Report Code: 12831 | Available Format: PDF | Pages: 330

Digital Diabetes Management Market Size and Share Analysis by Offering (Devices, Application, Services), Device Type (Handheld, Wearable), End User (Home Care Settings, Hospitals & Specialty Diabetes Clinics, Academic & Research Institutes) - Global Industry Demand Forecast to 2030

- Report Code: 12831

- Available Format: PDF

- Pages: 330

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Digital Diabetes Management Market Overview

The global digital diabetes management market revenue for 2023 has been estimated at USD 17.8 billion, which is expected to observe a compound annual growth rate of 13.7% during 2024–2030, to reach USD 43.4 billion by 2030.

According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, and this number is expected to reach 643 million by 2030 and 783 million by 2045.

The need for better diabetes care solutions has grown due to the rising prevalence of this polygenic disease. The growing geriatric population and government initiatives are also predicted to drive the market expansion, as would the increasing R&D expenditure and aggressive tactics by top competitors, such as product launches. Moreover, due to the advancements in technology, people can now access flexible options, including smartphone-based diabetes checkups and regular glucose monitoring.

Among the other key drivers for the market expansion are the rising acceptance of cloud-based enterprise solutions and the increasing use of connected devices and apps. in this regard, the technical developments in the remote patient monitoring sector are the prominent digital diabetes management market trends. Additionally, in the coming years, the market will grow due to the rising adoption of continuous blood glucose monitoring devices.

The surge in the incidence of polygenic disease cases worldwide is attributed to the rapidly changing lifestyles, visible in the excessive smoking and alcohol intake. Moreover, one of the major causes of diabetes is obesity. With the rising number of obese people and the overall increasing awareness of this issue, the market for diet and weight control apps is showing enormous promise. Thus, with the ongoing developments in digital technologies, a wide range of advancements in this area are expected in the near future.

Technological Advancement Will Support Market Growth

In the last few decades, the medical device sector has witnessed significant technological advancements in the field of diabetes care, including focused sensor-based CGM technology, closed-loop systems, implantable digital diabetes management devices, and wearable and smartphone-based health trackers. Technologically advanced methods have enhanced diabetes management and made it possible to achieve tight control, while allowing for a more-flexible daily schedule and diet for patients, kids, and their families. Prefilled syringes, insulin pumps, and glucose meters with test strips are a few examples of digital diabetes management products that are competitive with their analog counterparts.

Essentially, the worldwide digital diabetes management market is growing with the enhancements in the treatment and detection approaches for hyperglycemia. For instance, in many smart insulin pens, an i-Sens adaptor is used to measure the insulin level, which also informs people of the correct angle of injection, to optimize hormone administration. Moreover, many connected insulin pens use the Mallya (formerly known as Easylog) adapter. It provides patients with the correct dose and enables them to keep track of the injections administered in order to treat hyperglycemia, thus reducing hospital visits and helping users save money. Similarly, a sensor-equipped cap, InsulCheck, is integrated into insulin pens to track the temperature and usage of the hormone.

Rising Deployment of Artificial Intelligence

With the continuous developments in artificial intelligence (AI), its application in the diagnosis and treatment of diabetes has expanded and evolved. By using machine learning algorithms to support predictive models for assessing the risk of diabetes and its complications, AI makes it possible to continuously and easily monitor a patient's symptoms and biomarkers remotely. This approach also allows for automatic retinal screening for the detection of diabetes mellitus and offers clinical diagnosis support.

For instance, Livongo Health uses a big-data-enabled strategy to assist people in managing their health and enhancing their lifestyles. Many people use the company’s blood pressure cuffs and blood glucose meters, which gather data and transfer it to a bigger database. The organization makes use of this data to produce thorough insights for the benefit of patients.

| Report Attribute | Details |

Market Size in 2023 |

USD 17.8 Billion |

Market Size in 2024 |

USD 20.1 Billion |

Revenue Forecast in 2030 |

USD 43.4 Billion |

Growth Rate |

13.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Offering; By Device Type; By End User; By Region |

Explore more about this report - Request free sample

Continuous Glucose Monitoring (CGM) Systems Category Dominates Market

CGM systems hold the largest revenue share, of 40%, in 2023, because of their advanced features, such as connectivity with smart gadgets, which act as display devices. Additionally, these systems can be configured to notify patients in a specific way when certain glucose thresholds are achieved.

During the forecast period, the smart insulin pens category is expected to expand at the highest CAGR, of 14.3%, due to the increase in the launch of products integrated with AI. Essentially, the market is being driven the strong concentration of a number of players on developing smart insulin pens to boost their presence. For instance, in March 2022, Novo Nordisk introduced intelligent insulin pens, named NovoPen Echo Plus and NovoPen 6, in the U.K. The devices, which automatically track the amount of insulin administered during every injection, are now available to diabetic patients getting treatment through the NHS.

Furthermore, diabetes & blood glucose tracking applications will show significant growth during the projection timeframe, due to the rampant adoption of smartphones and advanced wearables and rise in the geriatric population. Additionally, the developments in the IT infrastructure are leading to the higher accuracy of healthcare management applications. Additionally, companies are focusing on ensuring better patient compliance, which is why they are creating better apps with more features than ever.

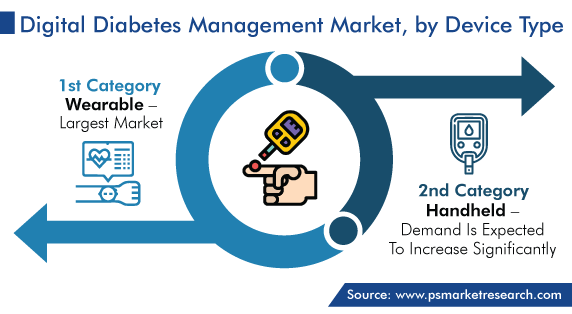

Wearable Devices Category Holds Larger Market Share

Based on type, wearable devices are expected to hold the bigger global digital diabetes management market share, of around 70%, in 2030, because CGM systems have received regulatory approvals and smart insulin patches are undergoing continuous technological advancements. Additionally, most CGM systems provide blood glucose readings along with additional data and alert patients if their blood glucose levels rise beyond or fall below pre-set levels. Thus, as these systems offer patients added convenience, their adoption continues to rise around the world.

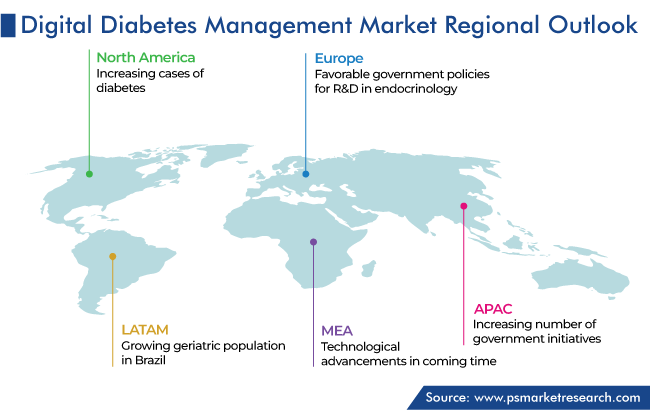

North America Is Prime Revenue Contributor

North America has captured the largest revenue share of the market, of around 55%, in 2023. This is attributed to the increasing cases of diabetes, technical advancements in solutions that help manage this endocrine condition using digital technologies, rising usage of smartphones, and high adoption of cloud-based solutions by healthcare professionals for maintaining the health records of patients. Moreover, the rise in the focus of governments and healthcare providers on improving the quality of treatments drive the market.

North America also dominates the global market because of the advancement in its healthcare infrastructure, rise in the use of connected diabetes management apps, and increase in the popularity of remote online coaching services. Additionally, the recent approvals to many digital blood glucose monitoring devices propel their sale. For instance, in January 2022, Insulet Corporation reported that the U.S. FDA has given its clearance to Omnipod 5 automated insulin delivery system, which works with the Dexcom G6 continuous glucose monitoring system. The Omnipod 5 mobile app, which has an integrated SmartBolus calculator, makes it easier to monitor patients remotely and send their data to their healthcare providers.

Moreover, Europe is the second-largest market globally due to the favorable government policies for research and development in endocrinology, availability of sufficient funding from the government, rise in number of HIT startups, surge in the prevalence of diabetes, enhancements in the healthcare infrastructure, and adoption of advanced medical technologies.

Furthermore, companies are collaborating for making the tracking and management of this condition more convenient and effective. For instance, in September 2019, Medtronic plc and Novo Nordisk signed an agreement to integrate data from Novo Nordisk’s insulin pumps and Medtronic’s continuous monitoring systems.

Top Providers of Digital Diabetes Management Solutions Are

- Abbott Laboratories

- Medtronic plc

- Sanofi S.A.

- DexCom Inc.

- DarioHealth Corp.

- F. Hoffmann-La Roche Ltd

Market Size Breakdown by Segment

This report offers deep insights into the digital diabetes management market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Offering

- Devices

- Smart glucose meters

- Continuous glucose monitoring (CGM) systems

- Smart insulin pens

- Smart insulin pumps/closed-loop pumps & smart insulin patches

- Application

- Diabetes & blood glucose tracking apps

- Obesity & diet management apps

- Data management software & platforms

- Services

Based on Device Type

- Handheld

- Wearable

Based on End User

- Home Care Settings

- Hospitals & Specialty Diabetes Clinics

- Academic & Research Institutes

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The digital diabetes management industry will have a CAGR of 13.7% during 2024–2030?

Remote patient monitoring is trending in the market for digital diabetes management solutions.

Continuous glucose monitoring systems holds the largest digital diabetes management industry share.

In 2030, homecare settings will dominate the market for digital diabetes management solutions.

The digital diabetes management industry is propelled by the rising incidence of diabetes and advancements in the healthcare IT space.

North America is the largest market for digital diabetes management solutions, Europe the second-largest, and APAC the fastest-growing.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws