Market Statistics

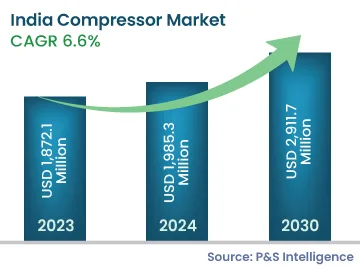

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 1,872.1 Million |

| 2024 Market Size | USD 1,985.3 Million |

| 2030 Forecast | USD 2,911.7 Million |

| Growth Rate(CAGR) | 6.6% |

| Largest Region | North India |

| Fastest Growing Region | North India |

| Nature of the Market | Fragmented |

| Largest Application | Automotive |