Market Statistics

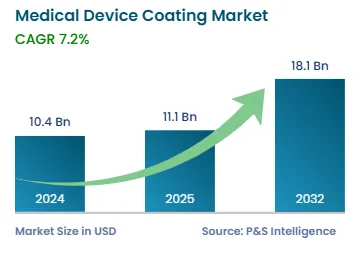

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 10.4 Billion |

| 2025 Market Size | USD 11.1 Billion |

| 2032 Forecast | USD 18.1 Billion |

| Growth Rate(CAGR) | 7.2% |

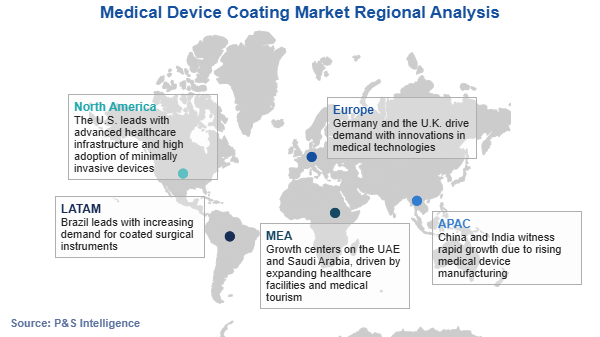

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

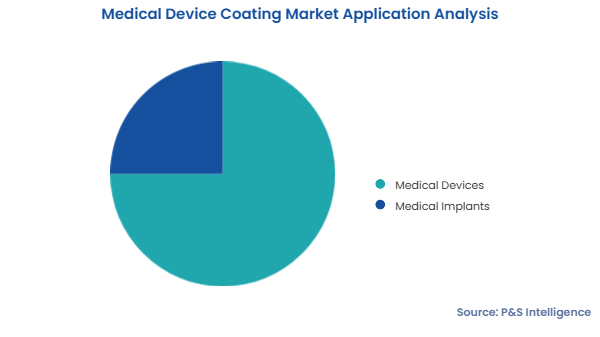

| Largest Application Category | Medical Devices |