Report Code: 11044 | Available Format: PDF

GNSS Chip Market Research Report - Global Size, Share, Growth, Regional Outlook, Revenue Estimation and Forecast, 2024-2030

- Report Code: 11044

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

GNSS Chip Market Overview

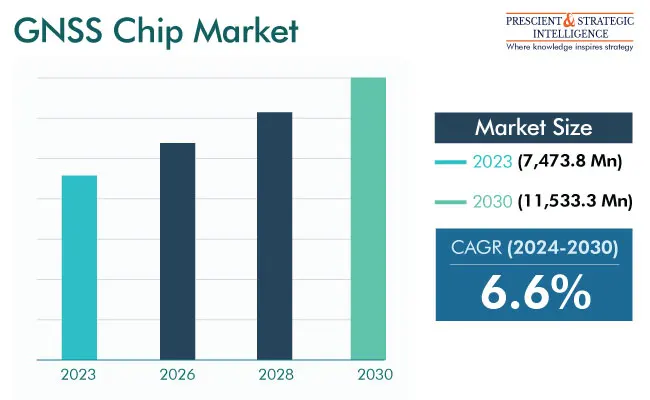

The GNSS chip market size has been estimated at USD 7,473.8 Million in 2023, and it will reach USD 11,533.3 Million by 2030, advancing at a 6.6% compound annual growth rate between 2024 and 2030.

This can be ascribed to government support and initiatives, developments in navigation & positioning devices, the rising popularity of AR/VR, and increasing investment in satellite navigation programs.

- For instance, the IKEA Place application, by IKEA, utilized AR to enable customer virtually place products in their homes.

- Moreover, the demand for AR and VR will reach a value of USD 200.1 billion in 2030.

A GNSS chip is a small semiconductor component that allows electronic devices to read radio waves from satellite constellations, including GPS, GLONASS, BeiDou, or Galileo. This chip works on signals from several satellites to establish the velocity, time, and location of a device. It plays an important role in delivering precise real-time global positioning data, which is utilized worldwide by mapping applications, navigation systems, and numerous location services in devices such as vehicle navigation systems, wearables, and smartphones.

Driver

- Growing Autonomous Vehicles Acceptance: GNSS technology is essential for the automotive sector innovations towards autonomous vehicles due to its high precision geotagging. With the growth in autonomous vehicle development and commercialization, there will be an increase in demand for high-performance GNSS chips.

- For instance, the demand for autonomous cars in North America will reach a value of USD 52.3 billion in 2030.

- Moreover, in November 2022, Waymo LLC, an American autonomous driving technology business, became the 1st autonomous vehicle operator in the U.S. to introduce paid robotaxi solutions to & from the Phoenix Sky Harbor International Airport.

- Increasing Need for Location-Based Services (LBS): The adoption of smartphones and various other connected devices has resulted in the growing need for location-based services, including mapping, real-time tracking, and navigation. The GNSS chips play an integral role in ensuring that precise and dependable location data is provided for the services.

- For instance, the demand for location-based services is expected to touch USD 83.9 billion in 2030.

- Incorporation of GNSS in Wearable Devices: GNSS technology is also being integrated into wearable devices including smartwatches and fitness trackers. This integration improves the location-based features as well as services in these devices.

- For instance, in September 2023: Apple introduced the Apple Watch Ultra 2 and Apple Watch Series 9, which both include GNSS.

Trend

- Multi-Constellation & Multi-Frequency GNSS Chips: One of the key trends in the industry is innovation as well as the acceptance of chips that support signals from multiple frequencies and multiple satellite constellations. This trend is focused on improving reliability, positioning accuracy, and accessibility, particularly in hash environments.

- Miniaturization & Integration: Miniaturization as well as integration of the GNSS chips leads to smaller measurements that are more efficient in terms of power consumption. This is especially important for applications such as wearables, IoT devices, and UAVs where space constraints are highly an important consideration.

- For instance, in September 2021, Broadcom Inc. introduced the BCM4778 (the lowest power L1/L5 GNSS receiver chip in the world), optimized for wearable & mobile applications.

- This chip (3rd generation) is 35 percent smaller as well as uses 5 times less energy compared to the previous generation.

- Improvements in Sensitivity & Signal Processing: Signal processing algorithms improvement as well as sensitivity enhancements continue to provide greater performance in difficult conditions, including dense foliage and urban canyons. This trend provides more stability as well as precise positioning in any kind of atmosphere.

- For example, in December 2021, Trimble introduced the “Trimble R750 GNSS Modular Receiver”,

- which is a connected base station for application in geospatial, agricultural, and civil construction purposes.

Challenge

- Signal Interference & Jamming: The GNSS signals are vulnerable to intentional or unintentional interference or jamming. Reducing the effect of signal interference as well as guaranteeing GNSS receiver resilience to jamming continues as a significant challenge.

- As per the European Aviation Safety Agency, GPS jamming or spoofing has become more widespread as well as sophisticated since 2022.

- Indoor Positioning Accurateness: Being precise in indoor environment positioning is still a key problem with GNSS technology. The incapability of traditional GNSS signals to work their way through buildings or similar structures significantly reduces the efficacy of such systems in an indoor application.

- Security & Privacy Worries: As the GNSS technology integrates into many applications, issues on security as well as privacy of location data start arising. Addressing these worries and offering an appropriate level of security is also a key challenge for the industry.

- Energy Consumption in Portable Devices: GNSS chips utilized in portable devices, including wearables, smartphones, and others face issues regarding power consumption. However, it is a challenge to achieve an effective combination of precise and continuous positioning while dealing with limited power resources in these devices.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,473.8 Million |

Revenue Forecast in 2030 |

USD 11,533.3 Million |

Growth Rate |

6.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Smartphone Is Largest Contributor

The smartphone category, based on devices, is the largest contributor to the industry. In smartphones, the GNSS chip uses satellite systems’ signals and enables a user to precisely locate the specific device. Many location-based apps such as weather apps, ride-sharing apps, and maps, use this data to offer services. In response to the increasing demand for location-based services and the growing popularity of smartphones, GNSS adoption has significantly increased. The modern smartphone has GNSS technology that enables users to identify local locations, navigate, and monitor their health.

- In September 2023, Apple introduced the iPhone 15 series, which comprises various GNSS.

Consumer Electronics Account Largest Share

The consumer electronics category, on the basis of vertical, accounted for the largest share of the industry. The largest share of this category can be ascribed to the:

- Increasing IoT acceptance: The growth in IoT contributes to the growing need for GNSS chips in various smart home devices, which need accurate location information.

- For example, the total value of the smart homes industry will reach USD 196.5 billion in 2030.

- Developments in GNSS technology: GNSS chips are getting smaller, less costly, and more energy-efficient. This boosts their acceptance among consumer electronics manufacturers.

- High requirement for GNSS-enabled devices: Wearables, tablets, smartphones, and various other consumer electronics devices progressively depend on GNSS chips for location-based services, such as mapping, fitness tracking, and navigation.

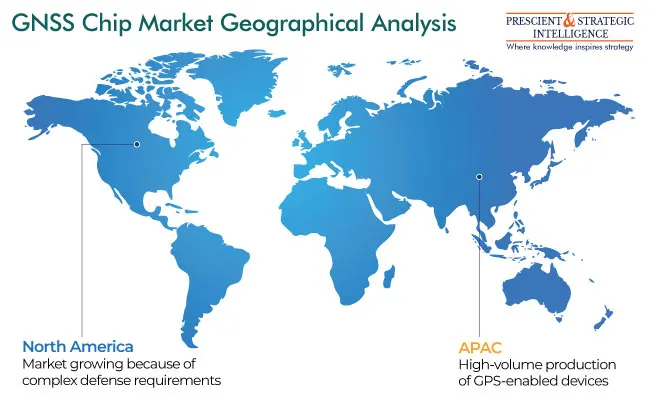

APAC Is Largest Contributor

APAC accounted for the largest share of the industry. Major contributor to the regional industry includes Japan, China, and South Korea. Rising demand for location-based services, the emergence of GPS-enabled devices, and growing acceptance in the automotive sector are aiding the industry's expansion. Moreover, the proliferation of connected devices such as wearable technology and smartphones is boosting the need for GNSS chips.

- As per an article, China produced 679 million smartphones between January–August in 2023.

Furthermore, the defense spending of nations such as India clearly shows the emphasis of the government on enhancing the nation’s defense abilities. The growing need to maintain national security as well as military dominance is further supporting the demand for GNSS devices in the region.

- In the Indian Union Budget 2023-24, the defense gets INR 5.94 lakh crore,

- Which is an increase of 13% from last year.

Competitive Landscape

The GNSS chip market is highly fragmented, with numerous chip manufacturers holding small shares. Key companies are taking different measures such as mergers, acquisitions, partnerships, and product launches, to improve their position.

- In September 2023: U-blox, introduced its “SARA-S520M10L”, a cellular and satellite IoT module with precise, ubiquitous connectivity, and low-power positioning.

- In May 2023: Qualcomm Incorporated declared that the company had entered into a definitive agreement to acquire Autotalks ( an Israeli-based vehicle chip startup).

Major Companies in the Industry

- Qualcomm Incorporated

- Intel Corporation

- Broadcom Inc.

- Furuno Electric Co. Ltd.

- Quectel Wireless Solutions Co. Ltd.

- Skyworks Solutions Inc.

- MediaTek Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- U-blox Holding AG.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws