Report Code: 12082 | Available Format: PDF | Pages: 135

Europe Automotive Telematics Market Research Report: By Product Type (Embedded, Tethered, Integrated), Service (Safety and Security, Infotainment and Navigation, Remote Diagnostics, Fleet/Asset Management, Insurance Telematics, V2X), Channel (OEMs, Aftermarket), Vehicle Type (Two-Wheeler, Passenger Car, Commercial Vehicle, Construction Machines), Verticals (Transportation and Logistics, Government and Utilities, Travel and Tourism, Construction, Education, Healthcare, Media and Entertainment), Offerings (Hardware, Software, Services) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12082

- Available Format: PDF

- Pages: 135

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Europe Automotive Telematics Market Overview

The European automotive telematics market generated revenue of $7,340.3 million in 2019, and it is expected to progress with a CAGR of 16.1% during the forecast period (2020–2030). The rising demand for improved safety features in vehicles, coupled with the existence of supportive government regulations, is the key factor driving the growth of the European automotive telematics industry.

However, due to the ongoing COVID-19 pandemic, governments of different European countries are taking measures to restrict operations, in order to curb the spread of the disease. The market, including vehicle manufacturers, suppliers, and retailers and technology and service providers, is facing a mass shutdown of production and slump in demand across nearly all European countries. Thus, the manufacturers of automotive telematics products across the region have been witnessing the adverse impact of this crisis, which, in turn, is temporarily hindering the growth of the European automotive telematics market.

Embedded Product Type To Continue Dominating Market in Forecast Period

In 2019, the embedded category generated the highest revenue in the European automotive telematics market, when segmented on the basis of product type. Furthermore, the category is set to continue its domination during the forecast period, primarily owing to the mandates of the European Union (EU) to incorporate the necessary passenger safety solutions in vehicles.

Original Equipment Manufacturers (OEMs) To Be Larger and Faster-Growing Channel during Forecast Period

OEMs were the higher-revenue-generating category in the European automotive telematics market in 2019, when segmented on the basis of channel. The category is also expected to be the fastest-growing one during the forecast period. OEMs are aggressively promoting telematics in low- and medium-end car models, which is naturally being welcomed by consumers.

Passenger Car Category Dominated Market in Historical Period (2014–2019)

Passenger cars led the European automotive telematics market during the historical period, when the market is segmented on the basis of vehicle type. The high sales of passenger cars, coupled with the increasing demand and regulatory mandates for safety and security features, have led to the domination of this category in the market. However, the commercial vehicle category is expected to hold a significant share during the forecast period. The increasing adoption of Next-Generation Telematics Protocol (NGTP) to enhance telematics service delivery and the stringent government regulations for deploying vehicle tracking features in commercial vehicles are benefitting the market in this category.

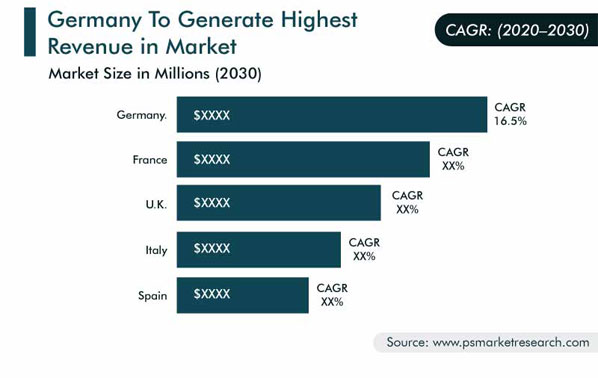

Germany – Highest Revenue Contributor to Industry

Germany held the largest share in the European automotive telematics market in 2019, and it is expected to continue dominating the market in the forecast period. Factors such as technological advancements and the government policies related to vehicle and passenger safety are expected to boost the demand for automotive telematics solutions in the country. Furthermore, the presence of major players such as Webfleet Solutions, Trimble, and Teletrac Navman offering telematics products and services, coupled with the rising awareness among consumers about road safety and increasing adoption of telematics by fleet owners, is propelling the demand for telematics solutions in the country’s market.

Partnerships and Collaborations Are Major Market Trend

One of the major trends being witnessed in the European automotive telematics market is the collaborations and partnerships among system providers, OEMs, telematics solution providers, and other stakeholders. These partnerships are aimed at gaining access to the existing knowledge of the acquired companies and enhancing their portfolio with the addition of an attractive suite of products and services. For instance, in February 2020, Masternaut Ltd., part of Michelin Group, signed a long-term contract with Fraikin SAS, a commercial vehicle fleet service company in Europe. Under this partnership, the former will provide connected fleet management tools and services to Fraikin’s 3,000 online order delivery vehicles in the U.K.

