Report Code: 10453 | Available Format: PDF

Radio Frequency Integrated Circuits (RFIC) Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2024-2030

- Report Code: 10453

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

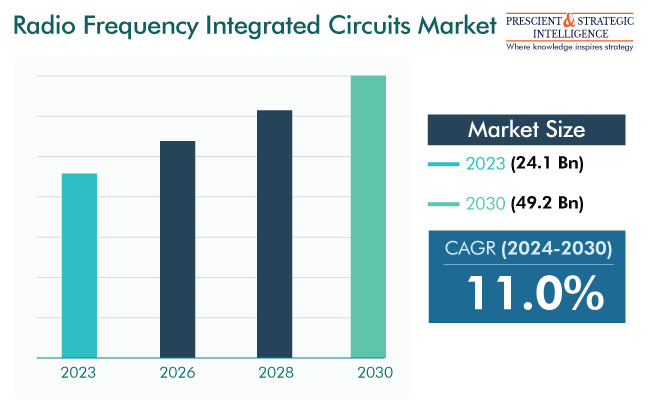

The radio frequency integrated circuits (RFIC) market estimated value is USD 24.1 billion (E) in 2023, and it will propel at 11% compound annual growth rate during 2024–2030, to reach USD 49.2 billion by 2030.

The industry is primarily propelled by the growing need for higher-bandwidth radio communications. Essentially, the rising need for consumer electronics has powered the manufacturing of RFICs in the past few years.

The enhancements in the detection capacity, along with a reduction in the average price and package size of RFICs, have led to their extensive acceptance in consumer electronics. Smartwatches and smartphones require compact and thin-package RFICs for the latter to be able to fit in such compact devices. The minimization of consumer goods in the past few years has led to substantial developments in the packaging technology of RFICs.

The kind of microchip utilized for the processing of radio frequency data is a radio frequency integrated circuit. RF codes are utilized in walkie-talkies, cell phones, and other radio devices because they strengthen the signal and reduce interference. Moreover, the different components utilized in an RFIC for altering radio signals to the digital code include capacitors, transmitters, inductors, and resistors.

The development of radio frequency integrated circuits has transformed communication technology as they are the major element of wireless devices. One of the key factors boosting the quality of LTE wireless networks for the next generations is the rising integration of advanced RFICs in wireless communication devices. Because of the increasing global acceptance of LTE networks, semiconductor and electronic device makers are required to deploy more of these components.

Additionally, the acceptance of 5G-powered services will be simplified by a substantial surge in the number of smartphone customers globally. In turn, the RFIC industry will advance because of the extensive acceptance of applications such as the internet of things, augmented reality, driverless vehicles, and other technical developments.

In this regard, a major aspect driving the development of the radio frequency integrated circuits industry is the growth in the usage of IoT applications. The IoT is a network of things, such as homes, cars, and other machinery, which can be connected to each other and share information via software, electronics, and sensors.

IoT is finding acceptance in several industries, such as healthcare, consumer goods, manufacturing, and automotive. Moreover, because of the miniaturization of electrical equipment, RFICs are also required to be small and more efficient. In particular, this trend is reflected in the mobile phone industry, where thin and lightweight devices are more prevalent.

Transceiver Category To Have a Significant Share

Based on product, the transceiver category is dominating the industry. The development of IoT and the expanding availability of internet services in the U.S., Brazil, China, and India have been boosting the purchase of connected devices. Moreover, with the increasing number of smartphone users, the demand for transceivers is on the rise, as these components are essential to establishing wireless communications.

As per Business Today, the number of smartphone users in India will reach 1 billion in 2026, with rural areas powering the sale of internet-enabled phones. There were 1.2 billion mobile subscribers in 2021, and about 750 million were smartphone users. Moreover, India will become the second-largest smartphone manufacturer in the next five years.

Wi-Fi Category Will Grow Significantly

In the coming few years, the Wi-Fi category will experience a substantial CAGR in the radio frequency integrated circuits industry, based on technology. This can be ascribed to the increasing use of video sharing, online search, e-commerce, and social networking applications in Asia-Pacific, Europe, and North America.

Furthermore, APAC is the largest market for devices with Wi-Fi connectivity. This is mainly because of the rising requirement for free public Wi-Fi, growing affordability of smartphones, and increasing expenditure on wireless technologies.

| Report Attribute | Details |

Market Size in 2023 |

USD 24.1 Billion (E) |

Revenue Forecast in 2030 |

USD 49.2 Billion |

Growth Rate |

11.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Near-Field Communication Category To Advance at Considerable Pace

Till the end of this decade, the near-field communication (NFC) category will experience substantial development, mainly due to the growing use of RFIC chips in mobile phones. The overall industry for NFC is projected to grow across the projection period propelled by the developments in digital communication infrastructure. Further, the rising acceptance of smartphones and tablet computers among middle-class consumers in nations such as China and India will drive this growth.

Growing Usage of Smartphones

In 2022, there were 6.8 billion smartphone users globally, which is almost double of the approximately 3.7 billion at the end of 2016. The worldwide populace is 8 billion, which means a smartphone penetration of more than 80%. This means that in the last seven years, the number of mobile phone operators has increased by an incredible rate of 86.5%. Smartphone utilization will continue to increase in the coming years, reaching 7 billion in 2024, before expanding further to 7.5 billion by 2026.

Consumer Electronics Industry Is Largest End User

The end user segment of the market is dominated by the consumer electronics category. All consumer electronics, be it smartphones, laptops, tablets, or PDAs, enable communications via the wire or over the air. This makes RFICs vital for these devices, which is the essential factor driving the market advance. The sale of such products is rising with people’s increasing spending power and growing level of urbanization around the world.

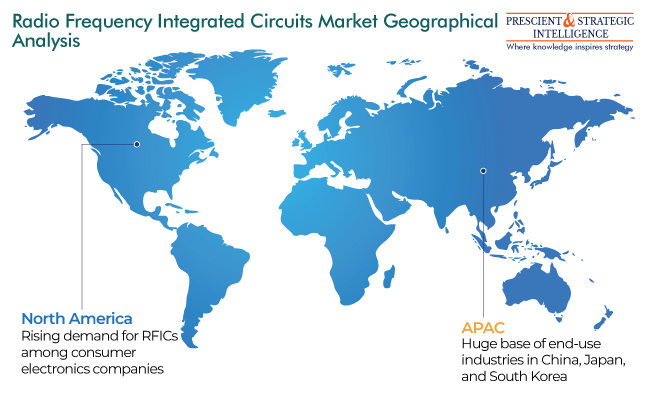

North America Is Contributing Significantly to RFIC Market

The radio frequency integrated circuits market receives a massive revenue contribution from North America, which will also observe a substantial growth in the coming years. Because of the high number of electronics companies in this continent, the demand for the RFIC technology will rise as internet usage continues to surge and supply chain management improves.

To fulfill the increasing need for pioneering features in radio frequency integrated circuits, numerous players in the U.S. are fortifying contracts with science and technology organizations. Furthermore, a considerable portion of their income comes from the manufacturers of consumer devices in the nation. Furthermore, the need for RFICs in the U.S. continues to surge with the rising television and radio broadcasting activities.

The industry for RFICs in Latin America and the Middle East and Africa will also grow significantly in the coming years. This would be a result of the enormous unmapped customer base and the expansion of the IT infrastructure throughout the region.

Overall, APAC is the largest market for these components because it is the biggest manufacturer of these components. Additionally, even the end-use products, including smartphones, laptops, and smart home appliances, such as air conditioners, fridges, and washing machines. The region also has a huge manufacturing base for automobiles, which are increasingly being integrated with internet connectivity. Moreover, governments’ digital manufacturing initiatives are propelling the demand for connected and smart factory machines.

Key Players in Radio Frequency Integrated Circuits Market

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- TriQuint Semiconductor Inc.

- Avago Technologies Inc.

- Skyworks Solutions Inc.

- Texas Instruments

- Analog Devices Inc.

- Microchip Technology Inc.

- Broadcom Inc.

- Murata Manufacturing Co. Ltd.

- Qorvo Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws