Automotive Telematics Market Analysis

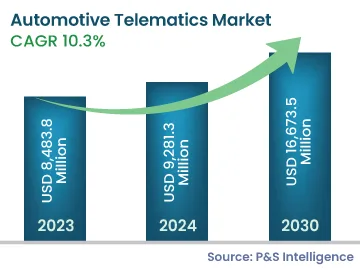

The automotive telematics market generated revenue of USD 8,483.8 million in 2023, which is expected to witness a CAGR of 10.3% during 2024–2030, to reach USD 16,673.5 million by 2030. This can be ascribed to factors, such as the rising demand for improved safety features in vehicles, the increasing adoption of connected vehicles, and the existence of supportive government regulations.

The incorporation of 5G network technologies, which have higher radio frequencies than the existing 4G network, in telematics solutions provides immense growth opportunities to players in the market.

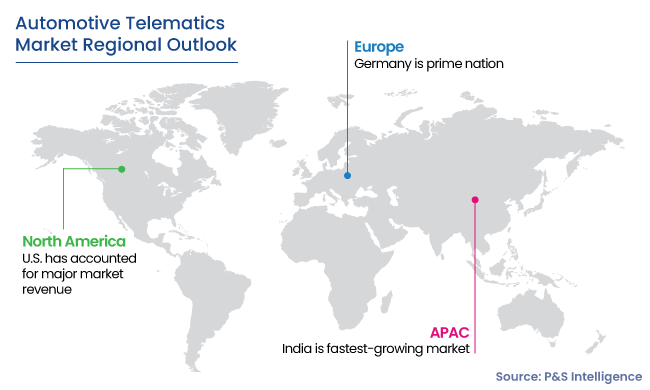

The telematics solutions increase the complexity of vehicle technologies, which, in turn, require enhanced network connectivity to simplify their functioning. Verizon Communications Inc. was the first ever company to introduce a 5G network in the U.S., thereby making the U.S. the first ever country to present the 5G network. Thus, the adoption of the 5G network for car connectivity service is expected to enhance the growth opportunities for telematics solution providers.

Further, the introduction of autonomous vehicles would create greater growth opportunities for telematics solutions providers. These autonomous vehicles have various functions, including such as eye tracking, speech recognition, gesture recognition, virtual assistance, driver monitoring, and natural language interfaces, all of which rely on telematics solutions.

Moreover, advanced driver-assistance systems (ADAS) include camera-based machine vision systems, driver condition evaluation systems, sensor fusion engine control units, and radar-based detection units, which are huge sources of vehicle data and are highly reliant on telematics solutions.

The increasing demand for improved safety features in vehicles and more efficient road traffic is the major reason driving the growth of the market. India registered the maximum number of road accidents in the world, followed by China and the U.S.