Rising Demand for Improved Safety Features in Vehicles

The increasing demand for improved safety features in vehicles and more-efficient road traffic is the major factor driving the growth of the European automotive telematics market. Road traffic, serious injuries, and deaths are some unfavorable outcomes of road transportation, with human error being one of the biggest causes of road crashes. As per the Community database on Accidents on the Roads in Europe published in 2018, road accidents in EU member countries claimed around 25,600 lives and left more than 1.4 million injured in 2016. Moreover, according to the EU, in 2019, for every million inhabitants, about 51 died in road accidents. This occurrence can be reduced by incorporating different telematics solutions, which provide a safer driving option to vehicle users.

Existence of Supportive Government Regulations

The European government is actively implementing supportive policies related to the use of telematics solutions in vehicles, which is a major driver for the growth of the market. For instance, the European Commission has mandated the installation of the 112-based eCall in-vehicle alarm system in all new M1 and N1 vehicles (passenger cars and light-duty vehicles, respectively) sold in the EU member countries from March 31, 2018, onward. The eCall system is an in-built device that automatically calls emergency services in case of an accident in which one or more of the car's airbags have been triggered. The implementation of this regulation is expected to boost the European automotive telematics market advance.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$7,340.3 Million |

Forecast Period CAGR |

16.1% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional Breakdown, Impact of COVID-19, Market Indicators, Regulatory Landscape, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Product Type, By Service, By Channel, By Vehicle Type, By Verticals, By Offering, By Country |

Market Size of Geographies |

Germany, U.K., Italy, France, Spain, Netherlands, Rest of Europe |

Secondary Sources and References (Partial List) |

Connected Vehicle Trade Association (CVTA), Danish Artificial Intelligence Society (DAIS), European Automobile Manufacturers Association (ACEA), European Union eSafety Forum, Organisation Internationale des Constructeurs d'Automobiles (OICA), Permanent International Association of Road Congresses (PIARC), Telecommunications Industry Association (TIA) |

Explore more about this report - Request free sample

Market Players Are Entering into Partnerships and Collaborations to Attain Competitive Edge

The European automotive telematics market is fragmented in nature, with the presence of market players such as Robert Bosch GmbH, Valeo S.A., Continental AG, MiX Telematics Ltd., and Verizon Communication Inc.

In recent years, players in the industry have undertaken collaborations and partnerships in order to stay ahead of their competitors. For instance:

- In October 2019, HARMAN International Industries Inc. announced that it has entered into a partnership with Volkswagen AG in order to provide its audio solutions to the latter. The partnership was debuted with the global launch of Volkswagen AG’s Golf 8, at an event in the new Hafen 1 location in Wolfsburg, Germany.

- In January 2019, Valeo S.A. entered into a partnership with Mobileye NV with the intention to develop and promote a new autonomous vehicle safety standard. The safety standard would be based on Mobileye NV’s mathematical safety model, responsibility-sensitive safety (RSS), with the aim to encourage widespread adoption.

Some of the Key Players in the European Automotive Telematics Market Include

-

Robert Bosch GmbH

-

Valeo S.A.

-

Continental AG

-

MiX Telematics Ltd.

-

Verizon Communication Inc.

-

AREALCONTROL GmbH

-

FleetGO Group Ltd.

-

MAC & NIL srl

-

frameLOGIC PL

-

Emixis SA

-

ICOM Ltd.

-

iData Kft.

-

CVS Mobile Inc.

-

Mireo d.d.

-

Movildata Internacional SLU

-

Axtech AB

-

SafeFleet

-

Transpoco

-

BigChange Group Limited

-

Loqus Holdings p.l.c.

Europe Automotive Telematics Market Size Breakdown by Segment

The Europe automotive telematics market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Product Type

- Embedded

- Tethered

- Integrated

Based on Service

- Safety and Security

- Infotainment and Navigation

- Remote Diagnostics

- Fleet/Asset Management

- Insurance Telematics

- Vehicle to Everything (V2X)

Based on Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Based on Vehicle Type

- Two-Wheeler

- Passenger Car

- Commercial Vehicle

- Construction Machines

Based on Verticals

- Transportation and Logistics

- Government and Utilities

- Travel and Tourism

- Construction

- Education

- Healthcare

- Media and Entertainment

Based on Offerings

- Hardware

- Software

- Services

Geographical Analysis

- Germany

- U.K.

- Italy

- France

- Spain

- Netherlands

- Rest of Europe

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws