Report Code: 11032 | Available Format: PDF

Hard Coatings Market Research Report - Global Size, Share, Development, and Demand Forecasts, 2024-2030

- Report Code: 11032

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Hard Coatings Market Overview

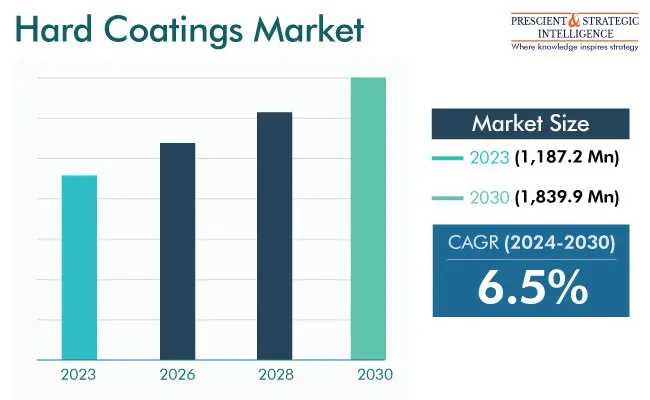

The hard coatings market was USD 1,187.2 million in 2023, which will increase to USD 1,839.9 million by 2030, powering at a rate of 6.5% between 2024 and 2030.

Driver

- Growing urbanization & infrastructure development: The growing requirement for robust as well as long-lasting infrastructure is boosting the need for hard coatings in construction applications.

- For instance, the Cabinet Committee on Economic Affairs of India approves 6 multi-tracking projects across Indian Railways. The financial expenditure of the projects will be approximately INR 12,343 crore, and it is likely to be complete by 2029-30.

- Surging need for durability & performance: Hard coatings provide superior protection against scratches, corrosion, wear, and various other kinds of damage. This is resulting in surging needs across different sectors such as construction, electronics, and automotive.

- Increasing emphasis on sustainability: The increasing importance of the regulation on lower VOC coatings as well as consumer preferences has led to the increased interest in environmentally friendly coatings with low VOCs and minimal waste generation.

- In February 2023, Chemcraft, a division of AkzoNobel, introduced a waterborne coating system called “Acquaduro”, an excellent chemical as well as water resistance, with low odor benefits, low VOC, and HAPs.

- Developments in technology: Improvements in deposition methods, including physical vapor deposition and chemical vapor deposition, are resulting in the creation of new and better hard coatings with better properties.

Trends

- Miniaturization & lightweight: The direction towards smaller as well as lighter devices in electronics and various other sectors is resulting in the progress of thin-film hard coatings with greater performance.

- Increasing need in developing nations: The surging middle-class population in developing nations boosts the need for consumer goods with hard coatings including tablets and smartphones.

- For instance, the middle-class population in India is likely to reach 715 million, from 432 (in 2020-21) million people, by 2030-31

- Emphasis on cost-effectiveness: Manufacturers are progressively moving towards producing cost-effective hard coating systems in order to cover a broader range of applications.

- Functionalization of hard coatings: The introduction of new capabilities, including self-cleaning, self-healing, and antibacterial properties, is generating new opportunities for hard coatings across different applications, including medical/dental equipment.

- The demand for medical device coating will reach a value of USD 15,165.9 million in 2030.

Challenges

- High Initial Investment

- Competition From Other Materials

A major barrier in the industry is the large initial investment needed. Setting up coating facilities and obtaining specialized equipment can be very costly involving infrastructure, sophisticated machinery, and trained personnel. This entry barrier makes it difficult for small businesses or startups to compete against already established players who already have the infrastructure and economy of scale. Additionally, research & development as well as the manufacturing of the new and enhanced hard coatings add to the initial investment challenges.

Moreover, hard coatings have to compete with other materials such as ceramics and polymers. Such materials possess comparable properties, such as wear endurance as well as durability, at a much less costly price. This makes them attractive options in certain applications, mainly those with low specific performance requirements.

- For instance, the global polymer industry is expected to reach USD 946,991.38 million in 2030.

For example, for basic wear protection, polymers could be used as an alternative to hard coatings in some construction applications. This competition therefore challenges coating manufacturers to develop and optimize their products to keep them competitive. They should concentrate on developing cost-effective solutions, emphasizing the distinctive advantages of hard coatings over other options, and aiming for applications where their greater performance explains the cost premium.

Borides Material Is Significant Contributor

The borides category, based on material type, accounted for a significant share of the industry. This is mainly because of the proliferation of the amorphous films, boosted by a rising atomic ratio and decreasing metallic radius of rare earth metals. The strong directional bonding of boron is a major factor in the growth of the category. The structural arrangement of the boride phase greatly affects both mechanical and optical properties, thus making it a significant player in the industry. This complex coordination of elements makes borides a key and influential player in shaping the industry's landscape.

Physical Vapor Deposition Is Largest Contributor

The physical vapor deposition category, based on deposition technique, is the largest contributor to the industry. The automotive sector boosts the need for hard film coatings due to its focus on lightweight materials to improve fuel efficiency as well as decrease carbon dioxide emissions.

- For example, the global demand for automotive lightweight material will reach USD 128,010.1 million in 2030.

This trend will drive the growth of the industry during this decade, as industries look for high-end coating solutions to meet strict environmental standards and improve the lifetime of critical components to achieve sustainable & effective manufacturing approaches.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,187.2 Million |

Revenue Forecast in 2030 |

USD 1,839.9 Million |

Growth Rate |

6.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

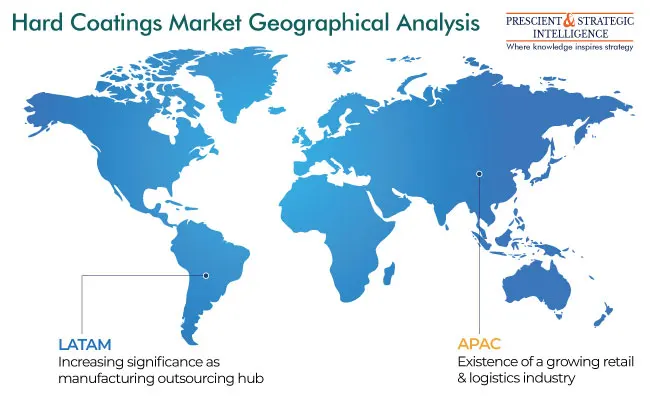

APAC Is Leading Market

Globally, APAC is the largest contributor to the industry. This can be ascribed to the region's strong industrial and manufacturing sectors, along with a vibrant aerospace and automotive sector. India, South Korea, Japan, and China, are leading the utilization of developed technologies and materials to improve their industrial abilities, thus also boosting the need for hard coatings.

- As per an article, China, between January to October 2023, produced approximately 21 million passenger cars.

- Moreover, the Korean government increased the budget for enhancing the infrastructure of cutting-edge sectors from KRW 1.6 trillion to KRW 2.0 trillion in 2023.

Furthermore, the developing consumer electronics sector of the region is another contributor to the rising need for hard coatings as manufacturers try to improve the product's performance and longevity. The region’s investment in infrastructure, as well as construction projects, further creates a strong demand for hard coatings in the industrial machinery & equipment area.

North America is likely to advance at the fastest compound annual growth rate during this decade. This can be mainly because of technological improvements, rising emphasis on sustainability, and innovative applications in the continent. The rapidly developing automotive and aerospace sectors of the region leverage hard coatings to achieve better fuel economy, less emissions, and better performance.

Furthermore, the increasing focus on renewable energy sources generates the need for hard coatings in the wind energy industry. The North American medical devices industry also considers hard coatings for surgical instruments and implants, which boosts regional industry growth.

Competitive Landscape

The hard coatings market is fragmented, which comprises established players as well as emerging startups. This results in a dynamic environment that is continuously innovative and competitive.

- In September 2023: PPG Industries Inc. declared the competition of expanding its powder coatings facilities in Sumaré, Brazil. The USD 2.7 million project boost the manufacturing volume of the plant by 40%.

- In December 2022: AkzoNobel Coatings finalized the acquisition of the wheel liquid coatings business of Lankwitzer Lackfabrik GmbH. This will enhance the company’s portfolio of performance coatings.

Major Player in the Market

- IHI Corporation

- MPM Holdings Inc.

- CemeCon AG.

- Akzo Nobel NV

- Duralar Technologies LLC

- Platit AG

- MBI Coatings

- Exxene Corporation

- ASB Industries Inc.

- Oerlikon Management AG

- Carl Zeiss AG

- Platit AG

- PPG Industries Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws