Market Statistics

| Study Period | 2019 - 2030 |

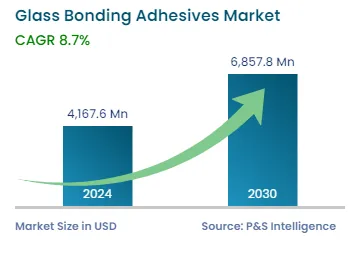

| 2024 Market Size | USD 4,167.6 Million |

| 2030 Forecast | USD 6,857.8 Million |

| Growth Rate(CAGR) | 8.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12686

Get a Comprehensive Overview of the Glass Bonding Adhesives Market Report Prepared by P&S Intelligence, Segmented by Type (UV-Cured, Epoxy, Cyanoacrylate, Polyurethane, Silicone), End User (Building & Construction, Automotive & Transportation, Electricals & Electronics, Healthcare, Industrial Assembly, Woodworking), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,167.6 Million |

| 2030 Forecast | USD 6,857.8 Million |

| Growth Rate(CAGR) | 8.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The glass bonding adhesives market size stands at USD 4,167.6 million in 2024, and it is expected to grow at a CAGR of 8.7% during 2024–2030, to reach USD 6,857.8 million by 2030.

The growth can be primarily ascribed to the fact that with the usage of these agents, the glass remains smooth, as there will be no visible screws, protruding bolts, and nuts. Moreover, these materials provide protection against corrosion and possess excellent cohesive strength. Essentially, the growing construction activities across the globe are expected to propel the market. This is attributed to the desirable characteristics of such materials including rigidity, non-yellowing nature, chemical inertness, and resistant against moisture.

Adhesives are also utilized in construction & building applications owing to their excellent strength-to-weight ratio, insulation properties, durability, and versatility. In several countries, such as India, China, and Brazil, the rate of infrastructure development is increasing; hence, they require a large amount of construction material, including adhesives. The construction of roads, bridges, airports, ports, and other civil structures requires these adhesives for joining panes of glass, such as those that encase safety lights, to the tarmac or building walls.

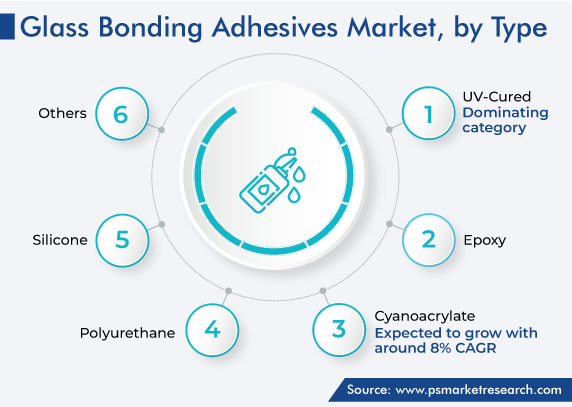

The UV-cured type holds the major share, of around 30%, attributed to its elasticity and high tensile strength. Moreover, these variants are strong, fast-curing, optically clear, resistant to changing weather conditions, and easy to use, and they also have lower processing costs. In addition, they do not cause pollution in the air, which is a key reason the usage of this type continues to advance in various industries, including aerospace, military, medical and dental devices, and electronics & fiber optics.

The polyurethane category is also growing at a significant rate, attributed to the flexibility and durability of PU glass bonding adhesives. They are used for sticking glass to structural components made of plastics and metals due to their significant mechanical and peel strength. They are also known to add flexibility to glass joints and offer resistant against a wide range of chemicals and materials.

The silicone category is also growing at a considerable rate owing to the various advantages of silicone glass bonding adhesives, such as flexibility, excellent resistance against moisture and weathering, and biocompatibility. Moreover, they possess durability and are, thus, used for the adhesion of glass in aquaria. They are also used to fill gaps and holes, have the capability to withstand low and high temperatures, and are weakly chemically reactive.

The automotive and transportation industry is the largest end user, as adhesives are being used to join lightweight materials, for minimizing harmful emissions by reducing the weight of the vehicle. It has been evaluated that over 2 million three-wheelers, passenger vehicles, quadricycles, and two-wheelers were manufactured in India in March 2023 alone. The demand for automobiles is increasing because of the presence of a large youth population, coupled with the middle-class’s rising income.

Due to the rising investments in augmenting the production of vehicles, the demand for glass bonding adhesives will continue to increase in the automotive and transportation sector. For this, they are used in door glass, sunroof assemblies, windscreens, and many more components. Advanced bonding agents enhance stiffness and strength, reduce the undesirable engine and road noise, and absorb vibrations, in order to provide safety and comfort. The demand for these agents is also growing in furniture, including doors, design panels, mirrors, partitions, decorative products, bathroom and display cabinets, and shelves.

Additionally, several companies are investing for the development of electric vehicles, because of the strict environmental regulations on conventional automobiles and the strong government support for electric transmissions. For instance, Mahindra & Mahindra has announced that it will invest USD 1.2 billion in an EV manufacturing plant in Pune, Maharashtra.

Similarly, in the aerospace industry, they are used on seals, sidewalls, microelectronic components, light covers, baggage racks, and other components. Moreover, in the healthcare industry, the consumption of these materials is increasing because of the frequent usage of microscopes and the bonding of metal cannulas into glass syringes. Adhesives provide an optically clear view of the product with no coloring, in the case of microscopes.

The growing usage of glass bonding adhesives in mobile phones and other electronic items is propelling the market. The rising usage of smartphones, computers, digital cameras, and other consumer electronics propels the demand for glass bonding adhesives. These agents are used for assembling various electronic components, such as screen guards, camera lenses, glass display windows, various decorative parts & nameplates, keypads & membrane switch components, speakers & microphones, battery compartments & exterior cases, and electromagnetic interference (EMI) shielding.

To these electronic components, these agents provide protection against heat, vibration, moisture, and corrosion. Moreover, using the UV curing technology makes the bonding process eco-friendly and the bond itself stronger. In this regard, the increasing number of electronics manufacturers and the rising focus of individuals on using mobile phones, LED & LCD TVs, and many more electronic products will contribute in the growth of the market

Drive strategic growth with comprehensive market analysis

APAC has the leading position in the glass bonding adhesives market, and it will hold the same position till 2030, with a value of USD 3 billion. This is attributed to the rapid urbanization, growing healthcare sector, and rising investments in the construction sector.

In APAC, China holds the leading position, and it will grow at a CAGR of 9% during the forecast period. This is attributed to the growing construction activities and increasing sales of automobiles. Further, in China, India, Thailand, and Indonesia, the development of automobiles entails lower expenditure. Combined with the financial support of the government, this factor continue to boost the regional automotive industry.

Moreover, according to government sites, around 33% of India’s population lives in cities, and this share will cross 40% of the population by 2030, which will create the necessity for around 25 million affordable housing units. This will boost the growth of the construction industry and, in turn, of the market. Additionally, the increasing sale of automobiles and houses is a result of people’s rising disposable incomes, which, ultimately, is driving the consumption of glass bonding adhesives.

Further, in several industries, such as electronics, building & construction, and automotive, the strict regulations governing VOC emissions will expand the application of isocyanate-free, radiation-cured, and solvent-free glass bonding agents.

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages