Report Code: 12800 | Available Format: PDF | Pages: 280

HVDC Transmission Market Size and Share Analysis by Technology (CCC, VSC, LCC), Project Type (Point-to-Point, Back-to-Back, Multi-Terminal), Location (Submarine, Overhead, Underground), Application (Bulk Power Transmission, Grid Interconnection, Urban Area Infeed), Component (Converter Stations, Transmission Cables) - Global Industry Demand Forecast to 2030

- Report Code: 12800

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

HVDC Transmission Market Size & Share

The HVDC transmission market is set to generate an estimated USD 11.3 billion in 2023. During the forecast period of 2024–2030, it will grow at a CAGR of 5.5% and reach USD 16.4 billion by 2030. This can be ascribed to the increasing demand for electricity globally, gradual shift toward renewable energy sources, government initiatives for grid expansion, and technological advancements in T&D.

The market is also growing as a result of the rising interest in the voltage source converter (VSC) technology and the enhanced transmission efficiency of the HVDC approach compared to HVAC systems. A rapid emergency response and independent control of reactive and active power are made possible by the HVDC-VSC technology. The current R&D efforts have opened up an enormous opportunity for power transmission companies to fully utilize the advantages of this technology and eliminate its drawbacks, such as high losses.

Rising Preference for HVDC over HVAC Transmission

Only synchronized AC networks can be connected by AC transmission lines. To connect asynchronous AC networks, the HVDC technology is being employed increasingly. For example, Japan has both 50-Hz and 60-Hz networks, whereas North America, LATAM, and the Middle East all have numerous asynchronous AC networks. The outputs from several asynchronous wind turbine generators are, additionally, combined in offshore wind farms using HVDC, before being sent via an undersea cable to the coast.

HVDC is also less expensive than the HVAC technology for underwater interconnects across distances of up to 50 km. Additionally, it allows for transmission with reduced losses over greater distances. Essentially, it has seen an increase in acceptance in recent years due to the rising demand for electricity internationally and the ensuing rise in the requirement to transport power. In turn, the demand for insulated-gate bipolar transistor (IGBT) valves and circuit breakers, which are used in converter stations, is driven by the rising number of VSC-based HVDC transmission projects. Essentially, a boom in the demand for these converter stations will be seen due to the growing need for more-efficient power transmission and to connect asynchronous grids.

Burgeoning Electricity Industry

Due to the rapid urbanization, industrialization, and various technological advancements, electrical energy consumption continues to skyrocket. For instance, China’s domestic consumption grew from 1,138 TWh in 2000 to 8,090 TWh in 2022. Countries are thus focusing on improving their power sector, to distribute electricity as efficiently and rapidly as possible.

For example, India’s Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) aims at electrifying rural areas by separating feeders for agricultural use from those for non-agricultural applications. It also calls for bolstering and expanding the sub-transmission and distribution network in rural areas, including implementing metering at distribution transformers, feeders, and consumers' ends.

Similarly, the Integrated Power Development Scheme (IPDS) is a similar scheme of the Indian government for urban areas. It calls for improving distribution and sub-transmission networks in urban regions, metering distribution at transformers, feeders, and consumers’ ends; and enhancing the IT capabilities of the distribution sector.

Further, large-scale electric energy storage is not a practical option. Therefore, raising the number of transmission systems is the only way to utilize power, because production and consumption locations are often wide apart.

Shift toward Clean, Renewable Energy

In the fight for a better environment, renewable energy sources, such as hydropower, are a potent weapon since they can lessen the greenhouse effect by reducing the emission of carbon dioxide and other toxic gases. Renewable energy is one of the fastest-growing businesses in the world, with more investment going to new projects than ever before. This is primarily because governments of many countries are taking initiatives to increase renewable energy production, which will drive the requirement for HVDC transmission systems.

As per the Ministry of New and Renewable Energy, India’s installed renewable energy capacity increased from 76.37 GW in 2014 to 150.54 GW in 2021, i.e., by around 97%. Renewable energy plants, including geothermal, tidal, and hydropower, are often far from customers; hence, efficient systems are required to transfer energy from producers to consumers over long distances. Essentially, there is a rising need to effectively integrate renewable energy into the existing power grids as nations make efforts to cut carbon emissions and combat climate change.

| Report Attribute | Details |

Market Size in 2023 |

USD 11.3 Billion |

Market Size in 2024 |

USD 11.9 Billion |

Revenue Forecast in 2030 |

USD 16.4 Billion |

Growth Rate |

5.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Technology, By Project Type, By Location, By Application, By Component, By Region, |

Explore more about this report - Request free sample

Increasing Focus on Smart Cities and Intelligence Grids

The global electrical power industry has a number of issues common across geographies and communities, including a rising demand, a lack of generation capacity, and power theft. The degree of these challenges differs depending on whether a nation is underdeveloped, developing, or developed. Moreover, smart cities will need to have a power system free of blackouts and one that is able to successfully handle the diverse demands of various applications. Additionally, one of the essential requirements for the next generation of smart cities is a reliable, efficient, and low-carbon energy source and distribution technology.

These issues necessitate the usage of a grid that can communicate with consumers and the utility grid in order to adapt and accommodate the changes in load demand. It must also offer better control over power sharing between generating units. The utility grid can be made intelligent by affixing different sensors along the transmission channel and establishing two-way communication between utilities and consumers. The digital technology works with the electrical grid to allow the latter to respond to the changing needs and enable intelligent control over the entire power system.

Establishing a smart grid by employing HVDC transmission offers a number of benefits over traditional HVAC transmission, including efficiency over long distances, better control on voltage levels, and integration with renewable energy. The Government of India formed the National Smart Grid Mission (NSGM) in March 2015 to hasten the adoption of the smart grid technology in the country. The NSGM has its own resources, power, and functional and financial autonomy to develop and oversee smart grid-related policies and projects.

Advancement in VSC Technology

In recent years, a key trend in the industry has been the rapid advancement in the VSC technology. HVDC systems based on it provide better control, dependability, and efficiency, which makes them perfect for grid modernization and the integration of renewable energy sources. Furthermore, grid management systems can provide real-time monitoring, predictive maintenance, and sophisticated problem detection with advanced VSC technology. With it, the grid's dependability and performance can also be improved.

One significant initiative by the Indian government in this regard is the National Electrification Project, which involves the construction of new transmission lines and the upgrade of the existing HVDC lines. India launched its first HVDC system based on VSCs in June 2021, when a 320-kV, 2,000-MW line connecting Pugalur in Tamil Nadu to Thrissur in Kerala went online.

Rampant Industrialization Is Key Driver for Market

As per reports, the mining, construction, agriculture, and manufacturing industries collectively use 54% of the electrical power, whereas road, rail, and air transportation consumes 26% and the residential sector another 7%.

Thus, as a developed and highly industrialized nation, Japan has a high demand for power. In order to improve the interoperability of the national grid, the government is building new HVDC lines. Japan inaugurated a new east-west HVDC transmission line connecting the prefectures of Nagano and Gifu in April 2021. It is expected that the additional line will add 900 MW to the grid's overall connectivity capacity.

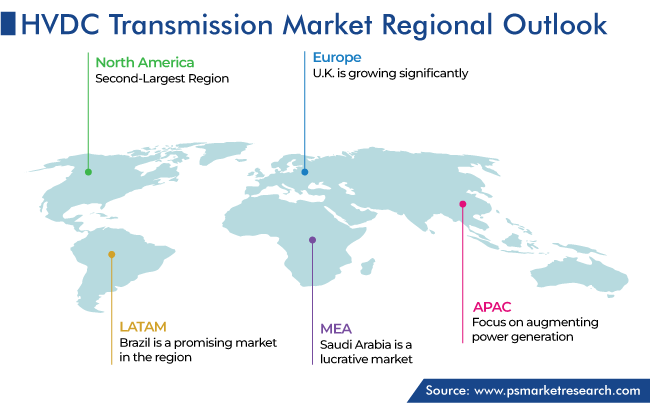

Asia-Pacific Generates Highest Revenue

Geographically, APAC is the largest market, with a share of 50%, in 2023, because the region is industrializing at a fast pace and growing economically as well. This is itself due to a high concentration of manufacturing plants of a number of industries, including electronics, aerospace, chemicals, automotive, and general heavy engineering. The key drivers for the regional industrial sector are the lower labor costs, tax breaks, and other industry-friendly laws, which reduce the cost of the produced goods for consumers.

This region has a variety of economies and industrialization levels, i.e., highly developed (Japan, Australia, Taiwan, and South Korea), rapidly developing (India, Thailand, Indonesia, China, and Malaysia), and underdeveloped (Nepal, Myanmar, and Cambodia). The governments in this region are making investments in modernizing their respective countries’ industrial, residential, and commercial infrastructure, in addition to adding new generation, transmission, and distribution capacity.

China's economy is the largest in the region, and it has a sizable industrial base, which drives energy demand. Hence, it has initiated several HVDC projects to help meet the growing energy needs.

South Korea is another significant regional nation upgrading its electrical grid. More-efficient power transmission is now possible due to the completion of the HVDC connection upgrade by GE Grid Solutions in February 2020 between the South Korean mainland and Jeju Island. Hence, with the growing industrial base and economic development, South Korea's HVDC transmission market will boom in tandem.

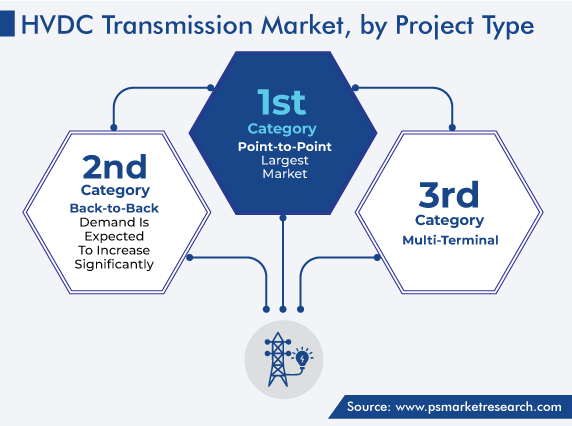

During Forecast Period, Point-to-Point Projects Will Dominate Market

Based on project type, the point-to-point category holds the largest share. These projects are employed when a lot of power needs to be sent between two converter stations. Due to their dependability in transporting heavy power loads, bipolar designs in point-to-point transmission have seen a major growth in popularity in the Asia-Pacific region in recent years. Another factor driving the market expansion in this category is the growing emphasis of European nations on the use of renewable energy and the ensuing requirement for efficient energy transmission.

Overhead Transmission Systems Hold Largest Market Share

The overhead category is the largest within the location segment of the market. Due to the lower installation costs compared to underground cables, this mode of transmission is becoming increasingly popular for long distances. As per reports, in 2022, the majority of the HVDC lines were installed above the ground. Additionally, because overhead lines can carry more power, more electricity may be transmitted over longer distances. In comparison to underground cables, overhead lines also suffer lower transmission losses, thus making them more efficient over long distances. Additionally, the move toward renewable energy sources, which are generally found in isolated locations, impels utilities to lay overhead HVDC powerlines.

Key Players in HVDC Transmission Market Are

- Hitachi Ltd.

- Siemens AG

- Toshiba Energy Systems & Solutions Corporation

- General Electric Company

- NR Electric Co. Ltd.

- Prysmian S.p.A.

- Mitsubishi Electric Corporation

- Nexans S.A.

- ABB Ltd.

- NKT Group of Companies

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the HVDC transmission industry from 2017 to 2030, based on all the relevant segments and geographies.

Based on Technology

- Capacitor Commutated Converter (CCC)

- Voltage Source Converter (VSC)

- Line Commutated Converter (LCC)

Based on Project Type

- Point-to-Point

- Back-to-Back

- Multi-Terminal

Based on Location

- Submarine

- Overhead

- Underground

Based on Application

- Bulk Power Transmission

- Grid Interconnection

- Urban Area Infeed

Based on Component

- Converter Stations

- Transmission Cables

Geographical Analysis

- North America

- U.S

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and

- Saudi Arabia

- South Africa

- U.A.E.

The size of the market for HVDC transmission solutions is estimated at USD 11.3 billion in 2023.

The HVDC transmission industry CAGR till 2030 will be 5.5%.

The market for HVDC transmission solutions is propelled by the rising population, industrialization, and urbanization.

Point-to-point projects hold the largest HVDC transmission industry share.

Overhead networks dominate the market for HVDC transmission solutions.

Smart grids and renewable energy integration are the biggest HVDC transmission industry trends.

APAC has the largest size in the market for HVDC transmission solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws