Market Statistics

| Study Period | 2019 - 2030 |

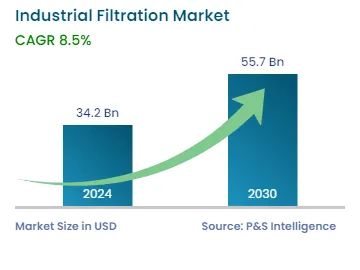

| 2024 Market Size | USD 34.2 Billion |

| 2030 Forecast | USD 55.7 Billion |

| Growth Rate(CAGR) | 8.5% |

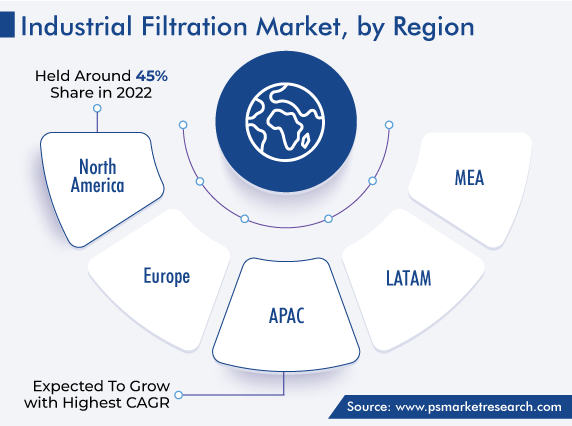

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12640

Get a Comprehensive Overview of the Industrial Filtration Market Report Prepared by P&S Intelligence, Segmented by Type (Liquid, Air), Filter Media (Activated Carbon/Charcoal, Fiberglass, Filter Paper, Metal, Non-Woven Fabric), Product (Bag Filter, Filter Press, Cartridge Filter, Depth Filter, Drum Filter, Electrostatic Precipitator, ULPA Filter, HEPA Filter), Industry (Food & Beverages, Chemicals & Petrochemicals, Power Generation, Oil & Gas, Pharmaceuticals, Metal & Mining, Automotive), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 34.2 Billion |

| 2030 Forecast | USD 55.7 Billion |

| Growth Rate(CAGR) | 8.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global industrial filtration market revenue was USD 34.2 Billion in 2024, and it is expected to reach USD 55.7 Billion by 2030, advancing with a CAGR of 8.5% between 2024 and 2030. The prime factors that drive the market are the advancements in the filtration technologies, stringent government regulations regarding emission control, rising need for safe working environments in industrial sites, and growing requirement for equipment dependability and lifespan extension.

Moreover, the continuous development of new products for industrial filtration and the growing food & beverage, metal & mining, and automotive industries are responsible for the market expansion.

The digitalization of filtration equipment offers the industry a significant growth opportunity, by aiding in the continuous observation of industrial filters. These filters include sensors, which record air cleaners' load status and then provide service-related data to the plant operator. By preventing unexpected machine downtime, the digitalization process contributes significantly to effective maintenance planning. It is possible to replace sensor technology as and when required. Additionally, such technology is crucial for eliminating the possibility that these are used beyond their functional lives. Additionally, it gives machines a longer service life.

Further, the adoption of Industry 4.0 accelerates the digitalization of industrial filtration processes, which, in turn, aids manufacturers in efficiently tracking operational performance and gathering data that supports workflow automation.

Industries are required to install as a result of the rigorous rules being implemented in response to the growing environmental concerns. The key driver for the market in this regard is the stringent limits set on GHG and particulate emissions and effluent discharge, which every industry must adhere to. Additionally, the policies adopted by many nations to address the issue of venting and flaring associated with upstream oil & gas operations are contributing to the expansion of the market.

The market is also expected to grow at a healthy rate throughout the projection period due to the implementation of worker safety and health laws in numerous countries. Numerous industrial air filtering laws have been put into place as a result of the rise of industrial facilities. For example, a federal law in the U.S., named The Clean Air Act, aims to reduce air pollution on a massive national scale. Similar to this, the European Commission proposed a clean air policy package in 2013 with the aim of reducing the effects of harmful pollutants by 2030.

The non-woven fabric category, based on filtration media, accounted for the largest revenue share, around 35%, in 2022, and it is further expected to maintain its dominance during 2022–2030. This is because non-woven fabrics are preferred by the pharmaceutical industry due to their low weight, reusability, durability, water resistance, and fire resistance. Additionally, they are commonly utilized in the mineral processing industry because of their intricate fiber arrangements, quick and inexpensive manufacturing, and numerous design options provided by the adaptability of the structure.

Moreover, the activated carbon/charcoal category held a significant revenue share in 2022. This is because this material is suitable for continuous-filtration operations because it is easily regenerable in situ, via heat and chemical treatment.

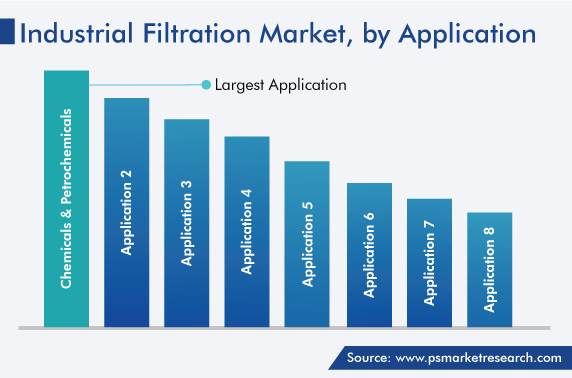

The chemicals & petrochemicals category accounted for the largest revenue share, of 40%, in 2022, and it is further expected to maintain its position during the forecast period. This is due to the fact that the manufacturing processes employed in this sector produce a variety of pollutants, which react with the equipment. Moreover, these chemical contaminants also pose a risk to the environment and employees, as well as carrying the possibility of cross-contamination with other materials, which lowers product quality.

Furthermore, the pharmaceuticals category will grow with a substantial CAGR in the coming years. This is because strict hygiene and safety requirements must be upheld to prevent the external contamination of medicines by both staff and the environment. Several enterprises may not be as concerned about the possibility of product contamination due to microbes, germs, and suspended airborne particles. However, contamination can render a product unsuitable for use and negatively impact the pharmaceutical industry's quality requirements, which is why it has emerged as a significant revenue contributor.

The liquid category accounted for the larger revenue share, over 60%, in 2022, and it is further expected to maintain its dominance in the coming years. This can be attributed to the strict environmental laws that forbid pollutants from getting into water sources. The high cost of wastewater treatment facilities and the rising demand for clean water are the main factors driving the category. Thus, over the projection period, the demand for industrial filters may be influenced by the deployment of improved water treatment equipment and zero-discharge technologies.

The filter press category will witness the fastest growth during the forecast period, with a CAGR of over 7%. This will be due to the fact that filter presses are extensively used in the food & beverage, metals & mining, pharmaceuticals, power generation, and industrial manufacturing sectors to collect undesired solid particles.

Moreover, the HEPA system category contributed significant revenue to the market in 2022. This is due to the existence of air filters with high effectiveness, which filter out the inorganic dust floating in the air, which includes bacteria, mold spores, viruses, dust mites, and pollen, which may cause serious harm. Instead of the flat fiberglass material used in conventional filters, HEPA variants use thick, pleated media, thus increasing the filtration surface area and filter life. In hospitals and clinics, HEPA filters are already the industry standard.

Drive strategic growth with comprehensive market analysis

North America accounted for the largest revenue share, of 45%, in 2022, and it is further expected to maintain its position during the prediction period. This is due to the rising environmental concerns, surging need for workplace safety in the industrial sector, government mandates to control emissions, and increasing R&D activities to provide cost-efficient solutions to owners of industrial facilities.

Additionally, industrial customers in this region utilize high-performance air filters for the effective removal of sub-micron particulates, in an effort to reduce health risks. In addition, the players are concentrating on reducing the pressure drop in air filters, which provides end users with substantial energy savings and, consequently, decreases the total expense of plant ownership.

Moreover,

APAC is expected to be the fastest-growing region during the forecast period. This is due to the rapid industrialization and urbanization, rising preference for packaged food owing to the surging per capita income, high acceptance rate of industrial filters, digitalization of plant operations, growing need for wastewater treatment, and governments’ strict regulations regarding emission control.

Moreover,

Based on Type

Based on Filter Media

Based on Product

Based on Industry

Geographical Analysis

The market for industrial filtration solutions valued USD 34.2 billion in 2024.

The industrial filtration industry is driven by the stringent regulations for product quality, emissions and effluent discharge, and employee safety.

The chemicals & petrochemicals industry dominates the market for industrial filtration solutions.

The industrial filtration industry CAGR forecast till 2030 is of 8.5%.

North America is the largest market for industrial filtration solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages