Market Statistics

| Study Period | 2019 - 2030 |

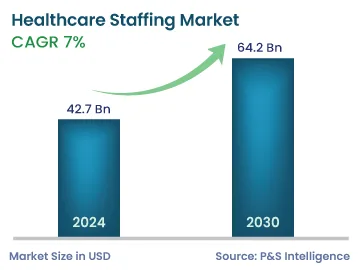

| 2024 Market Size | 42.7 Billion |

| 2030 Forecast | 64.2 Billion |

| Growth Rate(CAGR) | 7% |

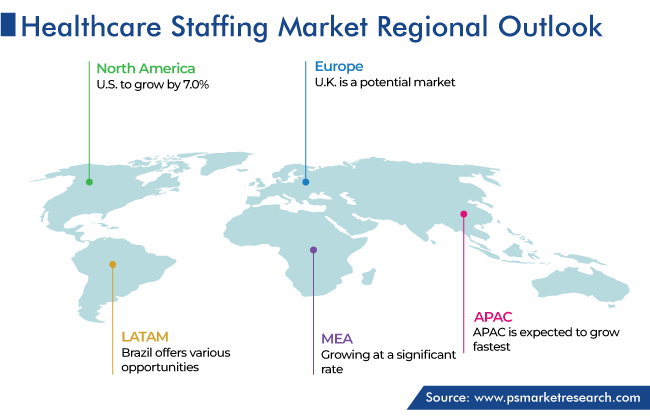

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12750

Get a Comprehensive Overview of the Healthcare Staffing Market Report Prepared by P&S Intelligence, Segmented by Service Type (Travel Nurse Staffing, Allied Healthcare Staffing, Per Diem Nurse Staffing, Locum Tenens Staffing), End User (Hospitals, Clinics, Ambulatory Facilities), Facility Type (Primary Care, Secondary Care, Tertiary Care), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 42.7 Billion |

| 2030 Forecast | 64.2 Billion |

| Growth Rate(CAGR) | 7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The healthcare staffing market size stood at USD 42.7 billion in 2024, and it is expected to advance at a compound annual growth rate of 7.0% during 2024–2030, to reach USD 64.2 billion by 2030.

The growth can be primarily ascribed to the high working flexibility and exposure professionals receive and the increasing prevalence of chronic diseases. Moreover, the knowledge of the benefits of temporary employment, incentives related to the job, and availability of opportunities worldwide has increased.

The advancing technology is presently helping in increasing the rate of employment in the field of diagnostics. Several advancements in medical devices, such as the incorporation of telehealth and medical informatics technologies, have simultaneously increased the need for a skilled labor force to handle both their non-technical and technical aspects. Moreover, the increasing number of non-government and government nursing homes, acute-care centers, long-term care centers, and health institutions is expected to fuel the growth of the market.

Registered nurses and midwives are in high demand as they can work in a wide range of specializations and at several locations across the world, through traveling nurse services. The rising need for high-quality care results in a greater number of doctors and health centers; hence, many more nurses will be required in the future. Moreover, the increasing geriatric population is driving the demand for registered nurses on the part-time and full-time bases.

A shortage of staff can cause a number of issues for and patients, ranging from increased workloads on the existing personnel, which leads to inefficiency and mistakes, longer waiting times for patients, and higher rates of in-hospital mortality and morbidity. The reasons behind personnel shortage include high salaries, lack of potential educators, retirement for a large number of employees each year, and growing aging population.

Per diem nursing can enable professionals to decide on a full-time position by familiarizing themselves with various locations that are new to them and those they do not have significant information about. It is stated by government reports that healthcare facilities are facing an around 85% shortage of allied professionals, which is leading to an increase in the incentives for hiring newly graduated professionals and providing them with employment.

For instance, in January 2022, TrueCare announced the launch of a digital medical staffing on demand platform, which is designed especially for health centers and medical institutions, helping them in solving the issue of employee shortage. The platform offers various job choices, such as per diem nursing, traveling nurses, and full-time positions.

The travel nurse category dominates the service type segment with a share of 40%, attributed to the lack of skilled nurses and the need for their round-the-clock availability and cost-effectiveness. Due to the rise in healthcare expenses during the COVID-19 pandemic, health centers were compelled to downsize their personnel. Hence, service providers decided to turn to staffing companies in order to ensure the availability of nurses, to handle the increased workloads.

Apart from leading to a faster process of recruiting pharmaceutical personnel, recruiters allow healthcare firms to choose from several candidates. During the pandemic, traveling nurses made approximately USD 10,000 a week, and after the pandemic, travel nurse occupancy increased by 500% compared to 2020.

Locum tenens staffing is expected to witness the fastest growth in the coming years, because of physicians’ increasing demand for working as locum tenens. They are mainly preferred by clinics and hospitals because they are cost-effective when the permanent physicians are on vacation. In addition, because of the flexible schedule, shorter period of the assignment, diversified clinical experience, and traveling opportunities, many doctors choose to serve as locum tenens.

Clinics are expected to show a significant CAGR, of 6.7%, over the coming years, ascribed to the presence of a large number of clinics and the increasing need for physicians. Moreover, the pandemic has led to a shortage of employees, due to which clinics are facing issues in hiring permanent, skilled professionals, which will, in turn, fuel the category’s development.

Hospitals hold the largest share, based on end user, because a large number of hospitals are hiring skilled professionals as per the regulations imposed by governments for maintaining an ideal nurse-to-patient ratio. The implementation of patient-centric regulations is, thus, driving the number of staff members in health centers.

Moreover, with the improving healthcare infrastructure and the growing public health spending, the number of hospitals has increased. Additionally, the norms of governments are expected to provide employees, including nurses, with the power to decide the patient's primary treatment, with the launch of several health plans, to offer improved care. These rules help individuals make wise decisions regarding their health.

Essentially, the lack of skilled nurses and professionals in hospitals affects clinical outcomes and patient care. As per government reports, from 2021 to 2030, the employment rate in healthcare will grow by 13%, with around 1.9 million openings every year. The faster increase in employment opportunities for nurses compared to other designations is fueling the demand for nursing staff.

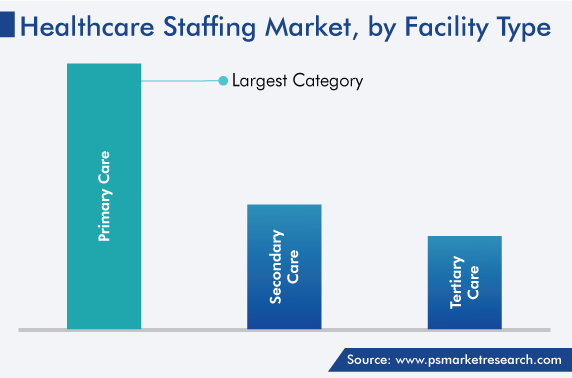

Primary care holds the major share, owing to the vast unmet need for addressing individuals’ requirements for healthcare, which include mental, physical, and social wellbeing. It is the first level of care, and according to several government websites, around 85% of the requirements related to wellness can be met at the primary level. The primary care system offers easy accessibility, centers located within the community, and promotive, preventive, and curative care.

Drive strategic growth with comprehensive market analysis

North America has the leading position in the healthcare staffing market, with a value of USD 20.0 billion, attributed to the rising need for medical workers.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of 7.0%, attributed to the increasing geriatric population.

The medical system of the region faces numerous challenges, one of the biggest being low patient satisfaction rates. To satisfy patients, many firms have started providing staff on a temporary basis. Moreover, for meeting different compliance demands, some organizations have figured out a few short-term fixes that help in offering the best treatment possible.

The market in the region also benefits from a robust healthcare infrastructure, huge geriatric population, favorable government regulations, and the availability of medical insurance for temporary staff. In 2021, as per government websites, healthcare spending in the U.S. grew by 2.7% and reached USD 12,914 per person. The rising spending on wellbeing will, in turn, fuel the growth of the market in the country.

The market is also growing in the region because of the existence of key players, an increase in the requirement for hospital professionals due to the financial difficulties connected with recruiting permanent employees, and a sudden rise in the older population. In a given period, people above 65 years of age visit a doctor's office almost twice as the general adult population, and the former set of people are known to remain in the hospital around three times longer.

In addition, during the pandemic, due to the increase in medical worker shortage, healthcare organizations strongly relied on recruiting personnel from nearby areas. For this, nurses and other clinical workers were compensated by the healthcare system to work extra hours with incentives on a per-hour basis. It is easy to move workers to different locations, as needed, with the help of internal float pools and flexible staffing models.

This fully customizable report gives a detailed analysis of the healthcare staffing industry, based on all the relevant segments and geographies.

Based on Service Type

Based on End User

Based on Facility Type

Geographical Analysis

The market for healthcare staffing solutions valued USD 42.7 billion in 2024.

Primary care facilities dominate the healthcare staffing industry.

Travel nurses witness the highest demand in the market for healthcare staffing solutions.

Hospitals hold the largest healthcare staffing industry share.

Asia-Pacific is the most-lucrative market for healthcare staffing solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages