Report Code: 11759 | Available Format: PDF | Pages: 310

Electric Vehicle Component Market Size and Share Analysis by Component (Battery Pack, Motor, Controller, EVSE, DC-DC Converter, High-Voltage Cable, PDM, Thermal Management System, VCIM), End Use (OEM, Aftermarket) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 11759

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Electric Vehicle Component Market Growth

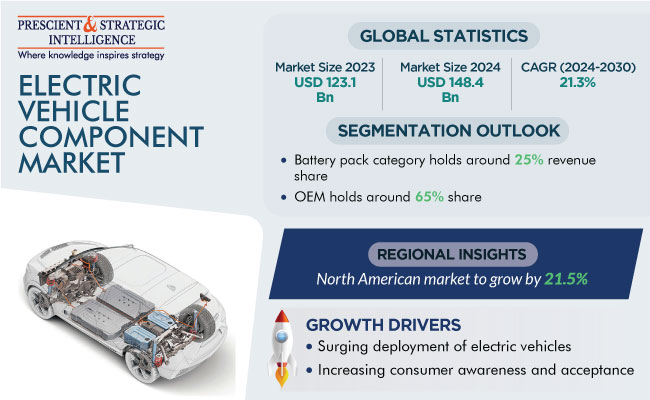

The electric vehicle component market size stood at USD 123.1 billion in 2023, and it is expected to reach USD 472.7 billion by 2030, exhibiting a CAGR of 21.3% during 2024–2030. This is due to the surging deployment of electric vehicles, which is being driven by many factors such as the portrayal of stringent fuel economy and emission norms, government incentives, and the improvement of charging infrastructure.

Moreover, several key industry players have been involved in various strategies, such as collaborations, product launches, and mergers and acquisitions, to drive the market growth. For instance, in January 2023, PTT Synergy Group Bhd announced the signing of a memorandum of understanding with Sany International Developing (M) Sdn Bhd and Root Cloud Technology (Singapore) Pvt. Ltd. The partnership aims to dwell into the collaboration within the electric vehicle sector. As stated in their fillings with Bursa Malaysia, all parties focused on delivering comprehensive EVs and their solutions. Thus, this will drive the demand for electric battery leasing services as well as the provision for renewable energy, which will lead to sustainable logistics to gear toward achieving zero carbon emissions.

Furthermore, companies are involved in several business areas, including the establishment of EV charging stations, the provision of EV battery charging and maintenance services, the assembly and sale of EV trucks, and the development of EV tracking, monitoring, and management software and systems. Additionally, they are involved in EV battery leasing and post-lease services, carbon management for EV truck fleets, and the exploration of alternative energy sources.

Moreover, after the pandemic, the sales of electronic vehicles have also seen a spike. Therefore, more and more players are seeking to focus on the development of electric parts and components. For instance, in January 2023, Sensata Technologies, an esteemed global industrial technology company specializing in sensor solutions, showcased its pioneering innovations designed to bolster vehicle electrification and an extensive range of essential sensors and electrical protection solutions tailored for both automotive and heavy vehicle off-road applications.

In addition, the rising cost of fuel and the growing concern of people toward environmental pollution drive the demand for zero-emission vehicles and lead to a huge increment in the manufacturing of high-quality electric vehicles. This in conclusion leads to the growth of the electric vehicle component market. Additionally, due to economies of scale, the cost of batteries keeps on decreasing. This is because the production volume of batteries has increased and ongoing research and development efforts enhance battery durability and recyclability. Thus, these factors boost the sales of EVs.

Moreover, consumer awareness and acceptance played an important role in the growth of the market, as consumers have become more aware and informed about electronic vehicles and their benefits. Also, word-of-mouth recommendations and positive experiences shared by early adopters have influenced others to embrace electric vehicles. Additionally, the development of charging stations and infrastructure, including a fast-charging network, has made electric vehicles more appealing to consumers by ensuring convenient and accessible charging options.

Battery Pack Dominates the Market

Based on component, the battery pack category holds the largest revenue share in the market. This is because battery packs are essential components of electric vehicles, as these are primary components for energy storage for EVs. Also, their prices are decreasing, due to the ongoing research in the battery pack segment by automakers and battery pack manufacturers, and the increasing investment in this segment.

In addition, with the increased competition, more and more automakers are entering the market in this category, with a great amount of innovation and improvements in battery technology. Also, with the help of government support in many forms, such as regulatory measures, subsidies, and incentives, developments in battery packs are rising.

Furthermore, the controller category accounts for a significant share of the market. This is because it is responsible for managing power flow between the battery and the motor, which makes it a crucial element for EVs. Moreover, the DC-DC converter category is expected to witness noteworthy growth in the market in the coming years, as it plays a vital role in controlling high-voltage battery systems and other onboard accessories.

Also, the high-voltage cable category records significant growth. This is because these cables are responsible for transmitting electrical power from the battery pack to the electric motor and other critical components of EVs and play a crucial role in the overall performance of the vehicles.

| Report Attribute | Details |

Market Size in 2023 |

USD 123.1 Billion |

Market Size in 2024 |

USD 148.4 Billion |

Revenue Forecast in 2030 |

USD 472.7 Billion |

Growth Rate |

21.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By End Use; By Region |

Explore more about this report - Request free sample

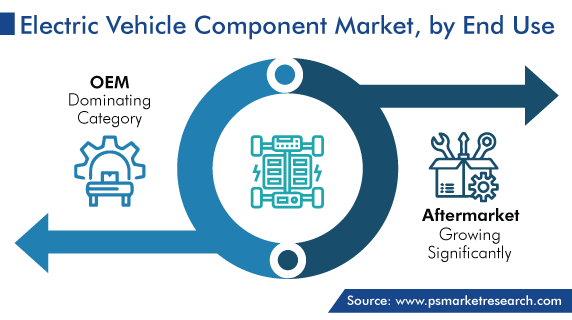

Original Equipment Manufacturers (OEMs) Are the Largest End Users

Based on end user, the original equipment manufacturer (OEM) category registers the largest revenue share in the market. This is because OEMs offer several types of EVs, from small hatchbacks to high-end sedans including Tesla Model 3. The availability of such a wide range of products equally attracts a large number of customers, resulting in huge demand for EV components. Furthermore, due to the increasing demand for electric vehicles, the need for EV components is rising from automakers to develop new EVs.

Moreover, the major trends and policy attempts, such as IEA’s stated policies, in the electric vehicle market promote the sales of EVs. Thus, OEMs are expected to embrace electric mobility more widely, and they have announced intentions to increase the number of available models and boost the production of electric light-duty vehicles.

In addition, there is a significant surge in aftermarket sales of components, as heightened interest in electric vehicles has opened a vast number of opportunities in this market. From start-ups to government organizations to multinational companies, each and every entity is looking forward to investing heavily in the technological innovation of electronic vehicles and their components. Recently, many technologies such as swappable batteries are trending in the electric vehicle market.

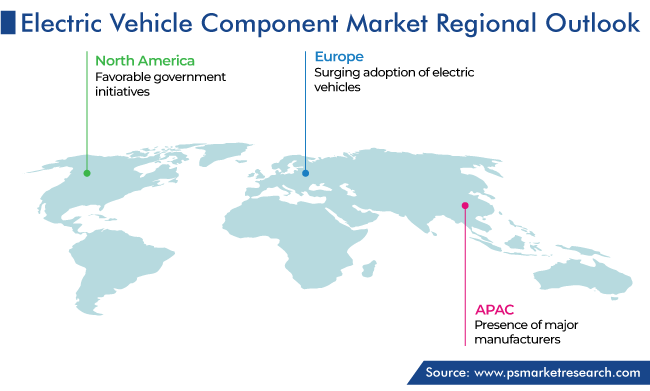

APAC Generates the Highest Revenue

Globally, the Asia-Pacific market holds the largest revenue share and it is also expected to witness the highest growth rate in the coming years. This is due to the availability of raw materials and low-cost labor, the presence of major manufacturers, and an increase in the sales of electric vehicles in countries like China and India, owing to several factors such as government subsidiaries and the presence of large domestic production facilities, hence leading to the increased demand for electronic vehicle components in the region. Also, the advancement of new technology in this component sector, along with the increased manufacturing, production of electric vehicles, and development of infrastructure, expands the market to a larger extent.

In addition, this region is the home to many growing economies. The governments of these emerging economies have recognized the potential of the electric vehicle sector, which ultimately led to the growth of the electric vehicle component market, and hence they have taken several initiatives to attract major OEMs to manufacture EVs in their countries.

Along with that, the transportation sector in APAC accounts for hazardous emissions of around 14% of overall pollution, therefore countries in this region are planning to go electric in order to reduce emissions in the coming years. China which is the leader in the market for electric vehicle components has already set its goals for the future to grow significantly. Similarly, countries like South Korea and India also are coming forward to contribute more to this sector.

Moreover, the North American electric vehicle component market is forecasted to grow significantly at a compound annual growth rate, of 21.5%, during the forecast period. The regional market is dominated by the U.S., which is responsible for over 70% of the total revenue. This is ascribed to favorable government initiatives, tax rebate programs to promote electric vehicle adoption and usage, and the presence of major players, such as Tesla, General Motors Company, Toyota Motor Corporation, Nissan Motor Company, and Volkswagen AG, in the region.

Furthermore, the European market is expected to grow significantly in the future years. This can be attributed to the surging adoption of electric vehicles, due to the rising environmental pollution in the region.

Some of the Top EV Component Companies:

- Robert Bosch GmbH

- Contemporary Amperex Technology Co. Ltd.

- Panasonic Corp.

- Siemens AG

- DENSO Corp.

- LG Chem Ltd.

- Tesla Inc.

- Hitachi Ltd.

- ABB Ltd.

- BYD Co. Ltd.

Market Size Breakdown by Segment

This report offers deep insights into the electric vehicle component market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

- Battery Pack

- Battery cell

- Battery management system (BMS)

- Battery thermal management system

- Others

- Motor

- Controller

- Electric Vehicle Supply Equipment (EVSE)

- DC–DC Converter

- High-Voltage Cable

- Power Distribution Module (PDM)

- Thermal Management System

- Vehicle Interface Control Module (VCIM)

Based on End Use

- Original Equipment Manufacturer (OEM)

- Aftermarket

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The electric vehicle component market size stood at USD 123.1 billion in 2023.

During 2024–2030, the growth rate of the electric vehicle component market will be around 21.3%.

Original equipment manufacturer (OEM) is the largest end user in the electric vehicle component market.

The major drivers of the electric vehicle component market include the surging manufacturing of high-quality electric vehicles and the increasing sales of EVs, due to the rising cost of fuel, the growing concern of people toward environmental pollution, and the enactment of stringent emission and fuel economy norms.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws