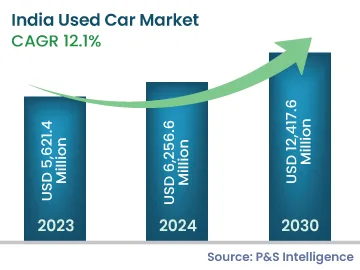

What will be the industry size of the Indian used car market by the end of the decade?+

The Indian used car market will reach USD 12,417.6 million by 2030.

What will be the CAGR of the Indian used car market during 2024–2030?+

The CAGR of the Indian used car market during 2024–2030 is 12.1%.

What are the key drivers boosting the development of the Indian used car market?+

The key drivers boosting the growth of the Indian used car market include internet accessibility for information, sales of guaranteed vehicles, and the rising demand for car subscription services.

What is a notable trend witnessed in the Indian used car market?+

A notable trend observed in the Indian used car market is the growing trend of web retail trade for secondhand automobiles, driven by internet usage, urban progress, and telecom extension.

Which region dominates the Indian used car market in terms of revenue share?+

Maharashtra dominates the Indian used car market in terms of revenue share, accounting for approximately 35%.

What is the key factor influencing the growth of the used car market in that region?+

The key factor influencing the growth of the used car market in Maharashtra is the strong depreciation values of luxury automobiles, increasing disposable income, rapid urbanization, and expanding internet penetration in non-metros.

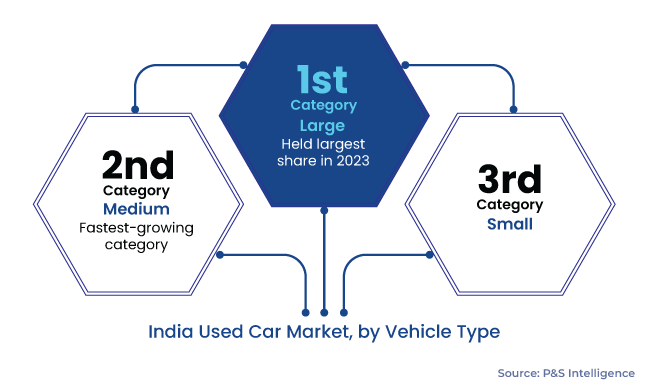

Which category holds the largest revenue share in the Indian used car industry in 2023?+

The large category holds the largest revenue share of around 50% in the Indian used car industry in 2023.