Market Statistics

| Study Period | 2019 - 2030 |

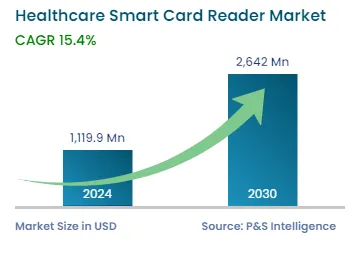

| 2024 Market Size | USD 1,119.9 Million |

| 2030 Forecast | USD 2,642 Million |

| Growth Rate(CAGR) | 15.4% |

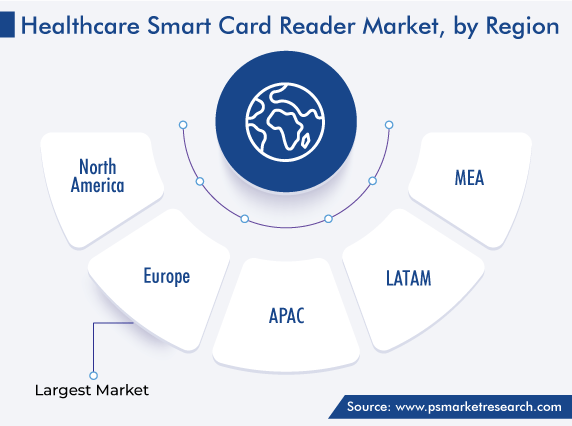

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12621

Get a Comprehensive Overview of the Healthcare Smart Card Reader Market Report Prepared by P&S Intelligence, Segmented by Interface Type (Contact-Based, Contactless-Based, Dual Interface-Based), Application (Identity & Other Sensitive Information Management, Security & Access Management), End Use (General Practitioners & Patients), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,119.9 Million |

| 2030 Forecast | USD 2,642 Million |

| Growth Rate(CAGR) | 15.4% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The healthcare smart card reader market size stood at USD 1,119.9 million in 2024, and it is expected to grow at a CAGR of 15.4% during 2024–2030, to reach USD 2,642 million by 2030.

The demand for such products is propelled by the rising rate of digitization, increasing number of patients, and their growing medical records. Since smart cards allow an individual access to the system, they require advanced and highly secure readers.

Moreover, the emergence of smart cards with micro-IC chips has offered added value to healthcare facilities, encouraging them to provide such cards to their employees and staff members, thus driving the demand for reader systems. Furthermore, healthcare facilities are in a dire need of advanced systems that allow them to limit the access to selected personnel and come with various other features, as a bonus.

Furthermore, in the last few years, the industry has upped its focus on building trust between patients and the medical fraternity. This has been leading to the penetration of the smart card technology in administrative operations for a more-secure workflow. Smart identity cards contain all the health information of patients; thus inserting them into a reading device connected to the hospital mainframe allows clinicians to keep a record of the patients and the treatments provided.

These devices would be even more helpful in an ambulance, because vital patient information needs to be processed immediately in the case of a medical emergency, especially by EMTs and paramedics.

Hospitals are issuing personal health cards, which store all the information about a patient, including insurance, reimbursement, and complete health records.

Smart healthcare cards also store information regarding the benefits covered under the Health Insurance Portability and Accountability Act (HIPAA), which further makes compliance with the HIPAA Privacy Rule simpler. Among the several provisions, the key aim of the HIPAA Privacy Rule is ensuring that individuals’ health-related data is protected and that they can control how it is accessed and used.

The chip embedded in the smart card holds the data in the electronic form and protects the information with complex encryption algorithms, which are only decodable by authorized smart card readers. Moreover, in order to enhance patient information privacy, market players offer devices that need multiple steps of authentication to unlock the data. The features could be biometric identification or a unique identity number; only after it is entered does the reader provide access to the personal healthcare information stored on the card.

Such products benefit both patients and healthcare providers, due to which the demand for them continues to boom. Their usage is especially prevalent at hospitals in the U.S., where patients may access their complete records, while healthcare providers may access their vital information that is required for treatment.

Moreover, hospitals are under the increasing burden of the cost of encryption, while smart card readers save the time in registering patients, with the potential to improve patient care and reduce medical expenditures. This technology also sustains new methods that decrease administrative costs, allow users to securely access emergency medical data, help eliminate healthcare fraud, and ensure adherence to government recommendations and mandates.

The healthcare sector is extensively adopting smart cards for securely storing and accessing patient identity credentials, such as treatment information, photographs, and laboratory and imaging results. Hospitals also utilize such cards to access information related to payments and for support while processing transactions. Additionally, this technology enables cashless payment transactions at hospitals and clinics and lessens the requirement for carrying loads of cash around. Moreover, smart cards improve the confidentiality and security of the patient information, along with allowing secure access to hospitals.

Smart cards allow the healthcare staff to maintain the efficiency of patient care, by storing all information and privacy safeguards. This minimizes the risk of healthcare fraud and also frees up doctors’ minds, thus enabling them to focus on actual patient care.

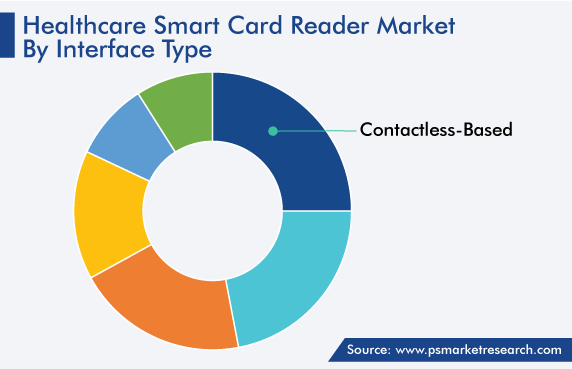

Contactless Category Is Expected To Dominate Market

Smart card readers are available with various interfaces. Contact-based variants require the manually insertion of the card into the device, whereas the contactless ones require no physical interaction with the device. Thus, based on interface type, the contactless category held the largest market share, of 27%, in 2022. These variants utilize the radiofrequency identification or near-field communication technology to create a wireless connection between the card and the reader. The reader processes the information contained in the card with a simple tap and allows access to the system as per the authorization level of the user.

Hence, the biggest advantages of contactless readers are convenience, higher data processing and access granting speed, and the elimination of the requirement to insert the card into the reader. The applications of contactless variants in healthcare centers include door and facility access, attendance access, and information fetching from patients’ smart cards.

Drive strategic growth with comprehensive market analysis

Most European countries have already implemented the smart card system in their healthcare sectors, while others are aggressively working on it; thus, the region held a more than 32% share in 2022.

The demand for such devices is driven by the rising efforts of European governments and the private sector to offer the best possible care. For instance, the NETC@RDS project, an initiative of the EU government, aims to enable healthcare access for European citizens. The pilots launched under it seek to study the feasibility and ways of integrating the national healthcare cards of individual EU members, so their citizens can avail of quality care wherever they are in the EU. Via its online verification of patient data, it also seeks to support both health insurance and care providers in their role in society.

Moreover, the fact that many European countries have their own national ID cards for healthcare services encourages companies to introduce secure and distinctive card readers.

Additionally, the APAC market is expected to register the fastest growth, at an around 14.6% CAGR, in the forecast period, due to the favorable government initiatives and technological advancement in the healthcare sector. For instance, the Government of Japan has announced plans to adopt smart health cards, which will be considered the national standard for digital health records and also serve as digital vaccine certificates.

This report offers deep insights into the healthcare smart card reader industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Interface Type

Based on Application

Based on End Use

Geographical Analysis

The market for healthcare smart card readers valued USD 1,119.9 million in 2024.

The healthcare smart card reader industry is essentially driven by the government rules for ensuring patient information privacy.

The market for healthcare smart card readers will witness a CAGR of 15.4% during 2024–2030.

The contactless interface is preferred in the healthcare smart card reader industry.

Europe is the largest market for healthcare smart card readers.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages