Smart Home Healthcare Market Future Outlook

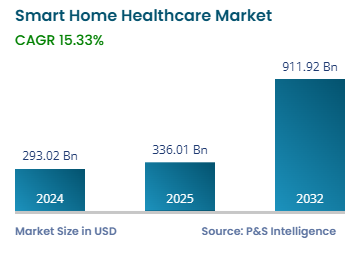

The global smart home healthcare market is estimated to generate USD 293.02 billion in 2024, and it is expected to advance at a compound annual growth rate of 15.33% during 2025–2032, to reach USD 911.92 billion by 2032. This is primarily ascribed to the growing geriatric population, the rising number of chronic ailments as well as orthopedic diseases, the surging healthcare cost, the increasing preference for personalized healthcare, the rising utilization of IoT-connected smart home healthcare gadgets, and the increasing need for mHealth technologies.

In addition, medical care portable gadgets such as heart rate monitors, BP monitors, respiratory aids & accessories, and blood glucose monitors have also enhanced the efficiency and usefulness of house care to deal with several diseases. In various developed and underdeveloped countries, governments offer either partial or full residence coverage services. Moreover, as per the Commonwealth Fund article, hospital home programs allow patients to obtain acute care in the comfort of their houses with reduced care costs by around 30%. Along with this, the rising awareness among people about home care services and devices drives the growth of the market.

The rising need for mHealth services is one of the major drivers boosting the industry growth. mHealth is the exercise of providing healthcare services with the help of smart gadgets, such as personal digital assistants, laptops, cell phones, and tablets. For instance, most recently launched smartphones come with health sensors, including Lava Pulse and Honor Play 4 Pro. This enables the use of mobile and wireless technologies for the treatment and monitoring of personal health at the house.

Moreover, the growing geriatric population, increasing burden of chronic diseases, surging demand for remote patient care, rising healthcare costs, and supportive healthcare regulatory norms are fueling the adoption of mHealth technologies. These technologies help in reducing medical costs and providing effective remote patient monitoring, as patients need not visit healthcare facilities for regular checkups.

Furthermore, there are several other benefits of mobile devices in healthcare, such as easy communication between staff members and patients, and the utilization of EHR applications. These apps enhance clinical documentation and optimize EMR workflow. Due to the availability of various mHealth technologies, they are being used in conjunction with smart home healthcare gadgets, which help in monitoring the health status of patients while they are at residence.

Furthermore, mHealth apps provide benefits, not only for both medical professionals and patients but also for health insurance companies. As a result, the extensive utilization of mHealth applications is projected to result in increased implementation of smart healthcare devices, thereby supporting the market growth.