Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 7.8 Billion |

| 2030 Forecast | USD 24.6 Billion |

| Growth Rate(CAGR) | 21% |

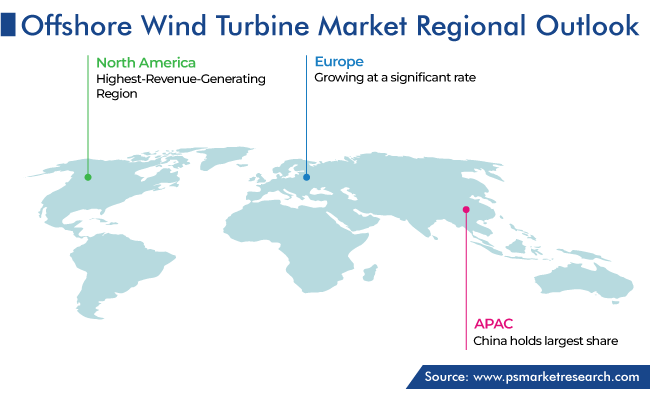

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12067

Get a Comprehensive Overview of the Offshore Wind Turbine Market Report Prepared by P&S Intelligence, Segmented by Water Depth (Shallow Water (up to 30 m), Transitional Water (30 m to 60 m), Deep Water (> 60 m)), Installation (Fixed, Floating), Turbine Capacity (Up to 3 MW, 3–5 MW, > 5 MW), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 7.8 Billion |

| 2030 Forecast | USD 24.6 Billion |

| Growth Rate(CAGR) | 21% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global offshore wind turbine market generated revenue of USD 7.8 billion in 2024, which will reach USD 24.6 billion by 2030, advancing at 21.0% CAGR between 2024 and 2030. This is due to the implementation of favorable government policies in several countries, huge investments in renewable energy sources, and constant technological developments in offshore plants.

Moreover, the reducing cost of offshore wind power, due to technological advances and economies of scale, has made offshore wind power more competitive with other sources of energy. Also, many governments are offering incentives and policies to support the development of offshore wind power. This is creating a favorable investment environment for the market.

With the increasing investment in the global renewable energy sector, there has been a noticeable shift in the usage of energy toward green power, including wind energy, to reduce carbon footprints and emissions, climatic changes, and depletion of fossil fuels. Thus, many ongoing projects are incorporated with advanced technology, which is estimated to boost the market growth during the forecast period.

For instance, according to the International Renewable Energy Agency (IRENA), the amount of renewable energy will increase from 25% to 86% by 2050 in the yearly global power generation. Moreover, factors such as surging investment in forthcoming offshore wind power projects and the reduced cost of wind energy have led to an increase in the adoption of wind energy, which, in turn, drives the demand for offshore wind turbines.

The shallow water category is the largest contributor to the market. This is because it includes offshore wind turbines installed in water depths of up to 30 meters, and installing wind towers in this depth is much easier and also reduces capital expenditure. Moreover, shallow-water regions are ideal for building the foundation for wind towers and offer higher convenience over deep and transitional-water installations.

In addition, the transitional water category holds a significant market share. It includes offshore wind turbines that are to be installed in water depths ranging from 30 meters to 60 meters, their installation type is floating, and the capacity for turbines ranges from 3 MW to 5 MW.

Whereas, the deep-water category is expected to witness significant growth in the coming years. It consists of offshore wind turbines installed in water depths larger than 60 meters. Moreover, the trend in the market is a shift toward deep water installation, as the turbine capacity is greater than 5 MW.

As energy demand is rising globally, the adoption of offshore wind energy is rising. Industry players have been able to install wind turbines in deep water, due to the improvement in technology and materials used for these turbines, allowing them to exploit higher altitude winds. With the much larger blades, they can sweep more than smaller turbines and have high generation capacity and low costs.

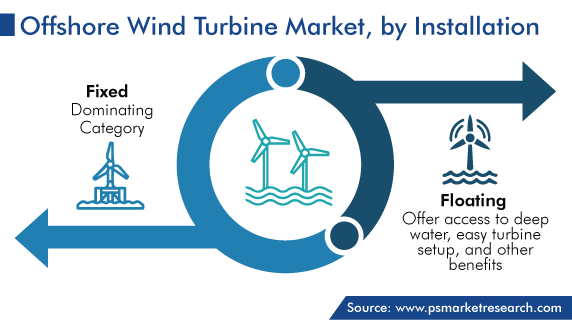

Based on installation, the floating category is projected to experience substantial growth in the offshore wind energy market in the near future. As the energy demand rises, major companies and countries are adopting renewable energy sources, especially wind energy, as they are clean energy and available in huge amounts around the clock. The limitation of fixed foundation is typically restricted to waters less than 50 meters deep. This has encouraged the development of floating offshore wind turbine farms.

These floating foundations also offer various advantages, such as access to deep water and an easy turbine setup, even in the transitional water depth of (30–60) meters, and can be built in various marine environments making them an all-rounder option. Moreover, the possibility for floating offshore wind generation is high, which has seen substantial growth, with several commercial projects entering the market.

