India Aerosol Market Analysis

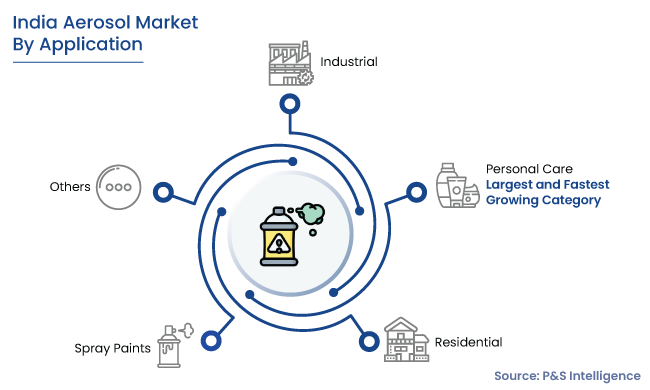

The India aerosol market stood at USD 634.9 million in 2023, and it is expected to reach USD 965.7 million by 2030, demonstrating a CAGR of 6.3% during the forecast period (2024–2030). Key factors responsible for the growth of the market are the rising demand for aerosols in the automotive and manufacturing industries and supportive government initiatives for research and development (R&D) in the manufacturing industry.

The market is also growing on account of the prospering manufacturing sector. As per the data presented by the IBEF, the Indian manufacturing industry is growing at a significant pace. This is attributed to the fact that the demand for electronic appliances and consumer devices is increasing at a high rate.

In addition, to support the country’s aviation industry, the Indian government provides a complete exemption on customs and countervailing duties for aircraft manufacturing, repairing, and overhauling (MRO) service providers, which is expected to boost such operations.

Moreover, manufacturing companies that produce electrical equipment, machinery, healthcare equipment, and consumer devices require aerosols to clean and maintain the production facilities at regular intervals, which will boost aerosol consumption in India during the forecast period.

Furthermore, according to a report published by the Ministry of Commerce and Industry, the Indian cosmetics and beauty products industry is expected to witness a growth of 4.3% during 2023–2025. This is majorly ascribed to the rising per capita income of people, which is allowing them to spend more on themselves than before.

Thus, the growth in the manufacturing industry leads to an increase in the demand for aerosols, which are used to maintain machines and protect them from rust and premature damage.

The market is experiencing a high product demand due to the initiatives being taken by the government to encourage companies to undertake R&D and augment production. The Indian government launched the Make in India initiative in 2014 with the aim of making India a global manufacturing hub and creating 100 million jobs in India, which will create a vast demand for industrial aerosols, especially for the operation and maintenance of machinery and automobiles.

Furthermore, the Indian government initiated some initiatives in order to attract overseas investors and propel this sector to new heights. Such initiatives are expected to increase the demand for the aerosols used for the repair and maintenance of machinery, tires, and automobiles.