Market Statistics

| Study Period | 2019 - 2030 |

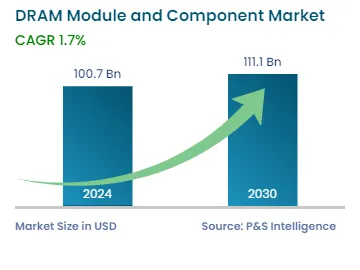

| 2024 Market Size | USD 100.7 Billion |

| 2030 Forecast | USD 111.1 Billion |

| Growth Rate(CAGR) | 1.7% |

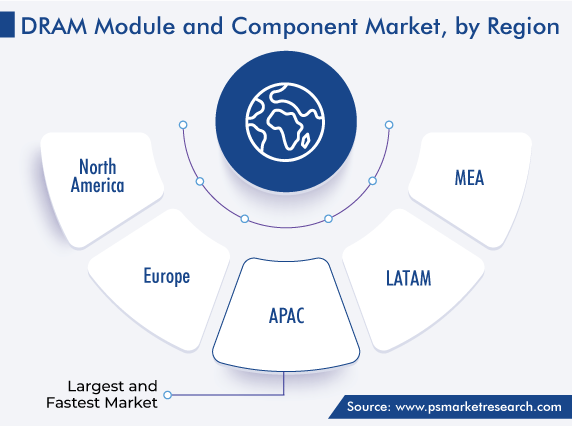

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12575

Get a Comprehensive Overview of the DRAM Module and Component Market Report Prepared by P&S Intelligence, Segmented by Type (SDRAM, RDRAM, DDR SDRAM), Memory (Up to 1GB, 2GB, 3-4GB, 6-8GB, Above 8GB), Industry (Consumer Electronics, Mobile Devices, Servers, Computers, Automotive), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 100.7 Billion |

| 2030 Forecast | USD 111.1 Billion |

| Growth Rate(CAGR) | 1.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The DRAM module and component market stood at USD 100.7 billion in 2024, and it is expected to grow at a compound annual growth rate of 1.7% between 2024 and 2030, to reach USD 111.1 billion by 2030.

The fostering adoption of IoT and 5G technologies, rising number of data centers, and increasing utilization of DRAM modules and components in various industries are the key factors that are expected to propel the market growth.

The memory of the computer, laptop, smartphone, and similar devices is a critical component. It enables the device to function and retain the data as per the requirements of the user. DRAM is a type of RAM, i.e., random access memory, which is volatile and stores data temporarily in real time. It enables the processor to have faster access to data and several applications simultaneously than flash storage.

The above 8 GB category in the memory segment is likely to hold the largest share and grow at a CAGR of 1.6% during the projection period. It can be attributed to the eternal requirement for a high memory capacity for the storage, processing, and transmission of high-volume data.

The rate at which data is being generated has been witnessing tremendous growth over the past 10 years. The processing of heavy applications has also become quite common these days due to the introduction of various advanced technological products and solutions. This brings about the need to regularly update them, for efficient functioning.

High-definition images and video qualities, such as the 4K, require higher memories for storage and processing. Moreover, the editing of videos and other media becomes convenient if optimum memory is available in computers and laptops, which is propelling the demand for DRAMs with over 8GB memory.

Additionally, the category of 6–8 GB is expected to hold a significant market share and grow at a CAGR of around 1.3% in the coming years, owing to the cost-effectiveness of this variant over other variants with higher memory capacities. Additionally, to ensure absolute performance and compatibility with the latest applications and technologies, an optimal memory capacity is required in the systems.

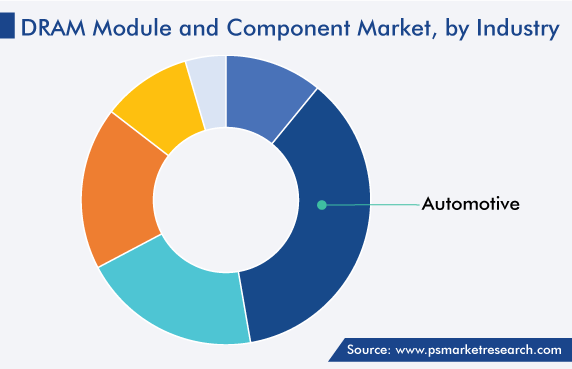

The automobile category in the by industry segment is expected to grow at a CAGR of more than 1.6% during the projection period. The growth can be attributed to the introduction of advanced digital devices and applications for enhanced performance and user experience improvement, by enabling a more-comfortable and safer drive. The growing adoption of IoT devices, automation solutions, and remote access applications in vehicles would essentially contribute in propelling the market growth.

DRAM components aid in the efficient running of applications specifically meant for automation, reliability, safety, and the overall performance enhancement in automobiles. Automobiles have been witnessing constant innovations, and they are now using a wide range of computer applications, software, and sensors to enhance their performance and deliver a better experience to users. DRAM with a varied memory capacity starting from 2 GB can be deployed in automobiles. Moreover, electronics companies have started to get certifications for their advanced memory products that are used for automotive safety and performance.

Drive strategic growth with comprehensive market analysis

APAC held the largest market share in the past, and it is likely to retain its position in the coming years. Moreover, it is expected to grow at a CAGR of 1.6% in the coming years, attributed to the expansion of the semiconductor industry and the growth in the demand for smart electronic devices from highly populous countries, such as China and India.

With the fast pace at which the adoption of smart digital devices in APAC countries is progressing, a stimulation of the demand for DRAM modules and components, due to their ability to cater to the memory requirements of those devices, is expected.

Moreover, the Government of India is taking initiatives to become a global hub for semiconductor production and an alternative to China. In this regard, a special scheme, which would provide incentives to the manufacturers of semiconductors, as well as display products, has been announced. Thus, the growth in the production of semiconductors would propel the advance of the DRAM module and component market in the coming years.

Moreover, the majority of these modules and components are manufactured in the APAC region, in countries such as South Korea and China, which export them to other countries.

Based on Type

Based on Memory

Based on Industry

Geographical Analysis

The size of the market for DRAM modules and components was USD 100.7 billion in 2024.

The DRAM module and component industry is driven by the adoption of advanced computer technologies.

The automotive category dominates the industry segment of the market for DRAM modules and components.

The DRAM module and component industry 2030 value will be USD 111.1 billion.

APAC is the largest market for DRAM modules and components.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages