Report Code: 10599 | Available Format: PDF

Industrial and Automotive Filters Market: Historical Size and Share Analysis, Future Growth Potential, Key Regions, Forecast till 2030

- Report Code: 10599

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

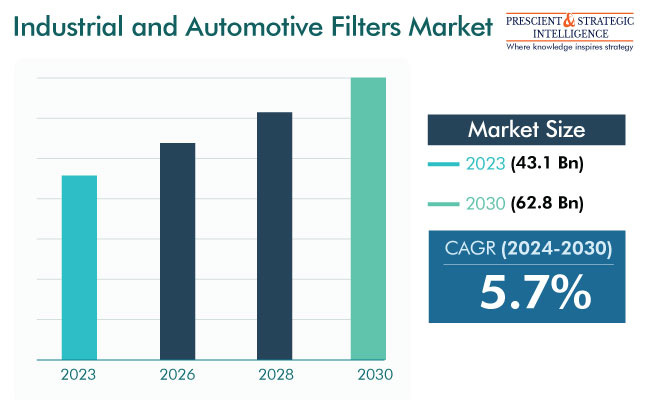

The industrial and automotive filters market is expected to advance from USD 43.1 billion (E) in 2023 to USD 62.8 billion in 2030, at 5.7% CAGR between 2024 and 2030.

The growth of this industry is because of the surging population and speedy urbanization, which have increased the prospects for industrialization. This has, in turn, led to a growing requirement for filters in the industrial and automotive sectors. Moreover, the rising concerns regarding the environment have resulted in the formation of strict rules for emission reduction for both these sectors.

Surging Acceptance of HEPA Systems To Boost Market

The increasing incidence of airborne ailments and the rising air pollution levels have driven the acceptance of air filters. It has been found that indoor air is five times more polluted compared to outdoor air since it does not circulate like outdoor air. Air filters clean the air of viruses, smoke, dust, odors, gases, volatile organic compounds, pollen, formaldehyde, and pet dander.

HEPA is among the most-frequently used filter technologies because of its greater effectiveness than traditional systems. The acceptance of these filters in clinics and hospitals has been increasing attributed to their capability to eliminate bacteria and viruses that cause airborne diseases. Moreover, their usage is mandated at pharmaceutical and F&B plants and strongly recommended for semiconductor companies, where a microbe- and contamination-free environment is vital.

Stringent Emission Regulations Are Key Driver

Governments and regulatory bodies across the globe have put in place strict emission regulations for automobiles releasing harmful gases, such as nitrogen oxides, sulfur dioxide, carbon monoxide, and carbon dioxide. For example, in April 2023, the Environmental Protection Agency introduced new planned standards to decrease harmful emissions from medium-duty and light-duty automobiles starting with model year 2027.

Likewise, in April 2023, the European Commission implemented Regulation (EU) 2023/851, reinforcing the performance standards for CO2 emissions for new light commercial vehicles and passenger cars. Particularly, the alteration of the regulations makes the emission targets more stringent, applying them from 2030, and sets a target for a 100% reduction from 2035 onward. To reduce CO2 emissions, these regulatory bodies have directed the installation of selective catalyst reduction technologies and diesel particulate filters in light trucks and diesel passenger cars.

| Report Attribute | Details |

Market Size in 2023 |

USD 43.1 Billion (E) |

Revenue Forecast in 2030 |

USD 62.8 Billion |

Growth Rate |

5.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Adoption of Digital Approaches in Industrial Filtration To Offer Opportunities

Digitalization is a major opportunity for the growth of the industry as it assists in the real-time monitoring of industrial filters. Filters can be integrated with sensors that store the load status of the air cleaners and send service-related data to the plant operator. This procedure supports in ideal maintenance, by preventing machine downtimes.

Filters integrated with the sensor technology can be exchanged at the correct time, as the data they send assists in avoiding the risk of their utilization beyond their recommended life. This ultimately guarantees a longer life of the machinery, which benefits industrialists to a great extent. As per an article in Forbes, unplanned machine breakdowns cause losses worth USD 50 billion in the industrial sector each year.

The increasing implementation of Industry 4.0 technologies further improves the scope for digitalization in industrial filtration. Apart from being of immense help to the end users, this approach assists filter makers in gathering real-time information and monitoring the performance of their products. The gathered data helps in predicting downtime and maintenance requirements, investigating system performance, automating workflows, and collecting system overviews, which results in easier analysis and monitoring.

Liquid Filters Are Widely Used in Industries

The liquid filters category, based on industrial filter type, is leading the industry. This can be attributed to the rising stringency of the environmental regulations associated with the release of contaminants into waterbodies. Liquid filters are used in the food & beverage, energy, medical, mining, and chemical industries, which generate significant volumes of effluents. Moreover, liquid filters are a key component of the machinery used in these factories, as it is vital to produce quality products bereft of contaminants.

In addition, revenue contribution from air filter sales will increase substantially during the forecast period. Global warming as well as the poor air quality have prompted various nations to pass legislations to reduce the emission of harmful contaminants into the air. As per an ongoing temperature analysis led by NASA’s GISS, the average temperature on earth has increased by a minimum of 1.1 degrees Celsius since 1880. The majority of the warming has taken place since 1975 at a rate of 0.15 to 0.20 °C every 10 years.

Intake Filters Are Highly Important in Automobiles

The intake filters category, based on automotive filter product, is dominating the industry. These filters clean the air before sending it to the cylinders, in order to prevent the entry of dust, dirt, and other contaminants into the combustion chamber. Automobiles running in dusty areas need a regular replacement of intake filters.

These filters are an important component of a vehicle engine as they sustain greater performance and enhance its durability. Moreover, they ensure a continuous inflow of clean fuel and oil into the engine and other vital mechanical parts, which helps increase fuel efficiency and mileage. This is because clean combustion reduces GHG emissions, which is a key concern for automobile OEMs and owners.

Top Industrial and Automotive Filters Manufacturing Companies:

- MANN+HUMMEL International GmbH & Co. KG

- Unifrax Holding Il Corporation

- Parker Hannifin Corp.

- VALMET OYJ

- K&N Engineering Inc.

- Freudenberg Filtration Technologies SE & Co. KG.

- Donaldson Company Inc.

- Nordic Air Filtration

- Sogefi SpA

- Denso Corporation

- Sefar Holding AG

- Valeo SA

- Sandler AG

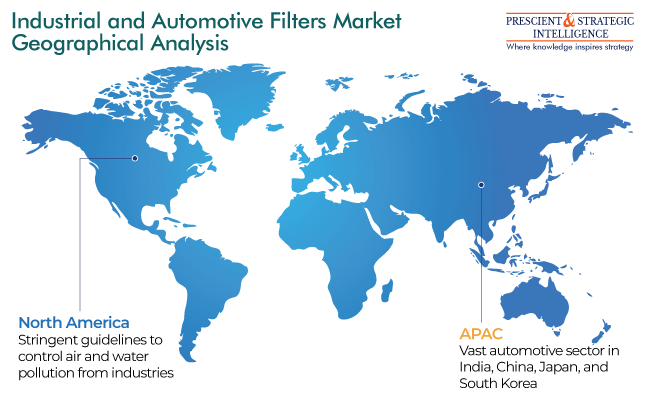

APAC Is Dominating Market

APAC is the largest contributor to the industry, mainly because of the existence of major industrial companies in the region. HEPA filtration is extremely important in the production of semiconductors, while fuel, air, and oil filters are crucial for generators. The surging population, rising worries concerning emissions from different sectors, and growing industrialization levels contribute to the market growth here.

Furthermore, the rising investment by key manufacturers for developing innovative filters with new raw materials, such as small fibers, is expected to boost the progress of this industry. In addition, China has the largest wastewater treatment plant in Asia, the Shanghai Bailonggang WWTP, which processes the wastewater released by approximately 3.6 million individuals. Liquid filters are vital at sewage treatment facilities because of the stringent municipal norms on water quality and water pollution.

The North American market will propel at a significant rate, mainly because of the extensive vehicle production owing to the existence of key manufacturers. Moreover, the requirement for these filters is boosted by the implementation of preventive procedures by the U.S. government to tackle air pollution from the manufacturing sector. Additionally, the employment of advanced technologies, such as nanotechnology, in the process of filtration will boost the product requirement in the continent.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws