Report Code: 12797 | Available Format: PDF | Pages: 260

ELISpot and FluoroSpot Assay Market Size and Share Analysis by Based on Product Type (Assay Kits, Ancillary Products, Analyzers), Application (Diagnostic, Research), End User (Hospitals and Clinics Labs, Biopharmaceuticals Companies) - Global Industry Demand Forecast to 2030

- Report Code: 12797

- Available Format: PDF

- Pages: 260

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

ELISpot and FluoroSpot Assay Market Overview

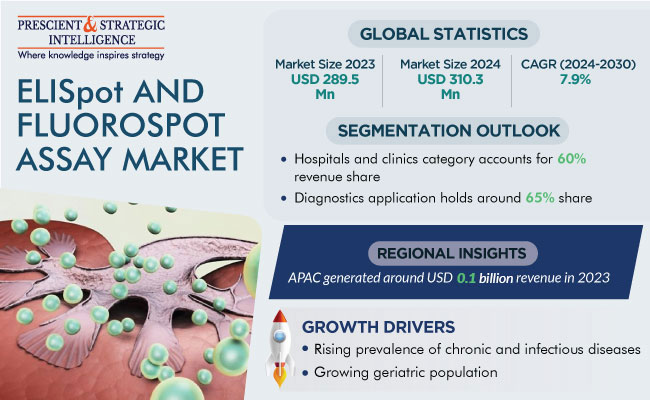

The ELISpot and FluoroSpot assay market generated USD 289.5 million revenue in 2023, and it is projected to witness a CAGR of 7.9% during 2024–2030, to reach USD 490.8 million by 2030.

Some of the factors driving the market are the rising prevalence of chronic and infectious diseases around the globe, especially human immunodeficiency virus (HIV), and the increasing geriatric population. ELISpot and FluoroSpot are diagnosis assays performed for many diseases, such as cancer, infectious disease (including HIV) and, autoimmune diseases. The ELISpot assay clearly detects the number of cytokine-secreting cells with high specificity and sensitivity. These advantages make it an attractive tool to measure the degree of innate and adaptive immune responses.

According to the Centers for Disease Control and Prevention (CDC)’s National Center for Emerging and Zoonotic Infectious Diseases (NCEZID), the risk of infectious diseases is increasing continuously because of climate change. Valley fever, Lyme disease, and West Nile disease are some of the infectious diseases that are rising in prevalence and spreading to new regions of the U.S. This is a result of the milder winters, warmer summers, and fewer days with frost.

Moreover, according to the WHO, globally, of every 100 hospitalized patients at any given time, 7 in developed and 10 in developing countries, acquire at least one healthcare-associated infection. Thus, the growing count of patients with infectious diseases is predicted to result in a high demand for immunoassay instruments globally.

The coronavirus disease (COVID-19) is an infectious disease caused by the SARS-CoV-2 virus. When the virus enters the body, the immune system produces antibodies in the form of T-cells, which can be measured by the ELISpot assay. Older patients with diseases such as cancer, chronic respiratory diseases, and cardiovascular disease are more prone to this serious illness.

Another key disease that is propelling the demand for the associated detection kits is HIV. COVID-19 has contributed in increasing the incidence of severe HIV infection because of HIV diagnosis service disruptions during the lockdowns and slowing response of public health systems. According to the WHO, 650,000 people died from HIV-related causes and 1.5 million people acquired HIV in 2021. As of now, there is no cure for HIV infection, which makes an accurate and prompt diagnosis even more important. Moreover, HIV destroys the immune system, which was a key reason for such a high burden of COVID-19 infection.

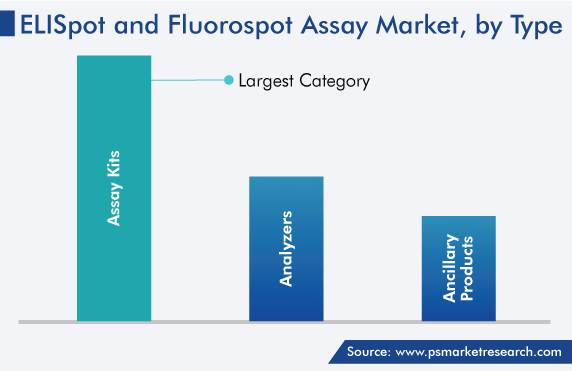

By type, Assay Kits Hold Largest Share

Assay kits are expected to hold the largest share during the forecast period due to the rising occurrence of infectious diseases and chronic diseases, along with the advancement in assay kits. The ELISpot assay is also used to check the effectiveness of vaccines on immune mediators, such as pro-inflammatory mediators, interferons, and interleukins. Further, the key advantage of this assay is that it is economical and shows results in short time.

Hospital and Clinics Are Largest End Users

Hospitals and clinics will hold the largest market share, of 60%, in 2023. This is because most patients prefer hospitals and clinics for the diagnosis of diseases, especially in developing countries. Moreover, with the sustained government efforts, the number of such medical centers continues to rise around the world, which, in turn, drives the demand for all kinds of diagnostic and therapeutic equipment at these places.

To address the enormous demand for biopharmaceuticals, there is a rising focus on research and, in turn, the related expenditure. The ability of biopharmaceuticals to treat diseases that were previously incurable has led to the release of such new medications in the market. Thus, it is expected that the market under investigation would grow throughout the given time frame.

ELISpot is a method for monitoring human immune response and accurately counting cytokine-secreting T cells. Thus, ELISpot assay is widely applied in biomedical research for vaccine development, organ transplantation, and research on cancer and autoimmune diseases.

Diagnostic Application Dominates Market due to Increasing Disease Prevalence

The diagnostics application category held the largest revenue share, of 65%, in 2023. This is because of the increasing geriatric population and rising chronic and infectious disease burden. COVID-19 is the major infectious disease that is contributing to the dominance of diagnostics applications in the current scenario.

The research application category is also projected to grow at a rapid rate due to the increasing prevalence of COVID-19 and its newly found variants, which is propelling research around the world.

| Report Attribute | Details |

Market Size in 2023 |

USD 289.5 Million |

Market Size in 2024 |

USD 310.3 Million |

Revenue Forecast in 2030 |

USD 490.8 Million |

Growth Rate |

7.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type, By Application, By End User; By Region |

Explore more about this report - Request free sample

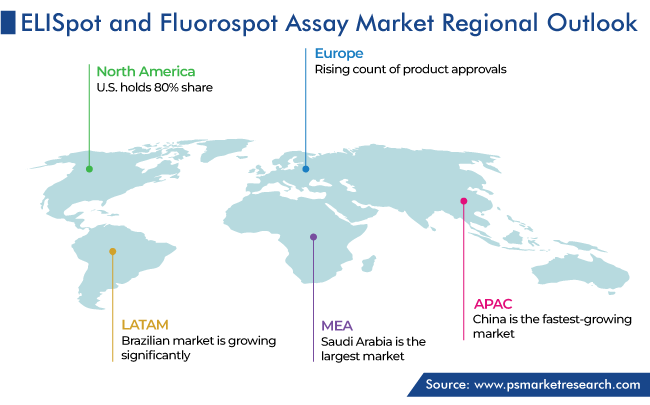

North America Holds Largest Share

The ELISpot and FluoroSpot market in North America held the largest revenue share, of 55%, in 2023. According to the U.S. Census Bureau, around 56 million adults aged 65 and above stay in the U.S. and account for about 16.9% of the national population. Further, it is projected that there will be more than 73 million older adults by the end of 2030, meaning more than 1 in 5 people will be older. The total number of adults aged 65 and older is projected to rise to 85.7 million by 2050 and account for about 22% of the overall population of the country.

Europe was the second-largest market for ELISpot and FluoroSpot assays in 2023. The market growth in the European region is driven by the rising count of product approvals, increasing consumer awareness on early and effective disease detection, strengthening focus of companies on geographical expansion, such as their acquisition of medium-scale local manufacturers to improve their product portfolios, and the expanding R&D operations.

Further, in the APAC region, China is expected to be the fastest-growing ELISpot and FluoroSpot assay market. This is because of the increasing prevalence of cancer and other chronic diseases, rising focus on R&D activities, growing patient population, and surging healthcare expenditure.

Mergers and Acquisition Strategies Key Focus for Market Players

Companies are focusing on mergers and acquisitions to boost their growth.

For instance, in October 2021, Abcam, a provider of tools and reagents, completed the strategic acquisition of BioVision Inc. to expand its kit and assay portfolios.

Abcam’s portfolio is improved by the integration of BioVision, which also brings scale to assist the former's biochemical assay and cellular assay businesses. After the successful acquisition, Abcam now has access to BioVision’s product line, capabilities, and 70-person manufacturing and development team. Through Abcam’s global commercialization network, the scientific community around the world will have access to these biochemical and cell-based assays.

Companies Are also Engaging in Geographical Expansions

In April 2022, Agilex Biolabs, a bioanalytical laboratory in Australia, announced its expansion in the U.S. In addition to opening a new laboratory in South Australia to study large-molecule therapies, Agilex Biolabs has established a San Diego branch. Modern bioanalytical methods and apparatus, such as EliSPOT/FluoroSPOT multi-spot reader for the detection of molecules with high sensitivity and digital droplet quantitative RT-PCR analysis, respectively, are available at the new facility.

FDA Approvals for T-Cell Select Test for Automated Tuberculosis Testing

In September 2022, the FDA approved a new cell kit developed by Oxford Immunotec to decrease the time needed in labs and minimize the cost for testing for tuberculosis. According to the chief executive officer of PerkinElmer’s Oxford Immunotec division, automation brings the ELISA and ELISPOT laboratory workflows closer, thus allowing more laboratories to conduct T-SPOT assays.

Recommendations on ELISpot Assay Validation by Global CRO Council in Bioanalysis (GCC)

Results of a survey were recently provided to the GCC in order to determine any recommendation needed. This survey received 52 responses, out of which 35 confirmed that they perform the ELISpot assay at their organization. ELISpot assays are not only utilized for research purposes, as 76% of the ELISpot tests are used for pre-clinical or clinical regulated bioanalyses. Further, more than 50% of the labs that deploy regulated ELISpot assays follow good clinical practice or good laboratory practice regulations. Additionally, the College of American Pathologists laboratories use regulated ELISpot assays.

Some of players in ELISpot and FluoroSpot Assay Market Are:

- OXFORD IMMUNOTEC

- Cellular Technology Limited

- Mabtech AB

- Becton, Dickinson and Company

- Bio-Techne Corporation

Market Size Breakdown by Segment

This report offers deep insights into the ELISpot and FluoroSpot assay market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product Type

- Assay Kits

- Ancillary Products

- Analyzers

Based on Application

- Diagnostic

- Research

Based on End User

- Hospitals and Clinics Labs

- Biopharmaceuticals Companies

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for ELISpot and FluoroSpot assays generated USD 289.5 million in 2023.

The ELISpot and FluoroSpot assay industry is growing with the increasing burden of infectious and chronic diseases, rising vaccine development activities, and burgeoning geriatric population.

Diagnostic application dominates the market for ELISpot and FluoroSpot assays.

Assay kit sales generate the highest ELISpot and FluroSpot assay industry revenue.

North America is the largest market for ELISpot and FluoroSpot assays.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws