Report Code: 12847 | Available Format: PDF | Pages: 280

Hydrodesulfurization Catalyst Market Size and Share Report by Type (Cobalt-Molybdenum Catalyst, Nickel-Based Catalyst, Ruthenium Disulfide, Tungsten Disulfide), Feedstock (Natural Gas, Naphtha, Heavy Oil, Diesel Oil, Kerosene), Application (Diesel, Naphtha), End User (Petrochemicals, Natural Gas Processing) - Global Industry Demand Forecast to 2030

- Report Code: 12847

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

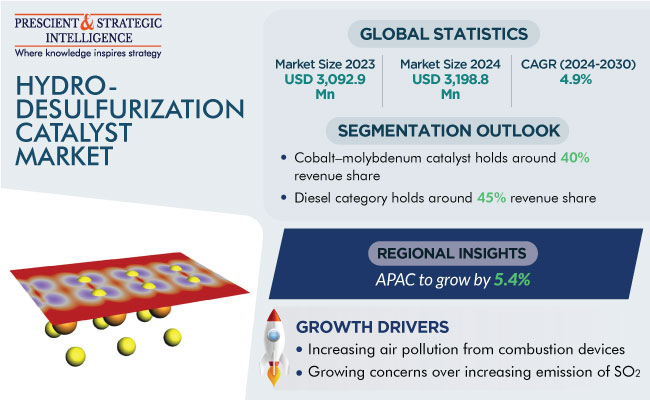

The hydrodesulfurization catalyst market generated USD 3,092.9 million revenue in 2023, and it is projected to witness a CAGR of 4.9% during 2024–2030, reaching USD 4,267.9 million by 2030. This is because of the increasing air pollution from combustion devices in houses, petroleum refineries, motor vehicles, industrial facilities, and fires in forest.

The major air pollutants include ozone (O3), carbon monoxide (CO), nitrogen dioxide (NO2), and sulfur dioxide (SO2), all of which are responsible for heart diseases, respiratory diseases, and even lung cancer. Moreover, air pollution can lead to damage to people's brain, liver, kidneys, and other body parts and cause birth defects as well.

Hydrodesulfurization (HDS), also called hydrotreating or hydrotreatment, is a process in which sulfur is removed from naphtha, petrol (gasoline), kerosene, and diesel with the help of hydrogen and a catalyst. In this process, when petroleum reacts with hydrogen in the presence of catalyst, such as cobalt–molybdenum, nickel, ruthenium, or tungsten, the sulfur comes out in the form of H2S gas.

The growing concern over the increasing emission of SO2 into the environment from the combustion of fuel is the major driving factor for this market. Moreover, the other reason for removing sulfur from petroleum is that even in low concentrations, it poisons noble metal catalysts.

Cobalt–Molybdenum Accounts for Largest Revenue Share

By type, the cobalt–molybdenum category holds the largest share, of around 40%, in the market, and it is projected to grow with a significant CAGR during the forecast period. Cobalt–molybdenum-based catalyst is the most commonly used for the hydrodesulfurization of crude oil in petroleum refineries. This is because molybdenum catalysts are resistant to poisoning by sulfur, and cobalt-based catalyst has the benefit of high catalytic activity, high selectivity toward hydrocarbons, weak water–gas shift reaction activity, and strong regenerability.

Moreover, cobalt–molybdenum-based catalysts are used for their high-octane occupancy and fuel impregnation. These chemicals increase the rate at which hydrogen reacts with the sulfur bound in the hydrocarbon feedstock. This decreases the need for energy for the reaction and enables the complete elimination of sulfur. Moreover, the emergence of new molybdenum-based catalysts has made this reduction possible. Thus, because of the adoption of this process, emissions of sulfur dioxide from vehicles are now a hundred times less than in 1993, despite a doubling in the demand for diesel fuel.

The nickel-based category also holds a significant share in the market as these catalysts are more economical and suitable for industrial applications due to their high efficiency.

In addition, ruthenium disulfide consumption is growing owing to its ability to dissociate hydrogen on the metal’s surface. Ruthenium, in its metallic form, finds numerous applications as a catalyst, with its effectiveness in thiophene hydrodesulfurization being proved during several studies.

Diesel Accounts for Highest Revenue Contribution

The diesel category holds the largest share, of 45%, in the application segment of the market. It is because diesel fuel has a high content of sulfur, about 1,000 ppm, which results in high emissions from engines. A high amount of this metal can harm plants and trees, by decreasing their growth. SO2 and other oxides of this metal can even lead to acid rain, which is harmful to human skin and the ecosystem. Hence, the burgeoning demand for sulfur-free diesel across the globe is increasing the adoption of the hydrodesulfurization process in crude refineries.

Essentially, the government initiatives for the use of low-sulfur diesel are propelling the usage of this process. In North America and Europe, ultra-low-sulfur diesel (ULSD) has been in use since 2006. In 2000s, in the U.S., the imposed limit for the diesel used in on-highway heavy vehicles was 300 to 500 ppm by weight of total sulfur. Afterward, in 2006, the limit was reduced to 15–30 ppm by weight. As the limits are reduced further, the market growth potential will enlarge.

Moreover, naphtha holds a significant share too. HDS is used to remove the total amount of sulfur in naphtha, in order to prevent the poisoning of metal catalysts in the subsequent catalytic reforming of this petroleum product.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,092.9 Million |

Market Size in 2024 |

USD 3,198.8 Million |

Revenue Forecast in 2030 |

USD 4,267.9 Million |

Growth Rate |

4.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By End User; By Region |

Explore more about this report - Request free sample

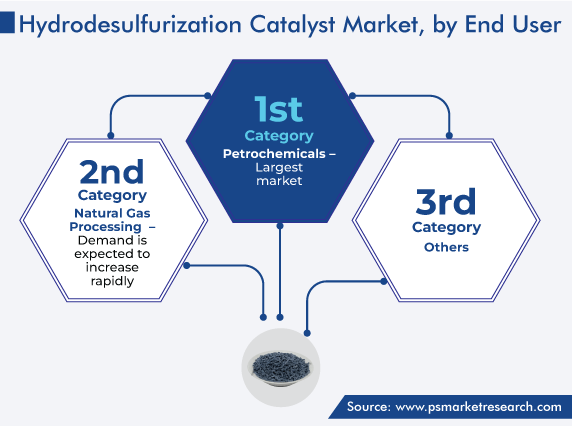

Petrochemicals Hold Largest Share in Market

The petrochemicals category dominates the hydrodesulfurization catalyst market, on the basis of end user. Hydrodesulfurization is commonly used in the petroleum industry to lower the amount of sulfur in crude oil. Moreover, the petrochemicals industry is expanding due to the increasing global demand for products such as plastics, fertilizers, and chemicals derived from petroleum. This growth is driven by industrialization, population growth and technological advancement.

Increasing Pollution Level Is Strongest Driving Factor for Market

The increasing level of air pollution, especially SO2, in the environment, is the major driving factor for this market. When coal, oil, or diesel high in sulfur is burned in the presence of oxygen, sulfur dioxide is released into the environment. The rising concerns about the health and environmental impact of this GHG have led to mandates for a reduction in the sulfur content of diesel from 2,000 ppm to 10 ppm over the past 20 years.

Additionally, in 2020, BS6 norms were implemented in India. In this norm, the maximum limit of pollutants in fuel, such as sulfur dioxide, carbon monoxide, and nitrogen oxide, is much lower than those in the BS4 norms. The maximum allowed sulfur concentration in BS4 fuel was 50 ppm, which has been reduced in BS6 fuel to 10 ppm. Such cleaner fuel is needed for BS6 engines, which is expected to boost the growth of the market.

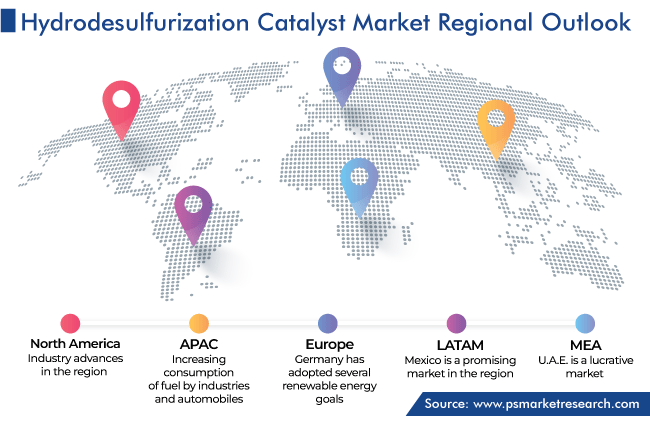

North America Accounts for Largest Revenue Contribution

Geographically, North America holds the largest share, of around 55%, in the market, and it is expected to remain the largest throughout the forecast period. The key factor driving the industry advance in this region is the increasing awareness of SO2 emissions from automobiles and its harmful effect on humans as well as the environment. Moreover, the implementation of rules by governments to protect the environment by regulating the content of sulfur in gasoline, natural gas, diesel, and kerosene propels the market.

In North America, the U.S. is the major revenue contributor. This is due to the presence of 130 petroleum refineries in the U.S. with a total output of around 18 million barrels per day. Moreover, many of these companies are entering into agreements with market players for molybdenum supply. For instance, in January 2023, Greenland Resources Inc. signed an MoU for the supply of molybdenum with Swedish company Scandinavian Steel AB.

Europe also holds a significant share in the market due to the increasing demand for sulfur-free petrol and diesel in this region. This this regard, the government initiatives to protect the environment are significant. For instance, the European Union has implemented the Green Deal with the aim to make Europe carbon-neutral by 2050. In addition, Germany has adopted several renewable energy goals, while others are focusing on sustainable transportation and waste management strategies. Together, these initiatives aim to mitigatea climate change and safeguard natural resources.

APAC is the fastest-growing regional market because of the increasing consumption of fuel by industries and automobiles. Further, China has implemented various regulations to control sulfur emissions from fuels. These regulations are part of the country’s efforts to reduce air pollution and improve environmental quality. Moreover, China’s petroleum refining capacity was 17 million barrels per day in 2021, the highest after the U.S.

In a similar way, India has implemented regulations to reduce sulfur content in fuels. The Bharat Stage VI (BS-VI) emission standards, introduced in April 2020, have set stringent limits on sulfur content in gasoline and diesel. These standards aim to improve air quality by reducing emissions from vehicles.

Biggest Providers of Hydrodesulfurization Catalysts Are:

- Albemarle Corporation

- Axens SA

- Johnson Matthey PLC

- JGC Catalysts & Chemicals Ltd.

- BASF SE

- Clariant AG

- Shell PLC

Report Breakdown

This report offers deep insights into the hydrodesulfurization catalyst market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Type

- Cobalt–Molybdenum Catalyst

- Nickel-Based Catalyst

- Ruthenium Disulfide

- Tungsten Disulfide

Segment Analysis, By Feedstock

- Natural Gas

- Naphtha

- Heavy Oil

- Diesel Oil

- Kerosene

Segment Analysis, By Application

- Diesel

- Naphtha

Segment Analysis, By End User

- Petrochemicals

- Natural Gas Processing

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

By 2030, the market for hydrodesulfurization catalysts will grow by 4.9%.

The hydrodesulfurization catalyst industry 2023 value is USD 3,092.9 million.

The market for hydrodesulfurization catalysts is driven by the international mandates to reduce sulfur dioxide emissions from fuel.

Cobalt–molybdenum catalysts generate the highest hydrodesulfurization catalyst industry revenue.

Diesel is the biggest application in the market for hydrodesulfurization catalysts.

APAC has the highest hydrodesulfurization catalyst industry CAGR in this decade.

North America dominates the market for hydrodesulfurization catalysts.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws