Market Statistics

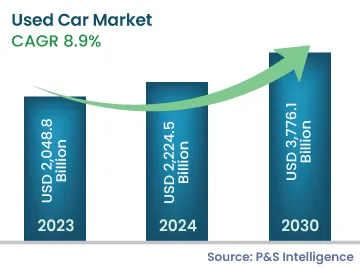

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 2,048.8 Billion |

| 2024 Market Size | USD 222,4.5 Billion |

| 2030 Forecast | USD 3,776.1 Billion |

| Growth Rate(CAGR) | 8.9% |

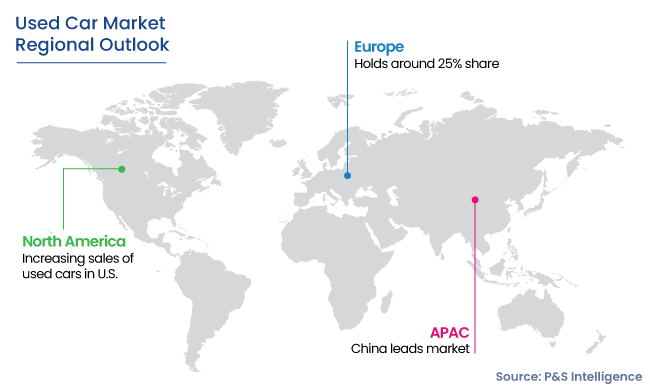

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Nature of the Market | Fragmented |

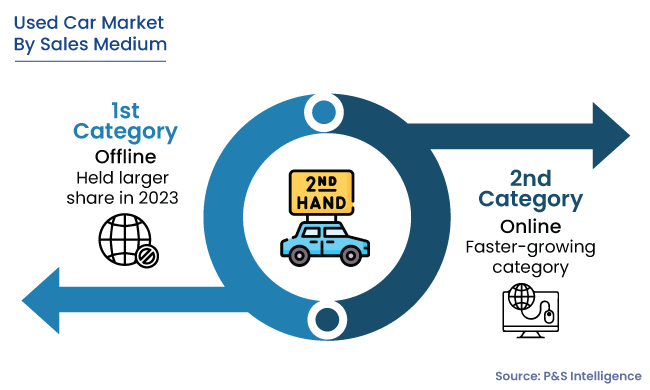

| Largest Sales Medium | Offline |