Report Code: 12046 | Available Format: PDF | Pages: 300

E-Mobility Services Market Research Report: By Service Type (Two-Wheeler Sharing, Ride-Hailing, Carsharing, Car Rental), Vehicle Type (Two-Wheeler, Passenger Car), Commuting Pattern (Daily Commuting, Last-Mile Connectivity ,Occasional Commuting), End Use (Personal, Business)- Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12046

- Available Format: PDF

- Pages: 300

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

E Mobility Service Market Overview

The global electric mobility services market size was $3,189.8 million in 2019. Furthermore, the market is expected to advance with a CAGR of 40.7% in the forecast period (2020–2030). The comparatively lower cost of ownership attached to the electric fleet, coupled with the increasing environmental concerns across the world, acts as the major driver for the growth of the market.

However, the ongoing COVID-19 pandemic across the world is expected to have a great negative impact on different aspects of society, including the automobile and transportation sector. Before the COVID-19 outbreak, 2020 was a crucial year for many shared mobility startups, which were preparing new market offerings and planning to expand their services. The sector, especially micromobility, had enticed a huge entrepreneurial and user interest. Moreover, in recent years, it had received great support from public policies and associated infrastructure. But, with the outbreak, the picture for all the stakeholders in the e-mobility services market has become grim.

COVID-19 recession is the first mobility-targeting recession in the world, and numerous concerns exist about the financial viability of some of these services. In the short term, there would be substantial shifts away from mobility and public transit, to reduce the risk of infection. This has majorly been due to a significant increase in the preference for remote working, which is being witnessed currently. The notion of reducing travel, in general, could, however, remain a longer-term consideration, in the context of climate change.

Segmentation Analysis

Two-Wheeler Sharing Was Largest Service Type in Market

The two-wheeler sharing category dominated the electric mobility services market during the historical period (2014–2019), on the basis of service type. This is attributed to the fact that apart from being a convenient, economical, and faster mode of commuting, electric two-wheeler sharing services also cater to the demand for last-mile traveling across the world. The two-wheeler sharing category is further subcategorized into bike sharing, kick scooter sharing, and scooter sharing. Among them, the bike sharing category held the largest market share in 2019, owing to the massive usage of such services in China.

Passenger Car Is Expected to be Faster-Growing Category in Market

During the forecast period, the passenger car category is projected to advance with the higher growth rate in the e-mobility services market, when segmented on the basis of vehicle type. This is buoyed by the expected increase in the demand for ride-hailing, carsharing, and car rental services during the forecast period. The passenger car category is further bifurcated into battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV). Among the two, the BEV category accounted for the larger share in the market in 2019, attributed to the supportive government initiatives, in the form of incentives and policy formulations, which encourage the adoption of these vehicles, and the operational benefits BEVsoffer over PHEVs.

Last-Mile Commuting Was Largest Commuting Pattern Category in Industry

In the historical period, last-mile commuting was the largest category in the electric mobility services market, on the basis of commuting pattern. Furthermore, the category is expected to remain the largest market in the forecast period. This is because e-mobility services provide convenience to users, to travel even the shortest distances, from mass transit spots, such as bus stop and metro station, to their destination, thus eliminating the need to walk down that distance.

Geographical Outlook

Personal End-Use Category Generated Higher Revenue in Market

Commuting services utilized for personal use accounted for the larger share in the e-mobility services market, when segmented on the basis of end use, during the historical period. Furthermore, the category is projected to remain the larger market in the forecast period. The dominance of the category is attributed to the fact that the majority of the customers use e-mobility services for personal work, which may include going to work, running errands, such as grocery shopping, and undertaking short trips, such as escorting someone to the airport.

Asia-Pacific (APAC) – Largest Regional Market in Industry

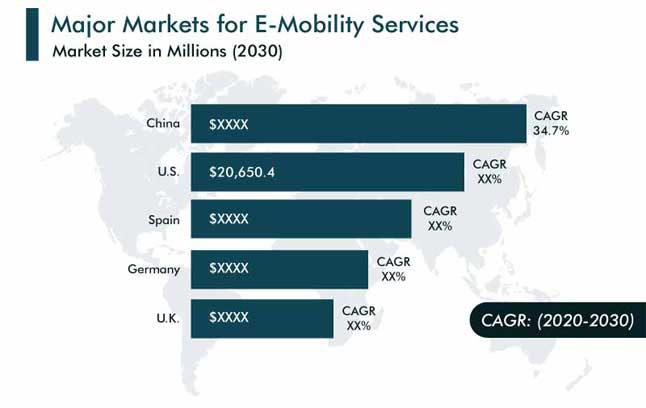

Geographically, APAC dominated the e-mobility services market during the historical period, and it is projected to remain the dominant region during the forecast period. Of all countries around the world, China continues to remain the largest market for e-mobility services. In recent years, several cities across China increased the usage of electric vehicles (EVs) across various service platforms, to promote a greener environment. With continuous support from the government, in the form of policies and incentives, the market in China is expected to demonstrate robust growth in the near future.

Latin America, Middle East, and Africa (LAMEA) –Fastest-Growing Regional Market

The LAMEA e-mobility services market is still at a nascent stage; however, the penetration of EVs and related charging infrastructure is increasing at a significant rate in the region, which is why LAMEAis offering a lucrative growth opportunity to the market. Mexico and Brazil are the major markets for e-mobility services in the region. The increasing adoption of EVs, especially in shared mobility, in Mexico and Brazil can be mainly attributed to the government incentives being given to combat pollution in large cities. The region is also witnessing the entry of some significant players, including Ekar FZ LLC and Localiza Rent a Car SA, in the market, which would give the region a promising growth prospect in the forecast period.

Trends & Drivers

Entry of Automotive Original Equipment Manufacturers (OEMs) in E-Mobility Business is Key Trend in Market

A key trend being witnessed in the market is the increasing involvement of several automobile manufacturers in the shared mobility business. For instance, Toyota Motor Corp., at the Consumer Electronics Show (CES) in 2018, announced that it plans to enter the shared mobility business. Furthermore, the company was working toward the introduction of the Autono-MaaS service, a mobility service which would be provided via self-driving EV, the e-Palette, by mid-2020. Thus, the forward integration undertaken by automobile giants would enable them to deploy their own fleet in mobility services, which, in turn, will optimize their operational cost and provide them with a competitive edge in the market.

Low Total Cost of OwnershipIs Driving E-Mobility Services Market

One of the major drivers propelling the adoption of EVs in public shared mobility services is the lower cost of ownership attached with these vehicles. The cost of charging the vehicle is much lower than the cost of fossil fuel for conventional vehicles. Moreover, the cost of maintenance is also lower for EV as compared to conventional vehicles, owing to the relative simplicity of the electric drivetrain, which consists of 70% fewer moving parts than an internal combustion engine (ICE) vehicle. The lower total cost of ownership of EVs facilitates their adoption in public shared mobility services, thus becoming a major driver for the growth of the e-mobility services market.

Increasing Environmental Concerns Are Fueling E-Mobility Services Market

The accelerating rate of environmental degradation due to the emission of greenhouse gases is raising the level of concern. This is one of the major drivers for the growth of the e-mobility services market. The increasing amount of exhaust fumes released from vehicles is one of the main contributing factors toward the degradation of the air quality, which has become a major concern for governments around the world.

E-mobility is an effective antidote in this regard, to curb the impact of pollution on the environment. The increased use of EVs in public shared mobility services would reduce the number of conventional privately owned vehicles on roads, which, in turn, will minimize the amount of carbon dioxide (CO2) emitted into the environment. Additionally, countries across the world are increasing their efforts to raise awareness about a sustainable transportation system. In an effort toward this, several countries have started deploying low- and zero-emission transport systems. Vehicles offered for mobility services under these systems are mostly powered by electric motors, which conform to environmental standards and ensure an emission-free ecosystem, which, in turn, contributes to the growth of the market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,189.8 million |

Forecast Period CAGR |

40.7% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Impact of COVID-19 on the Market, Company Share Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Service Type, Vehicle Type, Commuting Pattern, End Use, Geographies |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Netherlands, Switzerland, Japan, China, India, Australia, South Korea, Singapore, Brazil, Mexico, Saudi Arabia, South Africa |

Secondary Sources and References (Partial List) |

Alternative and Renewable Fuel and Vehicle Technology Program (ARFVTP), American Public Transportation Association (APTA), China Association of Automobile Manufacturers (CAAM), Federation of European Motorcyclists' Associations (FEMA), International Energy Agency (IEA), Light Electric Vehicle Association (LEVA), Mobility as a Service Alliance (MaaS Alliance) |

Explore more about this report - Request free sample

Market Players Launching New Services to Attain Competitive Edge

The global e-mobility services market is highly fragmented in nature, with the presence of a large number of established players as well as startups across the world, including Neutron Holdings Inc., Bird Rides Inc., Donkey Republic ApS, Cityscoot SAS, and ANI Technologies Pvt. Ltd.

In recent times, players in the e-mobility services market have launched a number of new services, in order to stay ahead of their competitors. For instance:

- In February 2020, Hertz UAE began to electrify its car rental fleet with hybrid electric cars from Toyota Motor Co. The company further intends to convert 30% of its fleet into hybrid electric vehicles (HEV), by adding different hybrid models provided by Toyota Motor Co., Volvo AB, and FCA US LLC (Jeep).

- In June 2019, Volkswagen AG launched an all-electric carsharing service, WeShare, in Berlin, Germany. The company deployed 1,500 e-Golf vehicles for carsharing purposes. Moreover, the company announced that 500 e-up! vehicles will be added to the fleet in the beginning of 2020, and the first units of Volkswagen’s new full-electric ID.3 will be further added to the fleet, when it is introduced in mid-2020.

- In May 2019, Zagster Inc. announced the launch of its first e-bike sharing program for commercial properties in the U.S. In partnership with GenZe, an electric micromobility startup, the service is being offered at Glendale Plaza, in California. E-bikes will only be provided to tenants, at no cost.

Some of the Key Players in the E-Mobility Services Market include:

-

Neutron Holdings Inc.

-

Bird Rides Inc.

-

Donkey Republic ApS

-

Cityscoot SAS

-

ANI Technologies Pvt. Ltd.

-

Uber Technologies Inc.

-

Beijing Xiaoju Technology Co. Ltd.

-

Grab Holdings Inc.

-

car2go N.A. LLC

-

Enterprise Holdings Inc.

E-Mobility Services Market Size Breakdown by Segment

The research offers market size of the global e-mobility services market for the period 2014–2030.

Based on Service Type

- Two-Wheeler Sharing

- Bike sharing

- Kick scooter sharing

- Scooter sharing

- Ride-Hailing

- Economic

- Executive

- Luxury

- Carsharing

- Peer-to-peer (P2P)

- Round-trip

- One-way

- Car Rental

- Local

- Airport

- Outstation

Based on Vehicle Type

- Two-Wheeler

- Passenger Car

- Battery electric vehicle (BEV)

- Plug-in hybrid electric vehicle (PHEV)

Based on Commuting Pattern

- Daily Commuting

- Last-Mile Connectivity

- Occasional Commuting

Based on End Use

- Personal

- Business

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Netherlands

- APAC

- China

- Japan

- India

- Australia

- LAMEA

- Brazil

- Mexico

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws