Report Code: 10665 | Available Format: PDF | Pages: 212

Aerosol Market Research Report: By Propellant Type (Liquefied Gas, Compressed Gas), Product Type (Dimethyl Ether, Hydrocarbons, Nitrous Oxide & Carbon Dioxide), Packaging Material (Aluminum, Steel, Plastic), End Use (Personal Care, Household, Food Products, Paints & Coatings, Medical, Automotive & Industrial) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10665

- Available Format: PDF

- Pages: 212

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Aerosol Market Overview

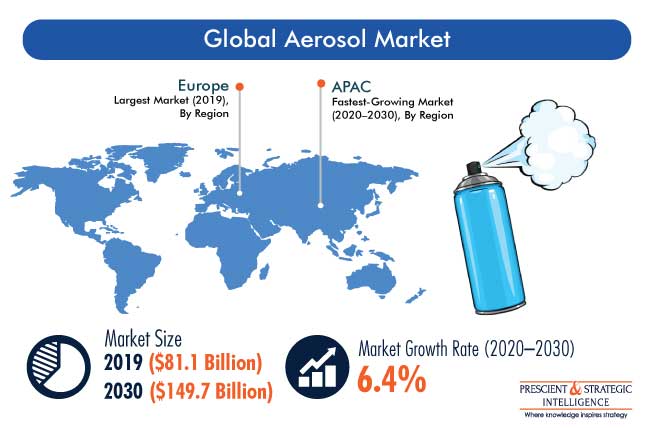

The global aerosol market was valued at $81.1 billion in 2019 and is expected to showcase a CAGR of 6.4% during the forecast period (2020–2030). This is majorly attributed to the surge in demand for personal care and household products, such as deodorants, hair sprays, room fresheners, and sanitizer sprays. Furthermore, investments in the industrial sector of developing nations and high consumption of aerosol sprays for cleaning and maintenance (lubrication and greasing) purposes are expected to benefit the market in coming years.

The COVID-19 outbreak has spread to almost every country around the world, and the World Health Organization (WHO) has declared it a public health emergency. The pandemic has affected every industry, including the aerosol market. Owing to government-imposed lockdowns in several countries, manufacturing operations were temporarily halted or reduced in order to curtail the spread of the disease. Since aerosols have a wide application base in manufacturing industries, such as paints, lubricants, greases, and cleaners, the demand witnessed a dip in the first half of 2020 and is expected to increase in coming years.

High-Pressure Holding Capacity of Liquefied Gas Propellant Led the Market

In 2019, the liquefied gas category accounted for larger market size in the aerosol industry, on the basis of propellant type. This is due to its ability to put enough pressure to force the product out of the can with ease. As the product level drops, more propellant evaporates to maintain a constant pressure in the space above the product. Owing to this, aerosols using liquefied gas propellants have a higher demand.

High Efficiency of Hydrocarbons Continue to Dominate the Market in Foreseeable Future

The hydrocarbons category, based on product type, is expected to hold the largest share in the aerosol market, by 2030. Hydrocarbons, such as butane, propane, and isobutane, help maintain a constant pressure and provide 85% can space to the product, thereby maximizing the output. Owing to such factor, the category is expected to witness a strong growth in future.

Aesthetic Appearance of Aerosol Products Pushed the Demand for Aluminum Packaged Aerosol

During the forecast period, the aluminum is expected to be the fastest-growing category in the aerosol market, based on packaging material. The high demand for this packaging material can majorly be ascribed to its excellent properties, including its lightweight, recyclable nature, and aesthetic appearance, when compared with other packaging materials.

Rising Consumer Spending Propelled the Demand for Personal Care Aerosol Products

Personal care was the largest end-use category in the aerosol market in 2019. Personal care products, such as deodorants, hair setting sprays, make-up setting sprays, and several other daily-use products, are used in aerosol form. Moreover, with the rise in consumer spending on personal hygiene goods, the demand for aerosols for personal care application is projected to increase during the forecast period.

High Demand for Skin Care Products in Europe Led the Market

During the historical period (2014–2019), Europe led the aerosol market, globally, due to the high demand for aerosols from the personal care, especially skin care products; household; and automotive & industrial sectors. With the growth in these end-use sectors, the consumption of aerosols is rising, which, in turn, is benefitting the market in the region.

Growing Awareness Toward Cosmetics Products Drives the Market in Asia-Pacific (APAC)

During the forecast period, the APAC aerosol market is expected to witness the fastest growth. This can be majorly attributed to the rising awareness regarding cosmetics products, such as hair care products including shampoos and conditioners; bath & shower related products including shower gels and liquid soaps; men’s grooming products; and deodorants and antiperspirants. The rising consciousness toward personal appearance and a considerable increase in disposable income have boosted the market in the region.

Shift in Preference Toward Organic Aerosol Products Is a Key Market Trend

The prominent trend in the aerosol market is shift in consumer preference for organic or herbal aerosol cosmetic and personal care products. Aerosols witness a high-volume demand for personal care products, such as makeup setting sprays and shaving sprays. However, these products contain a high content of chemicals that can potentially harm the skin and can lead to skin problems, such as rashes, acne, and blemishes. This has led consumers to switch toward the products prepared from herbal and natural floral extracts blended with essential oils, which offer therapeutic properties to help treat skin-related problems, in addition to enhance natural beauty.

Increasing Demand from Personal Care Sector

The increase in disposable income of consumers and rise in per capita expenditure have significantly benefitted the personal care sector, which, in turn, have created a high-volume demand for aerosol products. In order to meet this demand, manufacturers in the industry are expanding their product range. For instance, in August 2020, Nivea India Private Limited announced the launch of NIVEA DEO MILK deodorant, with milk as a key ingredient. Such innovations in the personal care sector have propelled the demand for aerosols globally.

Rapid Industrialization in Emerging Economies

Various emerging economies, such as China, India, Brazil, Thailand, and Indonesia, have witnessed a spur in investments, with several multinational companies focusing on shifting their manufacturing base to these countries. This is ascribed to the availability of low-cost labor and easy availability of raw materials in these countries. Thus, with a surge in industrial activities, the consumption of aerosols is likely to increase, owing to their high demand for lubrication and greasing applications.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$81.1 Billion |

Forecast Period CAGR |

6.4% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Impact of COVID-19, Company Share Analysis, Regional and Country Breakdown, Companies’ Strategic Developments, Key Offerings of Major Players, Company Profiling |

Market Size by Segments |

By Propellant Type; By Product Type; By Packaging Material; By End Use; By Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Japan, China, India, South Korea, Argentina, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E. |

Secondary Sources and References (Partial List) |

Aerosol Manufacturers' Association, Asian Aerosol Federation, European Aerosol Association, India Brand Equity Foundation, Indian Aerosols Promotion Council, Indian Paint & Coating Association, Indian Small-Scale Paint Association, Society of Indian Automobile Manufacturers, Southern Aerosol Technical Association, Aerosol Association of Australia, Aerosol Society, Association Française d'Etudes et de Recherches sur les Aérosols, British Aerosol Manufacturers' Association |

Explore more about this report - Request free sample

Product Launch and Partnership Are Key Market Strategies

The global aerosol market is highly fragmented in nature with the presence of several players such as Akzo Nobel N.V., Arkema Group, Linde Plc, The Chemours Company, Royal Dutch Shell p.l.c., Henkel AG & Co. KGaA, and Honeywell International Inc.

In recent years, the players in the industry have launched a number of new and advanced products and collaborated with other players, in order to stay ahead of their competitors. For instance:

- In July 2020, Honeywell International Inc. collaborated with Vesismin Health for an easy-to-use, non-flammable, and environmentally preferable aerosol solution to treat areas affected by coronaviruses and other infectious organisms. The solution uses Honeywell’s non-flammable solstice propellant HFO-1234ze to disperse a broad-spectrum disinfectant against bacteria, fungi, and viruses, effectively.

Some of Key Players in Aerosol Industry Include:

-

Akzo Nobel N.V.

-

Arkema Group

-

Linde Plc

-

The Chemours Company

-

Royal Dutch Shell p.l.c.

-

Henkel AG & Co. KGaA

-

Honeywell International Inc.

-

Diversified CPC International

-

Emirates Gas LLC

-

Grillo-Werke AG

Aerosol Market Size Breakdown by Segments

The aerosol market report offers comprehensive market segmentation analysis along with market estimation for the period 2014-2030.

Based on Propellant Type

- Liquefied Gas

- Compressed Gas

Based on Product Type

- Dimethyl Ether (DME)

- Hydrocarbons

- Nitrous Oxide & Carbon Dioxide

Based on Packaging Material

- Aluminum

- Steel

- Plastic

Based on End Use

- Personal Care

- Household

- Food Products

- Paints & Coatings

- Medical

- Automotive & Industrial

- Greases

- Lubricants

- Spray oils

- Cleaners

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- U.A.E.

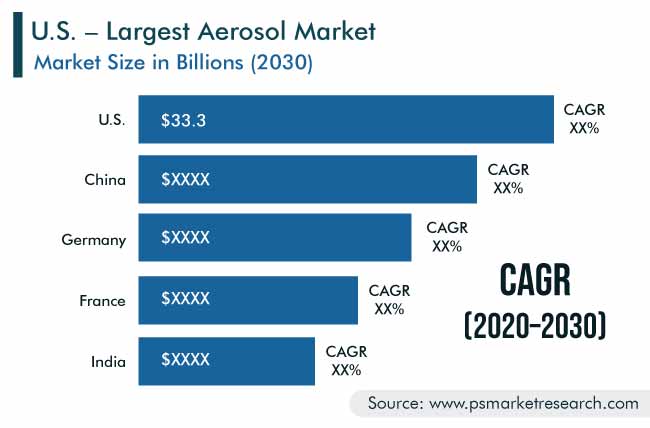

In 2030, the value of the aerosol market will be $149.7 billion.

Personal care is the largest category under the end use segment of the aerosol industry.

The major aerosol market drivers are increasing demand from the personal care sector and rapid industrialization in emerging economies.

Europe is the largest and APAC is the fastest-growing aerosol market.

Most aerosol market players are adopting product launch and partnership strategies to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws