U.S. Endoscope Repair Market Future Prospects

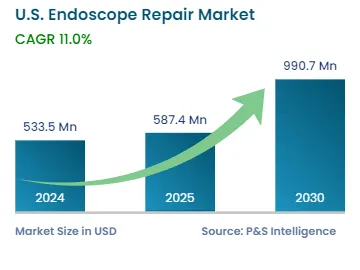

The U.S. endoscope repair market will generate USD 533.5 million revenue in 2024, and it is projected to witness a CAGR of 11.0% during 2025–2030, reaching USD 990.7 million by 2030. This is due to the shift toward minimally invasive procedures, increasing prevalence of gastrointestinal and colorectal diseases, and short life of endoscope components. Moreover, the growing aging population and increasing number of hospitals and clinics in U.S. propel the market