India Skin Care Dermacosmetics Market Analysis

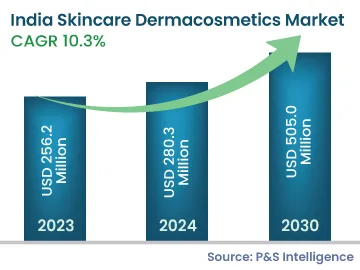

The Indian skin care dermacosmetics market size was USD 256.2 million in 2023, which is expected to witness a CAGR of 10.3% during the forecast period 2024–2030, to reach USD 505.0 million in 2030. The key factors responsible for the growth of the market include the increasing inclination toward spending on appearance, rapid shift toward e-commerce, growing prevalence of skin diseases, and teens growing older at an early age.

The increasing consciousness of appearance has a positive shift in skincare regime among teens. During the historical period, dermacosmetics were more in demand by women aged between 23 and 50 years. However, teenagers are now using them to enhance their beauty as well as to stop the early signs of aging. This demographic is aware of the ways to protect their skin from external damage by utilizing dermacosmetic products, such as sera, toners, and cleansers, at an early age. With the adoption of a wide range of such products, the market size is expected to increase in the future.

In India, there is an increasing demand for these products with a focus on improving skin and hair health. With this, there is also a rise in research and development (R&D) investment to develop effective and advanced products. This is primarily attributed to the increasing number of conferences hosted by the cosmetics industry, in which scientists and manufacturers share their expertise and discuss the latest technologies in this domain. For instance, in February 2023, the Second International DERMACON and 51st National Conference of Indian Association of Dermatologists were held at Jio World Convention Centre, India. The aim of this conference was to provide a platform to practitioners and researchers to talk about the new innovations in the dermatology field.

Moreover, e-commerce is expected to continue to play a key role in the growth of the industry over the forecast period. As consumers return to increasingly time-pressed lifestyles and demand convenience, they are expected to turn to the most-convenient ways of shopping. Meanwhile, the pandemic reinforced the need for brands to have a digital presence.

Online shopping and home delivery services saw a rise due to the temporary closure of beauty specialist retailers and department stores. Although the move toward e-commerce was already evident before the pandemic, the closure of retail outlets and fear of infection even after reopening led to a stronger influx of consumers to e-commerce.

They valued the convenience and safety of online shopping and home delivery when they were unable or unwilling to leave their homes. The rapid shift to the digital and online world, although an immediate impact of the pandemic, could result in long-term changes to the distribution of dermacosmetic products. This is coupled with the rising rates of internet penetration, which is enabling more consumers to transition online.