What will be the industry size of the global intelligent traffic camera market by the end of the decade?+

The global intelligent traffic camera market will reach USD 965.7 million by the end of the decade.

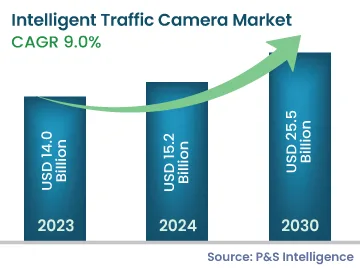

What is the Compound Annual Growth Rate of the global intelligent traffic camera market in the coming years?+

The CAGR for the global intelligent traffic camera market will be 9.0% in the coming years.

What are the main drivers contributing to the growth of the intelligent traffic camera market?+

Issues including increasing safety concerns, heavy traffic congestion in cities and towns, the continuous development of ADAS, government efforts toward traffic management and the increased adoption of smart technologies, are the key factors for the precipitous expansion of this market.

What significant trend has been observed in the intelligent traffic camera market recently?+

A notable trend is the increasing number of collaborations and partnerships among system providers, camera manufacturers, and traffic management firms, aimed at enhancing product offerings and knowledge exchange.

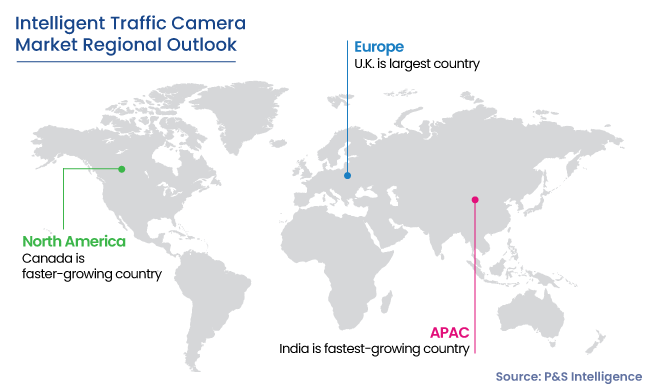

Which region dominates the global intelligent traffic camera market, and what factors contribute to its leadership position?+

Europe leads with a 55% revenue share in 2023, driven by advanced traffic control systems and collaborative efforts with governments. APAC is the fastest-growing market, with a 9.7% CAGR, due to increased investments in traffic solutions, especially in populous countries like China and India.

Which company holds a dominant market position in terms of conventional surveillance and Video Surveillance as a Service (VSaaS) applications?+

Hangzhou Hikvision Digital Technology Co. Ltd., particularly through its division Hikvision, retains a dominant market position in both conventional surveillance and VSaaS applications, leveraging advanced technology for product innovation and meeting supply chain demands.