and life science companies.

Moreover, other factors that propel the growth of the market are

- Rise in the pace of technological advancements

- Growth in the adoption of automated techniques in hematology

- Increase in public and private healthcare investment

- Development of ultracentrifuges, microcentrifuges, and multi-purpose centrifuges.

Furthermore, the rise in the frequency of product launches with regulatory approvals is expected to propel the growth of the market. For instance, in September 2022, Thermo Fisher Scientific Inc. unveiled the DynaSpin single-use centrifuge, which is specifically designed for large-scale cell culturing harvesting. The system offers higher efficiency during the process, at the same time decreasing the requirement for traditional depth filtration, thus offering cost-effectiveness, and quickening up the entire process.

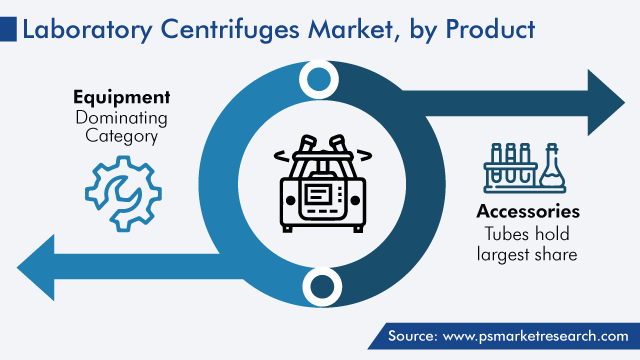

Equipment Held Larger Share

The equipment category accounted for the larger market share, of 70% in 2023. This can be attributed to the different types of centrifuges available with the players, such as multipurpose centrifuges, microcentrifuges, ultracentrifuges, and minicentrifuges.

In April 2021, Eppendorf SE, a life science company, introduced a new centrifuge to increase efficiency in the laboratory, Centrifuge 5910 Ri.

- The product is the next generation of the 5910 R multipurpose centrifuge.

- The 5910 Ri simplifies and boosts the centrifugation steps of the workflow with more features than the earlier product.

- Its touchscreen interface enables users to set the desired parameters quickly, with new documentation options and three user management levels providing enhanced traceability and security.

Similarly, in December 2021, Biosan presented a new low-speed laboratory centrifuge, LMC-56, for convenient sedimentation, collection of necessary samples, and centrifugation.

- It provides operation with tubes, gel cards, blood collection systems, microtests, and plates.

Moreover, the SCILOGEX SCI636 multipurpose centrifuge is ideal for the centrifugation of samples in cytology, clinical chemistry, research, and industrial laboratories.

- This centrifuge is suitable for tubes with caps, urine tubes, or blood collection.

- Swing-out bucket rotors and adapters can be made compatible with standard tubes of 3-to-100-mL capacity at low speeds.

In the same vein, in June 2022, Invetech launched Korus for cell therapies, which uses gentle counterflow centrifugation for elutriation and cell wash.

- Korus is designed to advance cell therapy industry standards with a better manufacturing performance than with samples prepared using standard techniques of washing.

- The system delivers populations of purified cells for downstream development and manufacturing, thereby leading to better overall process performance through higher recovery and purity of target cells.

In the accessories category, tubes hold the largest share. This is attributed to the wide use of tubes in the centrifugation process to keep liquids. Most times, a new centrifuge tube is used to avoid contamination and dilute solutions. Therefore, since tubes are a repetitive purchase, their sales generate the highest revenue for the players among all accessories.

Rotors also hold a significant share as they are available in various types, such as fixed-angle rotors, swinging-bucket, and vertical.

- In addition, the rotor is a key component of the centrifuge and used to house the tubes where separation occurs.

- Rotors used in centrifuges were earlier made of steel and then, replaced with alloys of titanium and aluminum.

- Carbon fiber rotors are resistant to corrosion and structural fatigue.

- In October 2021, the Fiberlite fixed-angle rotors made of carbon fiber were launched by Thermo Scientific.

Benchtop Centrifuges Are in More Demand

Benchtop centrifuges held the largest market share in 2023, and their sales revenue is expected to grow at a CAGR of 5% during 2024–2030. These variants are widely used in research institutes and diagnostics centers due to their small size, cost-effectiveness, user-friendliness, low weight, ability to easily fit in any place, and portability.

Further, seeing the rising demand for them, companies are advancing their popular products. For instance, in October 2020, Eppendorf SE introduced the refrigerated 24-place centrifuge 5425 R, the successor of its popular centrifuge 5424 R.

- This improved device makes numerous cell and molecular biology processes easier than earlier.

- Its cooling system gets ready to start immediately with a cool-down time of 8 minutes.

- Its six different rotors make it usable for more applications, including those in molecular biology, such as protein or DNA/RNA separation in spin columns, yeast and bacteria harvesting, and cell cultures in 5-mL tubes.

- An additional highlight is the comfortable operation of the centrifuge; the Eppendorf QuickLock seals allow users to handle the rotor lids quickly and easily.

- The OptiBowl design, which is characteristic of microcentrifuges by Eppendorf, emits low noises even when the rotor lid is not on.

Moreover, in February 2022, Beckman Coulter Life Sciences, a subsidiary of Danaher Corporation since 2011, launched its 3-liter benchtop centrifuge, the Allegra V-15R refrigerated centrifuge.

- Featuring 50 programmable runs, 10 rotor configurations, and a comprehensive adapter selection, it aids in an array of applications and workflows, ranging from high-throughput screening to blood separation.

- Advanced safety features include rotor cycle count and automatic rotor recognition, which tracks the number of cycles by the rotor model and bucket type to help, labs make informed decisions on the maintenance and decommissioning of the rotors.

Floor-standing centrifuge systems also hold a significant share, as these variants are designed for high-volume centrifugation, with holders for large sample containers. They are used in routine diagnostics, pharmaceutical laboratories, blood banks, and clinical laboratories.

Moreover, companies are providing the next generation of centrifuges to fulfill the needs of modern laboratories. For instance, in March 2021, Thermo Fisher Scientific Inc. introduced the general-purpose Pro Centrifuge Series to address the varying requirements of modern labs. The latest additions include 4-liter floor-standing and 1.6-liter benchtop centrifuge systems. Both systems provide reproducibility, sample safety, improved ergonomics, and reduced noise levels during in cell and gene therapy, clinical diagnostics, and biopharmaceutical and academic research.

Mergers and Acquisitions Are Key Trends in Market

- In March 2020, Eppendorf AG signed a contract with Koki Holdings Co. Ltd. in Tokyo for Eppendorf to acquire Koki’s centrifuge business.

- With this acquisition, Eppendorf AG aimed to enlarge its line of high-end centrifuges for pharma, life science, academic, and commercial research applications.

- Moreover, post being acquired, Koki Holdings Co. Ltd. is focusing on strategic investments in product and technology development.

Fixed-Angle Rotors Held Largest Share of Market

The fixed-angle rotors category accounted for the largest share in the in 2023. This is because of the increase in R&D activities and the benefits of fixed-angle rotors, as they do not have moving parts like other variants. Therefore, compared to swing-bucket rotors, fixed-angle rotors experience much lower metal stress, which leads to shorter centrifugation times and stronger g-forces.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,949.8 Million |

Market Size in 2024 |

USD 2,013.6 Million |

Revenue Forecast in 2030 |

USD 2,541.2 Million |

Growth Rate |

4.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Model Type; By Rotor Design; By Use; By Application; End User; By Region |

Explore more about this report - Request free sample

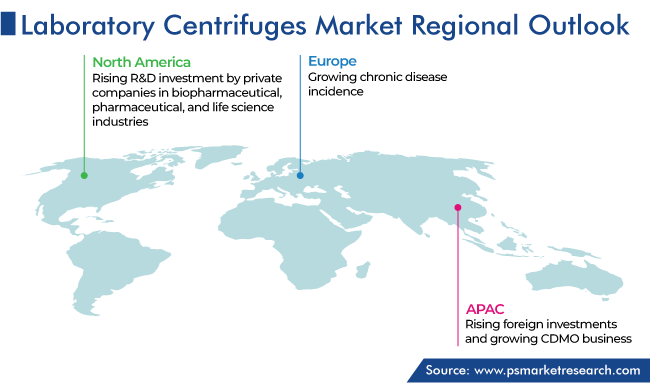

North America Accounts for Largest Revenue Share

North America held the largest share, of 35%, in 2023, and its size is expected to grow at a CAGR of 4.5% during 2024–2030. This is attributed to the rising R&D investment by private companies in the biopharmaceutical, pharmaceutical, and life science industries and government bodies.

- In January 2023, the Binational Industrial Research and Development (BIRD) Foundation, jointly set up by the U.S. and Israel, approved an USD 8.4-million investment for nine new projects between companies based in the two countries.

- Moreover, private-sector funding is expected to take the total project value to USD 20 million.

- The BIRD Foundation promotes partnership between U.S. and Israeli companies in various technological sectors for joint product development.

Asia-Pacific is the fastest-growing region in the market, primarily due to the rise in the spending on R&D activities. For instance, according to the National Bureau of Statistics, China's total expenditure on research and development was nearly USD 456 billion (RMB 3.09 trillion) in 2022, up 10.4% year on year.

Key Market Players Are:

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Eppendrof AG

- KUBOTA Corporation

- Sigma Laborzentrifugen GmbH

- Andreas Hettich GmbH & Co. KG

- Sartorius AG

- HERMLE Labortechnik GmbH

- Cardinal Health Inc.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Haier Biomedical

Market Breakdown

This report offers deep insights into the laboratory centrifuges market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Product

- Equipment

- Multipurpose centrifuges

- Microcentrifuges

- Ultracentrifuges

- Mini centrifuges

- Accessories

Segment Analysis, By Model Type

- Benchtop

- Floor-Standing

Segment Analysis, By Rotor Design

- Fixed-Angle

- Swinging-Buket

- Vertical

Segment Analysis, By Use

- General-Purpose

- Clinical

- Preclinical

Segment Analysis, By Application

- Diagnostics

- Microbiology

- Genomics

- Proteomics

Segment Analysis, By End User

- Hospitals

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutions

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The industry for laboratory centrifuges will reach USD 2,013.6 million in 2024.

The laboratory centrifuges market value will reach USD 2,541.2 million in 2030.

The North American market for laboratory centrifuges is the largest.

Increasing mergers and acquisition are the key laboratory centrifuges industry trends.

Fixed-angle rotors hold the larger laboratory centrifuges market share.

Benchtop centrifuges is the leading model type in the laboratory centrifuges industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws