Market Statistics

| Study Period | 2019 - 2030 |

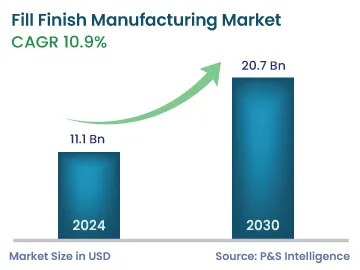

| 2024 Market Size | 11.1 Billion |

| 2030 Forecast | 20.7 Billion |

| Growth Rate(CAGR) | 10.9% |

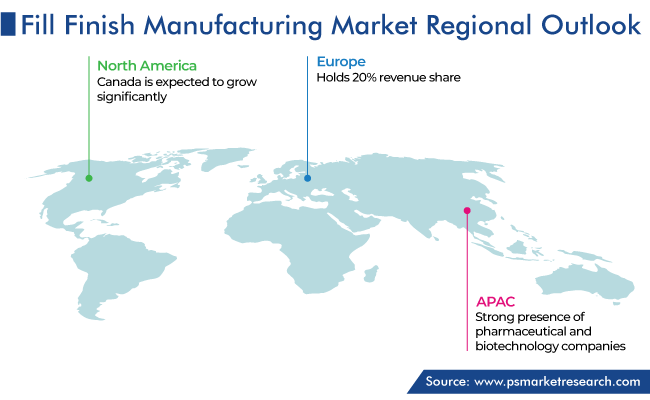

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12780

Get a Comprehensive Overview of the Fill Finish Manufacturing Market Report Prepared by P&S Intelligence, Segmented by Product (Consumables, Instruments), End User (Contract Manufacturing Organizations, Pharmaceutical and Biopharmaceutical Companies), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 11.1 Billion |

| 2030 Forecast | 20.7 Billion |

| Growth Rate(CAGR) | 10.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The fill-finish manufacturing market generated revenue of USD 11.1 billion in 2024, which will reach USD 20.7 billion by 2030, advancing at 10.9% CAGR between 2024 and 2030, driven by the growing demand for injectables, including biologics and customized medicines.

This process plays an important role in the pharmaceutical and biotechnology industries by being the last stage in the production procedure, wherein synthetic and biologic drugs are poured into their respective containers and packaged for distribution.

Moreover, the market is propelled by the growing incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders. These conditions often require the effective administration of injectable medicines, thus creating the need for efficient fill−finish processes. Additionally, the rising aging population globally contributes to the growing demand for such drugs, as aged individuals are at a greater risk of chronic illnesses.

Furthermore, technological advancements have performed a vital role in shaping the success of the market players. Automation and robotics have advanced production efficiency, accuracy, and sterility, thus reducing the risk of infection and human errors during the fill−finish process. Furthermore, the adoption of single-use systems and aseptic processing approaches has received momentum, as they offer improved flexibility, decreased cross-contamination risks, and faster turnarounds.

The regulatory landscape also impacts the market due to the stringent guidelines and high-quality requirements set by governments to make sure drug products are safe and effective. Thus, compliance with Good Manufacturing Practices (GMP) and the implementation of advanced quality control measures are crucial for fill−finish companies, to meet regulatory requirements and gain market approvals.

Moreover, the fill-finish manufacturing market is becoming increasingly competitive, with numerous players operating globally. All key players offer a wide range of services, such as vial filling, syringe filling, cartridge filling, and lyophilization. Contract manufacturing organizations (CMOs), additionally, play a considerable role, offering such services to major pharmaceutical and biotech corporations, many of which opt to outsource this stage of mass production.

The advancements in technology have revolutionized fill−finish processes, especially in terms of efficiency, accuracy, and quality.

Automation and robotics have helped replace manual labor with sophisticated machines. Automated systems have the ability to take care of a higher volume of production with precision and pace, thus minimizing human mistakes and augmenting productivity. Robots are used for vial filling, stoppering, capping, and labeling, thereby ensuring consistent operations. This not only improves the efficiency of the process but also ensures the sterility and quality of the final product.

Moreover, single-use systems have received traction in the fill-finish manufacturing market due to their several benefits. These systems include disposable components, such as bags, tubing, filters, and connectors, which can only be used for a single manufacturing run, after which they are discarded. Such disposable consumables eliminate the need for extensive cleaning and sterilization procedures, thus decreasing the threat of cross-infection as well as production costs. They, additionally, provide increased flexibility in manufacturing, as they allow for rapid changeovers between different drug products. Moreover, single-use systems help limit the capital investment and maintenance cost associated with traditional, reusable stainless-steel equipment.

Furthermore, aseptic processing strategies ensure the sterility of drug products during the fill−finish process. Advanced aseptic technologies, including isolators and restricted-access barrier systems (RABS), create controlled surroundings that prevent infection. These techniques reduce the risk of microbial growth and keep the integrity of the drug product to the desired level. Aseptic processing techniques also make contributions in advancing product stability and shelf life, which is essential for injectable drugs, especially biologics.

The fill-finish manufacturing market is strongly driven by the increasing demand for injectable drugs. Such drugs can be administered at once into the bloodstream or tissue through injections. They are used for the prevention, treatment, and management of a variety of diseases, including cancers, diabetes, autoimmune issues, and infections.

Such diseases require long-term treatment, often involving the regular administration of injectable medicines. As the occurrence of these sicknesses continues to rise, the demand for parental drugs will also increase, thus contributing to the growth in the demand for fill–finish services.

Furthermore, the enhancements in pharmaceutical R&D efforts have led to the invention and approval of a growing number of parentally administered medicines. Biologics, which can be complicated molecules derived from living assets, are increasingly being utilized for numerous sicknesses, including cancers, rheumatoid arthritis, and multiple sclerosis. Many of those biologics are best administered by injections, thus creating a substantial demand for fill−finish manufacturing services.

Moreover, the aging population is a major contributing factor to the rising demand for injectables. As human beings age, they are more likely to fall prey to chronic diseases, which require extensive treatment. Additionally, older individuals often have difficulty in swallowing drugs or possess reduced gastrointestinal absorption capabilities, which makes injectable medicines popular.

Furthermore, the development of personalized medicines is driving the demand for drugs that are administered via injection. Personalized drug development involves tailoring treatments to patients, based on their genetic makeup and lifestyle. Many personalized remedies, such as targeted treatments for cancer and , require injection. The shift toward personalized medicine, thus, drives the demand for injectable medications and, in turn, for fill–finish services.

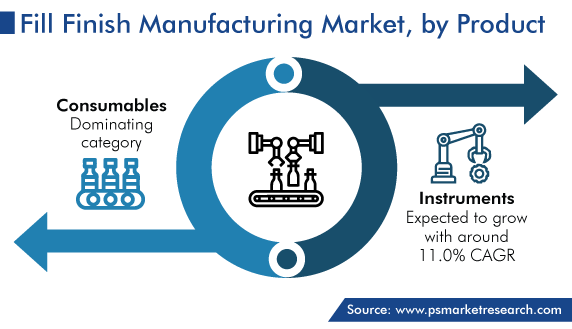

Based on product, the consumables category held the largest share, of 65%, in 2023, and it is further expected to maintain its dominance in the future. Consumables used in the fill−finish process include vials, syringes, cartridges, stoppers, caps, seals, and filters.

They are frequently single-use items, which means they can only be used once and then discarded. This growing trend of single-use consumables in the fill−finish process has received momentum due to the rising need to reduce the risk of cross-infection, achieve faster changeovers between different drug products, and minimize capital investments and maintenance costs. As a result, the demand for consumables has increased substantially, thus driving their fill-finish manufacturing market share.

Additionally, the consumables category benefits from the presence of a wide range of suppliers and producers. Additionally, various companies specializing in manufacturing consumables for the fill−finish process offer customized solutions to meet the particular requirements of pharmaceutical and biotech manufacturers. This competitive landscape ensures a regular supply and promotes innovation in consumables that are more efficient and resistant to infections.

Furthermore, consumables play an important role in maintaining the sterility and quality of injectable drugs. Prefilled vials, syringes, and other consumables are designed to fulfill the strict regulatory and product quality requirements the pharmaceutical industry is subject to. They undergo rigorous testing and validation to make sure that they are compatible with various drug formulations and capable of maintaining the drug's stability and efficacy. The importance of high-quality consumables in ensuring the safety and efficacy of injectable drugs, thus, contributes to their significant market share.

Drive strategic growth with comprehensive market analysis

Asia-Pacific held the largest share in the market, of around 45%, in 2023, and it is further expected to maintain its dominance during the forecast period. This is because the region has a strong presence of pharmaceutical and biotechnology companies.

Countries such as China, India, Japan, and South Korea are key hubs for pharmaceutical production and research & development activities. These countries have well-established pharmaceutical infrastructure, a large number of skilled workers, and favorable government guidelines that support the expansion of associated businesses. Moreover, many pharma and biotech companies from North America and Europe outsource their end-stage production process to firms based in the region on a contractual basis.

Moreover, the growing population and rising healthcare expenditure in the APAC region drive the demand for pharmaceutical products, including those given by injection. Further, the region is witnessing rising earning levels and improving access to healthcare, which are propelling the demand for advanced therapies and injectable drugs.

This fully customizable report gives a detailed analysis of the fill finish manufacturing market, based on all the relevant segments and geographies.

Based on Product

Based on End User

Geographical Analysis

The market for fill–finish manufacturing solutions will reach USD 20.7 billion by 2030.

Consumables are the widest-selling products in the fill–finish manufacturing industry.

Automation, robots, and aseptic processing techniques are trending in the market for fill–finish manufacturing solutions.

The pharmaceutical & biopharmaceutical category dominates the end user segment of the fill–finish manufacturing industry.

APAC is the largest market for fill–finish manufacturing solutions by region.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages