Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 6,913.8 Million |

| 2030 Forecast | USD 9,501 Million |

| Growth Rate(CAGR) | 5.4% |

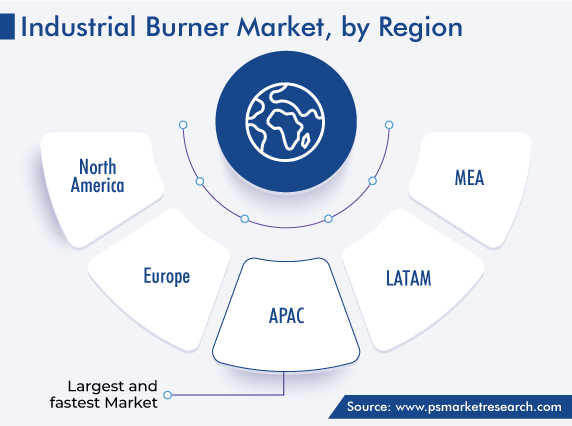

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12617

Get a Comprehensive Overview of the Industrial Burner Market Report Prepared by P&S Intelligence, Segmented by Type (Regenerative, High Velocity, Thermal Radiation, Radiant, Customized, Flat flame, Line), Operating Temperature (Low, High), Automation (Monoblock, Duoblock), Fuel Type (Oil, Gas, Duel), End User (Paper & Pulp, Food & Beverages, Power Generation, Chemicals, Metals & Mining, Automotive), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 6,913.8 Million |

| 2030 Forecast | USD 9,501 Million |

| Growth Rate(CAGR) | 5.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The industrial burner market size stood at USD 6,913.8 million in 2024, and it is expected to advance at a compound annual growth rate of 5.4% during 2024–2030, to reach USD 9,501 million by 2030. This is primarily ascribed to the growing industrial sector and rapid technological advancements; the surging demand for electricity generation and adoption of standard safety protocols; the rising production of automobiles; and the increasing mining activities.

These systems are used for various applications such as ovens, boilers, heating liquids, air heating, welding, glass blowing, and recycling. They possess various advantages including less pollution, low noise, longevity, and safety in operations, which, in turn, fuel their demand. They are also designed to treat materials in an enclosed system at very high temperatures.

Due to their advantages, various companies are launching new products with advanced technologies. For instance, in July 2021, Tenova launched burners for heat treatment furnaces, which use around 100% hydrogen and these keep NOx emissions largely below the strictest parameters.

Increasing Use of Burner Management System Boosts the Market Growth

The demand for industrial burners will increase with the rising usage of burner management systems (BMSs) in a variety of industries. BMS is used to control multiple furnace parts of a boiler, including it can be started, operated, and shut down safely. A large number of industries are rapidly adopting such systems to improve plant operations providing secure and dependable operations, which guarantee greater safety, save maintenance costs, and create a safer working environment for plant workers. Thus, these factors are propelling the industry growth.

The increasing development of the industrial sector all over the world is expected to further drive the applications of BMSs in boiler processes. Government regulations are also rising and various legislations supporting the installation of safety systems have significantly increased the installation of BMSs in existing as well as novel fired equipment. Thus, the demand for such systems across a wide range of end-use industries, such as chemicals, oil & gas, and power generation, is substantially increasing.

Moreover, various companies have started adopting BMSs because of the rising focus on manufacturing systems to ensure the system availability, safety, easy maintenance, and enhanced operations; the introduction of advanced safety systems; the increasing investments in R&D activities; and they are facing a large number of litigations for workplace accidents. The rising awareness about the benefits associated with the installation of advanced management systems, including damage detection through immediate diagnostic failure identification and enhancement in monitoring the status, is also predicted to influence the market positively.

With the increasing use of such systems, the market is also growing at a good pace. The introduction of advanced management systems monitors multiple aspects of boiler control, including fuel usage, stack temperature, hours of use, and boiler efficiency. It also includes alarm management features and operator displays, which help in simplifying unit operations and minimizing start-up time. The advanced operator messaging features and diagnostics in such advanced systems enable companies to minimize critical troubleshooting time.

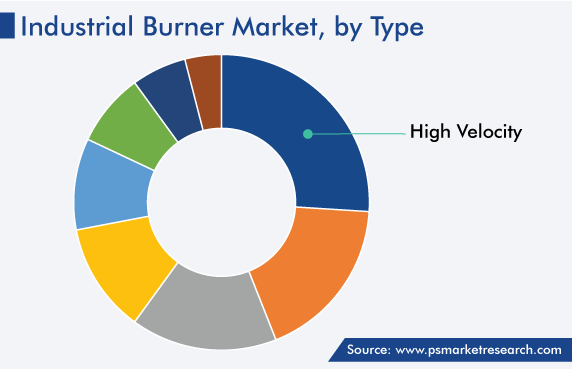

Based on type, the high velocity category held a major share in 2022, owing to the greater efficiency of high-velocity burners at less cost. These burners also offer rapid and uniform heat distribution, minimize the emission of greenhouse gases, and are effective in drying out moisture from refractory materials. During the requirement of a high rate of recirculation of combustion products, these are used, as they provide a high degree of heat penetration while working in a furnace.

High operating temperature (> 1,400 °F) burners are widely used because they are used in forging various metals and provide heat treatment in various applications such as food & beverages, glass, chemicals, ceramics, textiles, and many more.

Whereas, the low temperature (< 1,400 °F) category is growing at a considerable rate, owing to the wide range of designs, control zones, and operating temperatures of around 1400 °F, for continuous or batch furnaces, and a heat recovery system was designed where maximum temperature transfer and high efficiency are required.

The power generation category is expected to grow at the highest CAGR, of 6.4%, during the forecast period, owing to the rising demand for electricity generation. The increased industrial production, growing income, and rapidly enhancing services sector are the factors driving the demand for energy. According to the International Energy Agency (IEA), in 2022, the global electricity demand was around 22,500 TWh and by 2030, it is expected to increase to 25,000 TWh.

In order to produce more power, high-pressure steam is required. For this, burners are used in coal-fired, turbine-based, steam-power, and diesel-fired applications. Moreover, industrial burners are an important component of industrial boilers, whose demand is increasing significantly, as boilers are used more frequently in power generation facilities.

In addition, the chemical category is expected to show significant growth in the coming years. This can be ascribed to the heavily rely on chemical process industries on combustion to provide thermal energy for various processes such as fluid heating, heat transfer, endothermic chemical reactions, metal melting, steam production, and distillation. Also, burners require low maintenance and are cost-effective, which, in turn, fuels the market in the chemical category.

The demand for dual-fuel burners is expected to witness considerable growth in the forecast period because these offer precise temperature control and in combination with secondary fuel allow the use of cheap fuel sources. They have higher efficiency and are known for their features such as compact design, ease of operation, improved performance, and durability. Also, these have optimum flexibility because they provide two types of nozzles for two types of fuels. Thus, they are mostly used for melting furnaces, heat treating, and galvanizing units.

In addition, the gas category is projected to hold a significant share of the industry. This is attributed to its features such as longer service life, high-tensile strength, reliability, optimum performance, and durability, and the rising use of gas-heating equipment for various applications across several industries, including boilers, furnaces, bakeries and ovens, automobile workshops, metal industries, etc. Gas burners are also able to maintain the turndown ratio between high and low fires of 10:1 efficiently with ease of control and repeatability.

The monoblock category dominates the market, owing to its high-power efficiency and large capacity. In addition, it has a more compact design with less weight, which increases its use for small boiler rooms or limited areas. In this, the electrical panel consists of whole power and control circuits and is integrated into a dual-block type. As studied, the monoblock type has a smaller size, which makes it appropriate for batch production and hence the delivery time will decrease subsequently. In addition, it can be manufactured with the help of casting processes, followed by CNC machining or other high-precision-making techniques.

Moreover, it has been evaluated that there is less noise pollution in the monoblock category as compared to the duoblock category, due to the ventilation and combustion unification. Also, it is constructed by modular principle and possesses higher flame stability against pressure fluctuations in the combustion chamber.

Drive strategic growth with comprehensive market analysis

APAC has the leading position in the industrial burner market, and it will hold the same position till 2030, with a value of USD 4,276 million. This is attributed to the growing industrialization; rising petrochemical and mining activities; and governments of several developing countries implementing stringent regulations and various strategies for minimizing carbon emissions. In APAC, the Chinese market holds the leading position, and it will grow at a CAGR of more than 7% during the forecast period. This is attributed to the low cost of land, labor, and raw materials for the development of burners in the country.

This report offers deep insights into the industrial burner industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Operating Temperature

Based on Automation

Based on Fuel Type

Based on End User

Geographical Analysis

The industrial burner market size stood at USD 6,913.8 million in 2024.

During 2024–2030, the growth rate of the industrial burner market will be around 5.4%.

Power Generation is the largest end user in the industrial burner market.

The major drivers of the industrial burner market include the shifting focus of metal processing companies toward high-capacity industrial burners as an alternative to harmful furnaces, the increasing demand for electricity generation, and the growing end-use industries.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages