Report Code: 12834 | Available Format: PDF | Pages: 220

Integrated Microwave Assembly Market Size and Share Analysis by Product (Frequency Converters, Frequency Synthesizers, Amplifiers, Oscillators, Transceivers), Frequency (Ku-Band, C-Band, Ka-Band, L-Band, X-Band), Vertical (Avionics, Military & Defense, Communication) - Global Industry Demand Forecast to 2030

- Report Code: 12834

- Available Format: PDF

- Pages: 220

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Integrated Microwave Assembly Market Overview

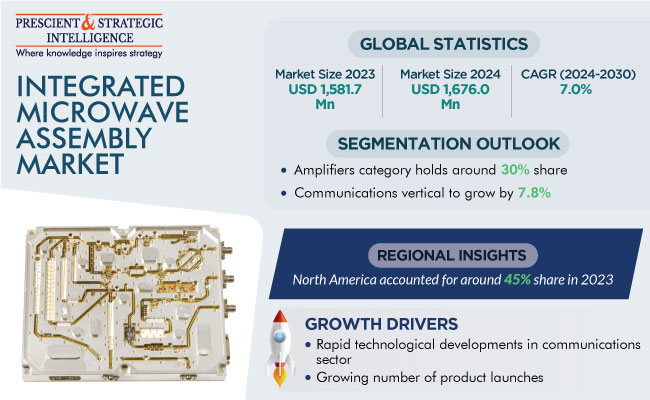

The global integrated microwave assembly market is valued at an estimated USD 1,581.7 million in 2023, and it is expected to display a CAGR of 7.0% during the forecast period (2024–2030), reaching USD 2,514.1 million by 2030. This can be ascribed to the rapid deployment of the 5G technology, advancement of the existing radio communications and radar systems, which are widely employed in the military; innovations in the technologies vital to the aviation industry, and increasing funding and capital investment in the electronics sector by the governments of emerging economies.

In the aerospace and defense sectors, apart from military communications, integrated microwave assemblies are ideal for avionics, phased arrays, RADAR, electronic surveillance, and countermeasure applications.

Military & Defense Sector Significantly Contributes to Market Growth

The military & defense category accounts for a significant revenue share. This is due to the rise in governments’ spending to enhance communication systems and deploy cutting-edge technologies for other defense purposes. As a result, to win multi-million-dollar defense contracts, several companies are engaging to deliver advanced solutions for this sector.

Moreover, the avionics category is contributing significant revenue. This is due to the growing aerospace industry, rising need for innovative products embedded in the cockpit, increasing air traffic owing to the high number of passenger flights, surging demand for military aircraft from emerging economies, and mounting popularity of sophisticated flight management solutions.

Furthermore, the communications category will register the highest growth rate during the prediction period. This will be due to the continuous development in the telecom sector with the mounting R&D investment, expansion of the technological infrastructure to deliver cutting-edge voice and data solutions to individual consumers and firms, and increasing count of international MNOs and MVNOs offering services in developing nations.

Essentially, the increasing need for cost-effective and highly reliable internet, voice, and video services and the burgeoning capital investment by numerous industry players in emerging economies, such as China, India, and South Korea, will further help the market in this category grow at a high pace.

High Acceptance of Gallium Nitride (GaN) in Microwave Modules

Characteristics of gallium nitride include hardness, mechanical stability, high heat capacity, thermal conductivity, and a wide bandgap, all of which combine to ensure power and operational efficiency in long-range communications. Additionally, GaN is an emerging alternative to pure silicon in the semiconductor and electronics fields due to its high brightness emission and intensity in opto-semiconductors, high-frequency handling capacity, and flexibility to be used with various substrates, including sapphire, silicon, and silicon carbide.

Moreover, it is expected that the adoption of GaN over silicon-based RF devices will increase in various industries, such as military & defense and telecommunications, owing to the continuous developments in the 5G technology.

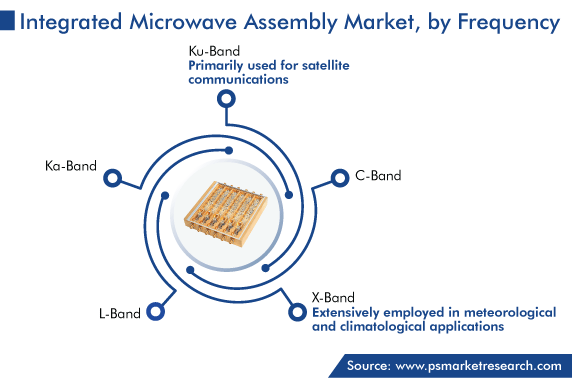

Ku-Band Holds Largest Share

The Ku-band category accounts for the largest revenue share, of 25%, in 2023, and it is further expected to maintain its position during the prediction period. Ku-bands are primarily used for satellite communications, particularly downlink, and employed in direct-transmission satellites for satellite TV, data communication services, to enable broadband internet access via satellite; and VSAT systems, which are used for maritime communications, telecommunication services, enterprise networks, and remote monitoring.

Further, the Ku-band is preferred over low-frequency microwave bands, as shorter wavelength can distinctly signal with different communication satellites employed with a smaller parabolical antenna.

Moreover, the X-band category will witness significant growth during the forecast period, as such frequency bands are extensively employed in meteorological and climatological applications. In this regard, the growing need for accurate weather predictions will propel the market. The X-band is used for aviation safety, such as in weather radars for weather detection and storm avoidance, in terrain avoidance systems, which help aircraft in obstacle collision prevention; and in the enhanced vision systems (EVS) of aircrafts to improve visibility during in low-visibility situations or adverse weather conditions.

Increasing Spending by Defense Sector Drives Market

The primary reason for the huge expenditure in the defense sector is the growing frequency of conflicts and political unrest among and within various countries. Additionally, the rise in terrorism activities, existence of numerous border security issues, and several technological advancements in the field of defense propel the market in this category. This is because to handle such situations, security organizations are looking for higher financial spending from their respective governments.

The military & defense sector heavily relies on IMAs for electronic warfare, radar systems, communication systems, satellite communications, and navigation. These components are also employed in the control systems of missiles as they assist in radar guidance, flight path tracking, and target acquisition, thereby improving the accuracy and effectiveness of weapons.

Amplifiers Contribute Most Revenue

The amplifiers category accounts for the largest revenue share, of 30%, in 2023, and it is further expected to maintain its dominance in the coming years. This is due to the high acceptance of power amplifiers in the military & defense sector; rising demand for high-speed communication, which creates a potential market for low-noise amplifiers; mounting need for consumer electronics, such as smartphones, tablets, and laptops; and technological innovations. Moreover, the penetration of the 4G technology is rising along with the introduction of next-generation wireless networks, specifically 5G.

Frequency converters also witness significant sales in the market. This is because such components are essential for the high performance of mission-critical systems, such as radars, electronic warfare systems, and broadband communication networks.

Moreover, oscillators will witness substantial growth during the forecast period. This will be due to the growing demand for higher-frequency operations in several sectors, including aerospace & defense and telecommunications.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,581.7 Million |

Market Size in 2024 |

USD 1,676.0 Million |

Revenue Forecast in 2030 |

USD 2,514.1 Million |

Growth Rate |

7.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Frequency; By Vertical; By Region |

Explore more about this report - Request free sample

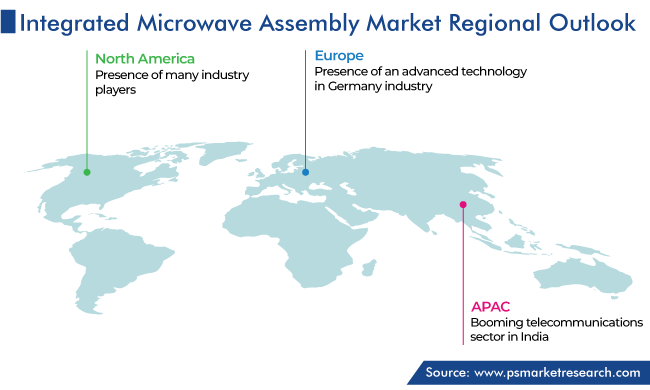

North America Dominates Market

The North American integrated microwave assembly market accounts for the largest revenue share, of around 45%, in 2023, and it is further expected to maintain its dominance during the forecast period. This can be ascribed to the presence of many industry players, growing demand for enhanced communication services, burgeoning adoption of advanced technologies, such as advanced radar systems and radio communications, in satellite communication and electronic warfare systems; and mounting need for specialized avionics due to the strict regulations regarding aviation safety.

Moreover,

- The U.S. contributes more to the regional market owing to the increasing usage of electronic goods, high R&D investment by industry players, and rising standard of cockpit functionalities.

- There are numerous companies in the country that provide high-power assemblies and microwave components for military & defense applications. They deliver mission-specific microwave components to the navy, army, and air force for fixed-based, air, and mobile platforms.

APAC will witness the fastest growth during the prediction period, with a CAGR of 7.5%. This growth can be attributed to the rise in the standard of living associated with the surge in the per capita income; increase in the internet penetration rate; boom in the demand for consumer electrical & electronic appliances, such as smartphones, headphones, and microwave ovens; commercialization of the 5G technology, rise in the preference for smart home gadgets; rapid urbanization; and growth of the medical and automotive industries, where such components are used in numerous applications.

Furthermore,

- China contributes the highest revenue to the market, and it is expected to maintain its position in the coming years. This is due the fact that the nation is the biggest manufacturing hub for several electronic products. This is itself credited to the easy availability of raw material and cheap labor, along with the government’s supportive policies.

- India will register substantial growth during the prediction period. This can be ascribed to the booming telecommunications sector owing to the rapidly rising demand for smartphones and internet services, deployment of the 5G network across the nation, and the government’s Digital India mission.

Europe will also witness significant growth in the industry in the coming years. This can be ascribed to the ongoing research and development by several players to deliver effective communication solutions and increase in the government spending on satellite launches for the enhancement of telecom networks. Further, the integration of cutting-edge avionics suites into commercial aircraft, the deliveries of which continue to increase, drives the market in the continent.

Additionally,

- Germany contributes the majority of the revenue to the regional market, and it is expected to maintain its position in the coming years. This is due to the presence of an advanced technology industry, strong manufacturing capabilities, and growing requirement for enhanced connectivity with high-speed data transmission over wireless networks across the nation.

- In addition, the country has a well-developed market for microwave assemblies as they are employed in several applications, including aerospace & defense, telecommunications, automotive electronics, and medical equipment.

Top Integrated Microwave Assembly Providers Are:

- Analog Devices Inc.

- Teledyne Technologies Incorporated

- MACOM Technology Solutions Inc.

- Cobham Advanced Electronic Solutions

- CPI International Inc.

- Spectrum Control

- Narda-MITEQ

- Knowles Corporation

- Mercury Systems Inc.

- AKON Inc.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the integrated microwave assembly market, to offer accurate market estimations for 2017–2030.

Based on Product

- Frequency Converters

- Frequency Synthesizers

- Amplifiers

- Oscillators

- Transceivers

Based on Frequency

- Ku-Band

- C-Band

- Ka-Band

- L-Band

- X-Band

Based on Vertical

- Avionics

- Military & Defense

- Communication

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

In 2023, the size of the market for integrated microwave assemblies is USD 1,581.7 million.

The integrated microwave assembly industry CAGR till 2030 is 7.0%.

Amplifiers hold the largest share in the market for integrated microwave assemblies.

The integrated microwave assembly industry drivers include the growing defense spending, rising demand for better telecom services, and increasing air traffic.

The military & defense and communications verticals generate significant revenue in the market for integrated microwave assemblies.

North America holds the largest integrated microwave assembly industry share.

The highest CAGR in the market for integrated microwave assemblies is being witnessed in APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws