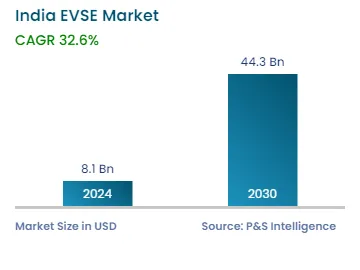

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 8.1 Billion |

| 2030 Forecast | USD 44.3 Billion |

| Growth Rate(CAGR) | 32.6% |

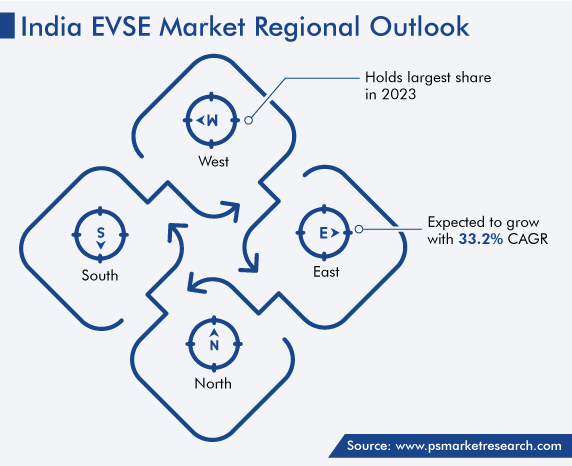

| Largest Region | Western India |

| Fastest Growing Region | Northern Region |

| Nature of the Market | Fragmented |

Report Code: 11803

Get a Comprehensive Overview of the India EVSE Market Report Prepared by P&S Intelligence, Segmented by Type (AC, DC), Application (Public, Private), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 8.1 Billion |

| 2030 Forecast | USD 44.3 Billion |

| Growth Rate(CAGR) | 32.6% |

| Largest Region | Western India |

| Fastest Growing Region | Northern Region |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The Indian electric vehicle supply equipment market size is estimated to have stood at USD 8.1 billion in 2024, and it is expected to reach USD 44.3 billion in 2030, with a compound annual growth rate of 32.6% during 2024–2030. This is due to the increasing preference for low-emission vehicles, the rising awareness of the benefits of electric vehicles, the surging adoption of EVs, and the growing awareness of protecting the environment. Moreover, the industry is adapting advanced technologies and innovative strategies to maintain its growth trajectory.

Furthermore, India is expected to create both direct and indirect job opportunities in the EV industry, including jobs in manufacturing, charging infrastructure development, and related services. The job creation potential is attracting investment and driving the growth of the EVSE market.

The growing adoption of electric vehicles is the most important factor contributing to the growth of the Indian electric vehicle supply equipment market. For instance, as per a report, in FY 2022–23, EV sales registered in India witnessed a 154% year-on-year growth over FY 2021–22 EV. The major reason for the increasing adoption of EVs is government support for these green vehicles and the growing public concerns for the environment, especially in tier-1 cities where the air quality is worst.

As per the report by IQ Air North America INC., India is ranked fifth in the air pollution ratings, with 58.08 µg/m³ particulate matter (PM) 2.5 concentration. Seven of the world’s top 10 populated cities and 22 of the top 30 cities are in India. Since the transportation sector is a major source of air pollution, governments at the central and state levels are promoting EVs. With the expected growth of EV sales, the demand for is also expected to rise. Thus, this factor drives the growth of the market.

Moreover, the increasing adoption of solar energy for powering charging stations is expected to create numerous growth opportunities for industry players. With the increasing use of EVs, there is a high need to harness a more sustainable energy source to run these vehicles, and the sun is a potential source of renewable energy to meet the increasing demand. For instance, India planned to attain a renewable energy generation capacity of 175 GW by 2022, of which 100 GW would be in the form of solar energy. Thus, the use of unconventional sources of energy for electric vehicles is expected to generate new growth opportunities in the market.

In addition, the growing consumer lifestyle changes and the rising per capita income have contributed to the extensive use of electric vehicles in the commercial and residential sectors. This trend is driven by the convenience of charging docks and their cost-effectiveness. Thus, this leads to the increasing need for EVSE in the country.

There is a significantly strong demand for high-voltage charging stations in commercial buildings in the EVSE market. This is because these are capable of delivering high-voltage electricity, providing efficient charging options for various vehicles, and cost-effective charging solutions for different types of electric vehicles.

In India, the market is consolidated in nature, because of the presence of a few players. It is expected to become fragmented in the forecasted years, owing to the entry of prominent global players and numerous startups in the country.

The current number of charging stations in India is relatively low compared to the growing sales of EVs. This is the biggest challenge for the EV sector in India. To cope with this, there is a need for expansion and establishment of more charging stations across the country. Thus, the entry of giant electric vehicle manufacturers in the country, such as Tesla, and the Indian government is promoting and making efforts toward the development of charging stations, which, in turn, drive the demand for EVSE in the nation.

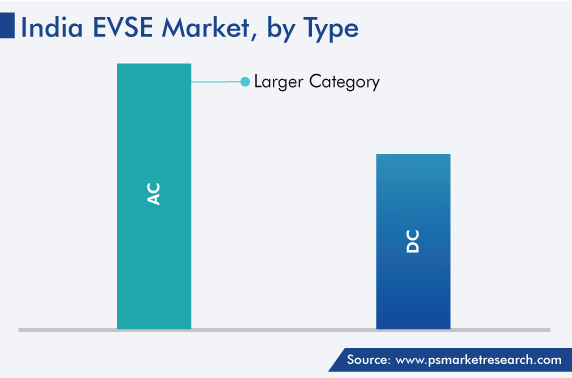

Based on type, AC chargers dominate the market, due to their lower cost of production, installation, and operation. Because of the lower installation and operational costs, cars are usually much cheaper to charge at AC stations, thereby making them more convenient for day-to-day charging. Furthermore, this type of charger is favored in both public and private sectors, due to its efficient, faster-charging capabilities, and ease of installation. They also provide higher charging power than standard household outlets, allowing for quicker charging times.

Whereas, the adoption of DC chargers is increasing rapidly in the country. This is because these are capable of delivering above 880 V of electricity to users; extremely efficient tools due to their ability to offer electricity to cars, two-wheelers, or SUVs; capable of storing electricity in case of outage situations; producers are concentrating on developing a cost-effective solution for several types of vehicles; and these chargers are used extensively in several charging stations to power several types of EVs.

On the basis of application, the public category is projected to witness faster growth, advancing at a CAGR of 33.0%, in the Indian market in the coming year. This can be because the government is supporting by making plans and offering monetary incentives to create fast-charging networks in the country; the entry of key players, such as Tesla, MG Motors, and Hyundai Motor Company; and their ongoing partnerships with OEMs in the country.

Whereas, private chargers dominated the Indian market. This is due to their early adoption in the country, low cost, and higher demand among customers, for overnight charging at homes and commercial places.

Drive strategic growth with comprehensive market analysis

The western region of India covers states such as Gujarat and Maharashtra. These states have a strong industrial base and are home to major OEMs of EVSE. Also, these states have a high demand for electric vehicles and charging infrastructure, due to the growing population, increasing transportation needs, and surging per-capita income. Thus, this region accounts for the largest revenue share in the Indian electric vehicle supply equipment market.

Whereas, the market in the northern region, which includes states like Delhi, Haryana, Uttar Pradesh, and Punjab, is expected to witness the fastest growth in the coming years. This can be because these states have a high level of air population and congestion in major cities and high government concerns about improving air quality. Thus, the adoption of electric vehicles and the development of charging infrastructure are increasing, which can help reduce pollution and improve air quality in these areas.

Moreover, the market in the eastern region of India, which includes states like West Bengal, Bihar, and Odisha, is also expected to witness significant growth in the coming years. This is because, in this region, the population is growing and urbanization is increasing. This provides a large customer base for electric vehicles and the need for charging infrastructure to support them.

In addition, the southern region, including states like Tamil Nadu, Karnataka, and Telangana, has a supportive ecosystem for electric vehicles and a strong presence of technology companies. Cities such as Chennai, Hyderabad, and Bengaluru are hubs for electric vehicles for manufacturing and research. Thus, these factors are driving the demand for EVSE in the region.

This fully customizable report gives a detailed analysis of the India electric vehicle supply equipment industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Application

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages