India HVAC Market Future Outlook

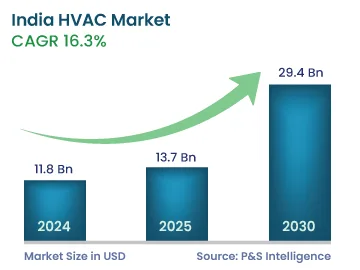

The Indian HVAC market size is estimated to have stood at USD 11.8 billion in 2024, and it is projected to reach USD 29.4 billion by 2030, growing at a CAGR of 16.3% between 2024 and 2030. This is ascribed to rampant infrastructure development, technological advancements, and rising tourism activities across the country.

Moreover, the rising disposable income and various government initiatives focusing on improving the energy efficiency of appliances are contributing to the market growth. Government campaigns, such as Atithi Devo Bhava and Digital India, are resulting in a high inflow of tourists, thus leading to the growth in the hospitality and tourism-related businesses.

Additionally, India’s growing middle-class population, rising disposable income, and surging ventilation and cooling requirements are resulting in the growth of the market in the country. The market is displaying a high focus on energy efficiency by sellers as well as consumers.

Furthermore, the ‘Make in India’ initiative is creating a favorable environment for global players to set up their factories in India, to cater to the local population, whilst making the country a global manufacturing hub. Owing to this, the Indian HVAC market is projected to display stimulated growth in the coming years.

Additionally, with the rising disposable income of the populace, consumer spending is on the rise in the country. Consumers are now spending more on home appliances, such as air conditioning systems and refrigerators. HVAC systems are now more widely accessible to communities, due to their increasing disposable income. Thus, the rising disposable income of the population in India is propelling the demand for HVAC products and supporting the market growth.