For instance, at the end of 2022, the global offshore wind capacity reached 63,200 MW, as compared to 21,000 MW in 2021. In addition, the estimation for floating wind power in Europe, the U.S., and Japan is set to be around 7000 GW. Also, countries like Japan, France, the U.S., the U.K., and Taiwan have already set targets for installing floating offshore windmills.

Furthermore, in 2022, China introduced the largest wind turbine as part of its project design for the technological advancement in the sector of offshore wind turbines and to demonstrate its capabilities. The floater, called Fuyao, was developed by the China State Shipbuilding Corporation’s (CSSC) subsidiary Haizhuang Wind Power. It is equipped with a 6.2 MW typhoon-resistant wind turbine with a rotor diameter of 152 meters. The site was chosen due to its complex seabed geomorphology and water depths that should range between 50 and 70 meters.

On the other hand, the fixed category is estimated to have held a larger market share, of 65%, in 2023, and this trend is likely to continue during the forecast period as well. This is because these turbines are attached directly to sea beds unlike the floating wind turbines, which use various types of foundations such as tripods and jackets, based on the specific depth of the sea beds.

Mostly fixed wind turbines are deployed in shallow or midway water depths, i.e., 0–60 meters. Thus, these have easier commissioning and decommissioning and higher economic feasibility than floating ones; and cables of fixed wind plants do not drift away with currents and waves, unlike those of floating installations.

Based on turbine capacity, turbines having 3–5 MW power capacity account for the largest market share, and the category is also expected to witness the same trend in the coming years. This is because these are widely deployed from near shore to transitional water and have large power generating capacity making them more efficient for large-scale energy projects; companies around the world are investing a huge amount for setting up these turbines; and their low operating and maintenance costs.

Other factors for considering these turbines include enhanced rotor and blade designs, improved performance, innovative foundations, and enhanced speed drive systems that work more effectively across a wide range of wind speeds, ultimately enhancing the overall energy production. Offshore wind turbine capacity is an important factor in determining the efficiency and cost-effectiveness of wind power.

In addition, turbines having up to 3 MW power capacity hold a significant share. These turbines are commonly used in offshore wind power generation because of their cost-effectiveness and much-explored technology that is adaptable to a full spectrum of wind energy.

Moreover, the demand for turbines having above 5 MW power capacity is increasing, due to the shift in trend toward the deeper installation and floated structure types. Also, due to the ongoing developments in large-scale projects in deep water sites and the progress of floating infrastructure fuel the growth of the market in this category. For instance, the demand for 10–12 MW offshore wind turbines is expected to witness an overall 17% growth in the coming years.

Drive strategic growth with comprehensive market analysis

The APAC market is projected to record the fastest growth in the coming years, growing with a CAGR of 21.6% during the forecast period. This can be because the region is expected to witness a large number of windmill installations on lakes, seas, and oceans, primarily due to the increasing government initiatives aimed to promote wind energy; and the surging focus on decreasing the dependence on fossil fuels for the generation of energy.

China is currently leading the APAC offshore wind power market, with 64.3 GW installed capacity, as of 2023. This is due to the country’s strong increase in the annual installation of offshore windmills. For instance, Guangdong, Fujian, and Jiangsu planned to attain a 2 GW, and 3.5 GW offshore wind power capacity, respectively, in 2023. Also, in China, the first large-scale deep-sea offshore wind power project started in 2022 under the POWERCHINA initiative to connect deep-sea energy with the national electricity power grid. Such missions require high-power turbines to work smoothly, which has, therefore, promoted the growth of the market in the country.

Moreover, the country’s National Energy Administration announced the reduction in offshore wind power prices, determined by competitive actions, instead of feed-in-tariffs. This cost reduction, the announcement of targets of deploying wind energy plants by several Chinese provinces, and rapid supply chain improvements are predicted to push up the deployment rate of offshore windmills in the APAC region.

Whereas, Vietnam is emerging as a new player in the regional market and Japan is currently investing highly in the market having an aim to reach 10 GW of installed capacity by 2030. Similarly, India aims to produce 140 GW of energy from offshore wind turbines by 2030.

On the other hand, the North American market holds the largest revenue share and is growing at a high pace. According to a report, the region accounts for a quarter of global installations in 2023. This is because regional governments, especially in the North Sea, have set ambitious targets for the development of offshore wind farms in their respective territorial water. In addition, the U.S. has a few of the most probable advanced offshore wind energy plants.

For instance, in 2022, according to Wind North America’s Annual Statistics report, North America has built 60 GW of new wind power capacity. The U.S. and Canada are the two major players in the North American market, and The White House has laid down an objective of significantly expanding the nation’s offshore wind energy amplitude to 30 GW by 2030.

This report offers deep insights into the offshore wind turbine industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Water Depth

Based on Installation

Based on Turbine Capacity

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages