Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 11.2 Billion |

| 2030 Forecast | USD 17.1 Billion |

| Growth Rate(CAGR) | 7.3% |

| Largest Country | Germany |

| Fastest-Growing Country | U.K. |

| Nature of the Market | Fragmented |

Report Code: 12269

Get a Comprehensive Overview of the Europe Mattress Market Report Prepared by P&S Intelligence, Segmented by Product (Innerspring, Memory Foam, Latex), Bed Type (Box Spring, Foundation), Size (Single, Double, Queen, King, Emperor), Distribution Channel (Specialty Stores, Furniture Stores, Direct, Online), End Use (Residential, Commercial), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 11.2 Billion |

| 2030 Forecast | USD 17.1 Billion |

| Growth Rate(CAGR) | 7.3% |

| Largest Country | Germany |

| Fastest-Growing Country | U.K. |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The European mattress market was valued at USD 11.2 billion in 2024, and the market size is predicted to reach USD 17.1 billion by 2030, advancing at a CAGR of 7.3% during 2024–2030. The market is driven by the increasing disposable income, government support for real estate development, surging urbanization rate, and growing healthcare and hospitality sectors.

The demand for hybrid mattresses is rising since the interest of customers is increasing in hygienic and healthy sleep habits. They are made of numerous components, including thermagel, polyurethane foam, spring coils, and latex layers, each of which provides users with specific benefits. Moreover, several manufacturers are infusing materials such as copper and aluminum in bed fillings.

Moreover, consumers are switching to eco-friendly products, owing to which market players are innovating the fabrics used in the outer covering of mattresses. Natural fabrics, including fiber, wool, and bamboo, are now being used to cater to environment-conscious customers. Additionally, advanced heat-reducing fabrics, such as lyocell, are gaining popularity, thus paving the way for further innovations in mattress technology.

Moreover, the preference of customers for tailored beds is one of the major trends in the market. Tempur Sealy International Inc. has begun to provide tailored choices to customers, wherein according to customers’ preferences, the firmness, size, and thickness of the mattress are customized. Since the physical dynamics of each person, including weight and height, are different, customization offers improved support during sleep for different physiques. Additionally, most mattresses of standard sizes do not always perfectly fit in customized frames of beds; therefore, customization is preferred.

The growing healthcare and hospitality sectors are another major driver for the surging demand for mattresses. To capitalize on the growing demand for mattresses from the healthcare industry, various players are launching specialized mattresses to suit multifunctional . The growing disposable income also drives the tourism business; hence, the hospitality sector is positively impacted. With the rise in tourism activities, tailored and premium mattresses are in high demand in the region.

Moreover, after the COVID-19 outbreak, the EU’s tourism industry has rebounded strongly. For instance, the total number of nights spent at tourist accommodations in 2022 was 2.72 billion. This estimate is close to the pre-pandemic level, which was 2.88 billion nights in 2019. This is projected to increase the demand for mattresses in Europe’s hospitality sector over the next 5–6 years.

The demand for eco-friendly mattresses is ballooning. Consumers’ buying habits are changing owing to the increase in their awareness of environmental issues, such as pollution and the emission of volatile organic compounds (VOCs) from polyurethane foam beds. As a result, consumers are now choosing natural, organic, and eco-friendly mattresses made of organic cotton, natural latex, organic wool, hemp, animal hair, and coconut fiber, which have a weaker chemical and ecological impact than conventional ones. Such materials used to make eco-friendly mattresses are, additionally, renewable and biodegradable. Moreover, such products do not have flame retardants, off-gassing, adhesives, and other chemicals that are used in the manufacturing of conventional mattresses and impact the environment negatively.

With the rising need for eco-friendly mattresses, market players are increasingly focusing on producing natural memory foam, natural latex, and natural innerspring mattresses. Some of the companies offering eco-friendly bedding options are DreamCloud Sleep and Astrabeds LLC.

The innerspring category held the largest share, of more than 45%, in 2023, as they are the most popular among Europeans. Furthermore, in the Eastern and Central parts of Europe, innersprings are preferred as they cater to various customers with cooling, bounce, and strong edge support.

In addition, latex mattresses are gaining traction in the region due to the increasing number of people suffering from back pain. Similarly, the demand for memory foam variants is growing fast in the region due to the bed-in-a-box scheme, wherein the bed arrives vacuum-packed in a box, thus easing the delivery process for sellers and the installation process for customers.

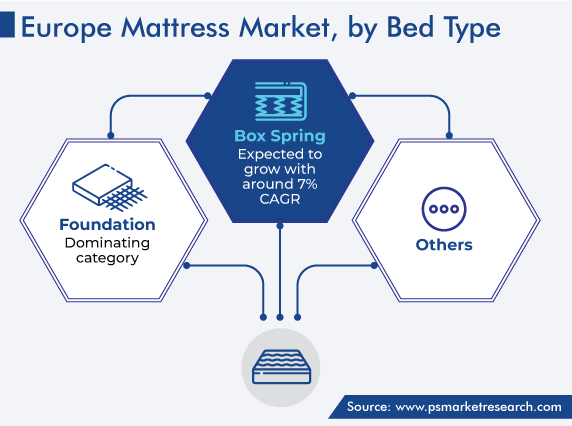

The mattress of a box spring bed typically requires a support or a base, and it aids in elevating the height of beds to a suitable level, absorbing impact to maintain the condition and improving the airflow.

Box spring beds have actual springs fitted in a wooden or metal frame, and they are also available with a layer of foam, for better comfort and air circulation, whereas foundation beds usually have wooden slates and provide evenly distributed support to the mattress.

Earlier, box springs were only compatible with innerspring mattresses, and the foundation alternative was compatible with all other mattress types, such as memory foam, latex, and those made with natural materials. But since the past 10–12 years, the popularity of box springs has increased substantially. The box springs make beds look premium and elevate the comfort level for sleep. Moreover, companies such as Savoir offer premium-quality natural materials and also have box springs in their product offerings for each of their mattresses.

In 2022, approximately 30% of the people were using box springs in the European region, and this trend is expected to continue in the coming years owing to the comfort and premium look of a complete bed.

Drive strategic growth with comprehensive market analysis

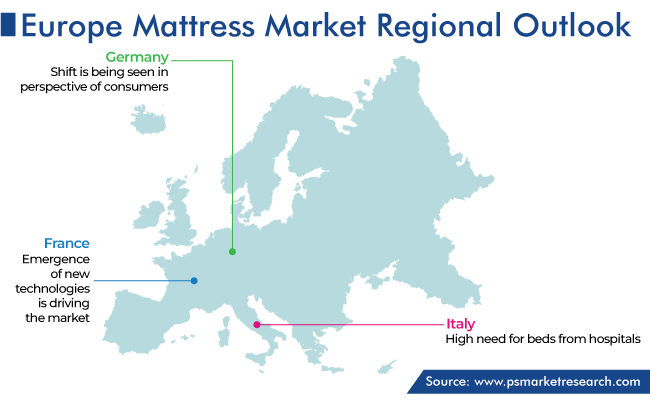

Germany held the largest share, of around 12.5%, in 2023. The demand for these common sleeping aids is increasing in the country due to their heavy usage in commercial facilities. Moreover, one of the vital factors for a customer while buying any product is price. The people of Germany favor quality products available at reasonable prices. A shift is being seen in the perspective of consumers, wherein the key focus is on product functionality and comfort. Moreover, the growth of the hospitality and healthcare sectors is offering a vast opportunity in the German mattress market.

Moreover, in France, bedding products, being a common household furnishing item, have experienced a high demand over the years. New compact products under bed-in-box series are suitable for users and retailers, as they are convenient to ship. The emergence of new technologies, including multifunctional beds with features such as height adjustment and electronic connectivity, is further driving the interest of consumers, especially hospitals, in replacing their older mattresses.

Moreover, in Italy, the recent growth in the demand for mattresses can be attributed to the high need for beds from hospitals during the pandemic. Moreover, advanced bed choices now extend to include models and sleeping systems that offer alternative materials and boast innovative construction methods, as well as integrated controls, which enable consumers to personalize their bedding to their own unique requirements. Thus, the burgeoning personalization trend would drive the market over the forecast period.

Moreover, in the Netherlands, hotels are the main end users in the commercial category, as they change mattresses more often than residential users. Popular hotel chains are focusing on providing excellent comfort and sound sleep, to attract more consumers. Thus, the rising demand from international hotel chains and the increasing penetration of brands offering premium and organic products are likely to boost the market growth in the country.

In Spain, the demand is increasing due to the consumer shift toward large houses and the growing preference for houses with multiple bedrooms. Moreover, since the incidence of problems related to the back and posture is rising due to uncomfortable sleeping surfaces, the adoption of waterbeds, airbeds, and foam-based beds, which provide more comfort through the even distribution of body weight and pressure, is increasing.

This report offers deep insights into the Europe mattress industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Bed Type

Based on Size

Based on Distribution Channel

Based on End Use

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages