Report Code: 11777 | Available Format: PDF | Pages: 138

Electric Vehicle Communication Controller Market Research Report: By System (EVCC, SECC), Charging Type (Conductive, Inductive), Geographical Outlook (U.S., Canada, France, Germany, Netherlands, Norway, Portugal, Sweden, U.K., Australia, China, India, Japan, South Korea, Brazil, Mexico) - Global Industry Trends and Growth Forecast to 2024

- Report Code: 11777

- Available Format: PDF

- Pages: 138

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

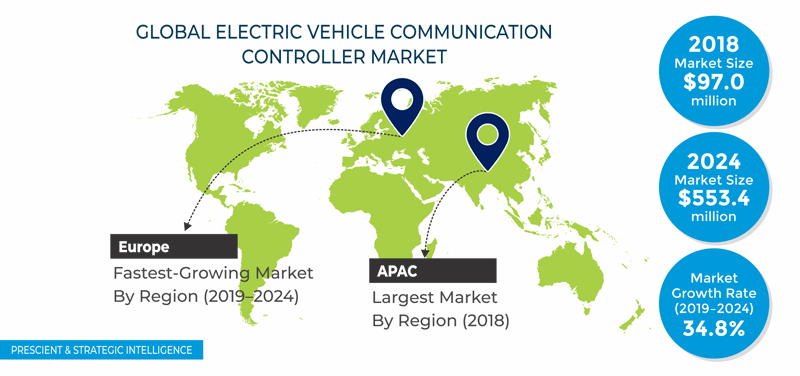

The electric vehicle communication controller market size was $97.0 million in 2018, and it is expected to reach $553.4 million by 2024, exhibiting a CAGR of 34.8% during 2019–2024.

Globally, the European market will showcase the fastest growth in the near future due to the rising adoption of electric vehicles (EVs) and charging stations in the region. In 2018, 384,000 plug-in electric cars were sold in Europe, which was a jump of nearly 33% from 2017. Out of these 384,000, 182,760 were plug-in hybrid electric cars, and 201,280 were battery electric cars.

Market Dynamics

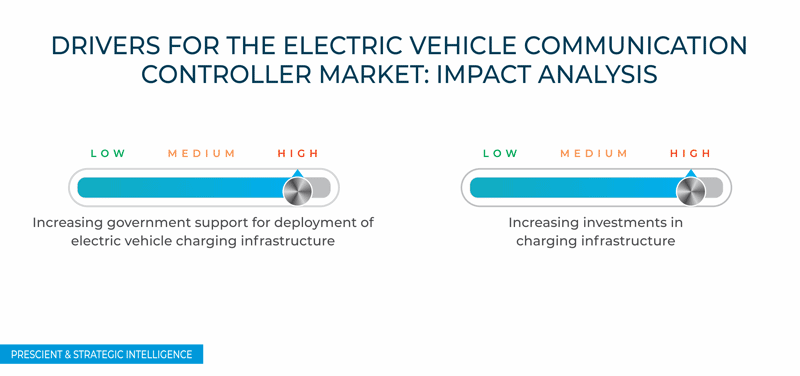

The electric vehicle communication controller industry is thriving on the increasing investments in the charging infrastructure. EV producers and charging component providers are making huge investments in the development of smart and efficient battery charging systems. These companies are taking advantage of the government provisions to manufacture high-capacity and efficient EVs and charging stations.

For instance, in October 2018, Chargefox Pty. Ltd. received a $15-million investment from various investors, which included a $6-million grant from the Australian Renewable Energy Agency (ARENA). The company will use this money to install rapid EV chargers across Australia, which will, in turn, amplify the requirement for EV communication controllers in the country.

The electric vehicle communication controller market players can gain from the development of novel technologies, such as vehicle-to-grid (V2G), for two-way management of the electricity demand. The rising adoption of EVs and spurring demand for easy access to charging ports have encouraged the players to focus on the development of advanced charging stations. Market players are working toward the development of the V2G charging technology because connecting multiple vehicles to the charging infrastructure increases the load on the grid. Here, the V2G technology helps by taking power from the battery of idling EVs and feeding it to the grid.

Segmentation Analysis

The electric vehicle communication controller (EVCC) category, within the system segment, held the larger share in 2018, in terms of volume, due to the mounting sales of plug-in electric vehicles (PEVs). A total of 2.1 million PEVs were sold around the world in 2018, which was a spike of 64% from 2017.

This can be credited to the soaring production and surging government support, in the form of incentives and subsidies, to consumers for the purchase of these EVs. For example, buyers of PHEVs and battery electric vehicles (BEVs) in the U.S. get a tax credit of $2,500–$7,500, depending on the vehicle size and battery capacity.

The EVCC category of the electric vehicle communication controller market is further classified by technology and by vehicle type. The BEV category, on the basis of technology, is projected to attain the faster growth in the coming years. This can be owed to the stringent environmental norms and supportive government policies encouraging the adoption of BEVs.

The conductive category accounted for the larger volume share under the charging type segment in 2018. This can be ascribed to the low cost and early adoption of conductive chargers for personal vehicles across the globe.

Global Scenario

In 2018, the Asia-Pacific (APAC) market for electric vehicle communication controllers generated the highest revenue owing to the high adoption of EVs and charging stations in China. The growing environmental concerns, increasing government support, in terms of subsidies for EVs and related charging stations, and declining total cost of ownership (TCO) are supporting the market growth in the region.

Competitive Landscape

Major players operating in the global electric vehicle communication controller market includes LG Innotek Co. Ltd., Tesla Inc., BYD Co. Ltd., Schneider Electric SE, ABB Ltd., Ficosa International SA, Robert Bosch GmbH, Vector Informatik GmbH, Siemens AG, and Mitsubishi Electric Corporation.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the global electric vehicle communication controller market?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from the investment perspective?

- What is the competitiveness of the major players operating in the market?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws