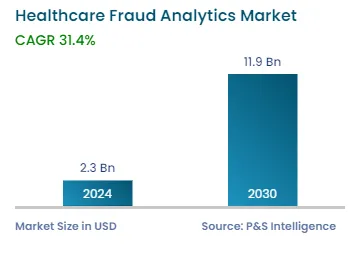

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2.3 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 31.4% |

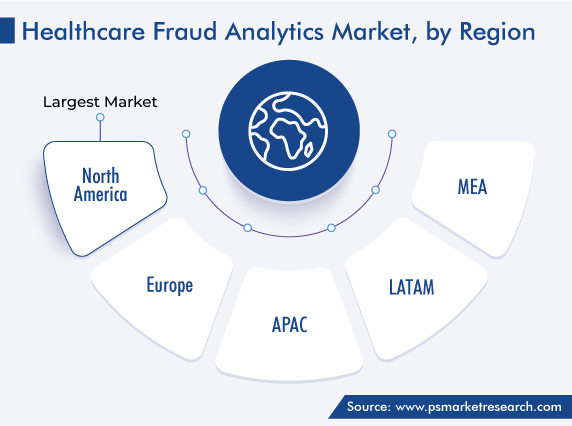

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12605

Get a Comprehensive Overview of the Healthcare Fraud Analytics Market Report Prepared by P&S Intelligence, Segmented by Solution Type (Descriptive Analytics, Predictive Analytics, Diagnostic Analytics, Prescriptive Analytics), Delivery Model (On-Premise, On-Demand), Application (Insurance Claims Review, Pharmacy Billing Issues, Payment Integrity), End User (Public & Government Agencies, Private Insurance Payers, Third-party service providers), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2.3 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 31.4% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global healthcare fraud analytics market generated revenue of USD 2.3 billion in 2024, which is expected to witness a CAGR of 31.4% during 2024–2030. The growth of this market is attributed to the increasing number of people with health insurance, coupled with the rising incidence of fraud in the medical industry. Among the frauds, those related to pharmacy claims have become a significant cause for concern for insurance firms, healthcare providers, as well as governments.

Moreover, the rising incidence of bribery and overcharging for the settlement of health insurance claims and the growing adoption of the prepayment review model create a high demand for such analytics services and software. Further, the growing literacy rate across the world and the high expenditure on health are driving people to opt for insurance. Due to this, the need for solutions that can reduce the chances of fraud, such as biometric sensors (to recognize fraudsters), is driving the market.

Furthermore, developing countries are increasingly adopting such software for detecting wrongdoing. Additionally, the advent of social media and its growing influence on the medical industry, as well as the role of artificial intelligence in fraud detection, will create new opportunities for medical fraud detection solution providers in the coming period. In addition, the increasing government focus on genuine claims scrutiny and enforcement of protective legislations is a key factor for this growth. The healthcare industry has become a major focus for law enforcement agencies due to the large amounts of money involved and the high potential for fraud.

Pharmacy- and prescription-related fraud is a major constant trend in the medical industry. As scams involving prescription drug diversion and other pharmacy activities are lucrative, criminals continue to carry them out. Although numerous prescription drug schemes exist, pharmacy fraud mainly occurs when insurers are billed for a medication a patient never received, or the pharmacy deliberately dispenses a different one. Some of the anomalies are prescription drugs that patients never pick up, hose that were never delivered or prescribed in the first place; drugs that were prescribed by a doctor who has not examined or met the patient, and one dispensed in a different amount from that prescribed.

Moreover, sometimes, pharmacists purposely provide patients with a lower dosage than prescribed, but do not make that change while billing. Patients may also be dispensed a costlier medication than what was actually prescribed, which tends to happen when the doctor mentions the API in the prescription, rather than an actual brand.

There even have been cases where a pharmacist has provided a patient with a drug that does not even have the approval of the FDA or the regulatory agency of the home country, because these types of medicines allow druggists higher profit margins. These frauds are common at both individual and hospital drugstores, in turn, driving the healthcare fraud analytics market in the future.

The number of individuals availing of numerous healthcare programs has amplified significantly over the past few years. The growing elderly population, rising healthcare expenditure, and increasing burden of diseases are behind the growth of the health insurance market. Moreover, healthcare expenditure is growing significantly all over the world, which impels people to adopt insurance to get some relief from the rising financial burden associated with quality care.

Medical insurance has played an important role in India during the COVID-19 epidemic, when approximately INR 25,000 crore worth of COVID treatment insurance claims were paid in the country. This is because during the pandemic, the perception of people toward health insurance changed significantly, with people buying plans that cover their entire families at once.

In 2022, based on solution type, the descriptive analytics category accounted for the largest share, of 42%, in the market, and it will further maintain its dominance in the forthcoming period. This is owed to the ease of usage offered by descriptive analytics solutions and their simplicity of integration into other sources of information, in order to produce expressive insights. Moreover, this type of analytics is frequently adopted for studying the existing as well as historical data for the identification of trends and relationships. Descriptive analytics is increasingly being utilized for assessing various clinical decisions and their consequences on service performance, care quality, and overall patient outcomes.

The predictive analytics category will show the fastest advance during the projection time frame. This technique is used more by healthcare payers for checking for fraudulent activity before paying the claim. Traditional approaches to detection fraud, such as manual investigations and audits, have limited speeds, scalability, and accuracy. That is where predictive analytics becomes useful, as it offers a new approach to detecting fraud before it happens. By the employment of statistical modeling, machine learning algorithms, and data mining, predictions about the future are made. This allows users to quickly identify fraudulent activities and take the appropriate action, which, ultimately, helps decrease losses, protect assets, and maintain customers’ trust. These solutions recognize patterns that are possibly fraudulent and then develop some rules to flag certain claims.

The prescriptive analytics category is also expected to witness significant growth in the forecast period, as this approach helps in estimating the cost and benefit of anti-fraud solutions and aids users in organizing patient data to analyze if they are spending more on trying to catch the fraud as compared to what they would be losing if it is carried out.

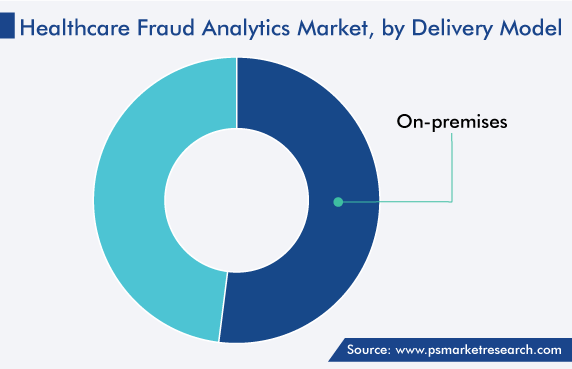

Based on delivery model, the on-premises category accounted for the larger share, of around 52%, in the market in 2022, and it is further set to maintain its dominance in the forthcoming period. The on-premises approach is reliable and secure, and it allows enterprises to uphold a level of control and ease of access to data, which allows for the better management of records, as well as monitoring of the information.

Moreover, the on-premises setup has been accepted widely by insurance companies to tackle large datasets hospitals have, which include patient history, diagnosis and prescription details, and payment and insurance information. Additionally, companies are accepting this deployment approach because it provides full ownership and control over the software and data, along with comprehensive insights, and aids in taking decisions related to hardware and software.

The on-demand category will show the faster growth in the future, due to the cost-effectiveness of this approach for any company. This is essentially a B2B model, where the software, hardware, and datasets are maintained by the provider for the company. Additionally, this model offers companies unlimited storage for the massive amounts of patient data, which will only increase with time.

Based on application, the insurance claims review category accounted for the dominant share in this market, and it will further maintain its dominance in the forthcoming period. This is owed to the growing adoption of health insurance, which, as a downside, results in an increase in the number of fraudulent claims. While performing an insurance claims review, the insurer will try to see whether the medical condition the treatment for which is to be reimbursed is covered by the policy. Both patients and their doctors will need to provide proof it is a genuine claim, and the insurer will need to be certain the claim satisfies the terms and conditions of their insurance policy.

Additionally, the pharmacy billing issues category is expected to grow at the highest rate, owing to the rising number of billing frauds involving drugstores. Many pharmacies produce unauthorized bills and dispense unprescribed drugs. The latter practice has the potential to seriously harm patients, which is why the need to detect such frauds is driving the adoption of appropriate analytics software.

Drive strategic growth with comprehensive market analysis

Geographically, North America held the largest share, of around 40%, in 2022, and it is expected to grow at a robust CAGR during the review period. This will be due to the high per capita income and healthcare expenditure, vast population of the elderly and patients, large number of people with health insurance, high incidence of healthcare frauds, favorable government initiatives for anti-fraud activity, and pressure to reduce healthcare costs. Moreover, the increase in the number of service providers and technological advancements in software meant to detect such wrongdoing are aiding in the growth of the market in the region.

Moreover, the presence of the corporate headquarters of the majority of the leading players in the healthcare fraud detection market drive the demand for the associated software. For instance, International Business Machines Corporation’s headquarters is located in Armonk, New York.

Furthermore, Canada is showing significant growth in this market due to its advancing healthcare infrastructure, rising number of government initiatives for reducing the incidence of healthcare frauds, and a large population covered by at least one health insurance policy.

Moreover, solution demand in Europe will rise rapidly due to the advancement in the regional countries’ health infrastructure, rising incidence of communicable diseases, and favorable policies for reimbursement.

Based on Solution Type

Based on Delivery Model

Based on Application

Based on End User

Geographical Analysis

The market for healthcare fraud analytics solutions valued USD 2.3 billion in 2024.

The healthcare fraud analytics industry is driven by the rising adoption of health insurance and the high incidence of fraud in the medicine sector.

The application segment of the market for healthcare fraud analytics solutions is dominated by insurance claims review.

Lately, the on-demand delivery model has begun to trend in the healthcare fraud analytics industry.

North America leads the market for healthcare fraud analytics solutions, and APAC will grow the fastest.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages