Report Code: 11676 | Available Format: PDF | Pages: 242

Diesel Genset Market Research Report: By Power Requirement (Prime Power, Backup Power), Mobility (Stationary, Portable), Power Rating (7-14 kVA, 15-24 kVA, 25-44 kVA, 45-69 kVA, 70-99 kVA, 100-149 kVA, 150-199 kVA, 200-299 kVA, 300-399 kVA, 400-499 kVA, 500 kVA and Above), Application (Commercial, Industrial, Residential) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 11676

- Available Format: PDF

- Pages: 242

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Diesel Genset Market Overview

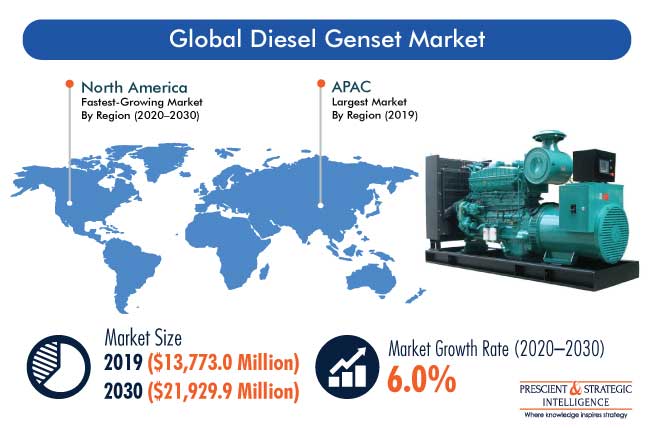

The global diesel genset market stood $13,773.0 million in 2019, which is set to witness a CAGR of 6.0% during the forecast period (2020–2030). This growth is majorly attributed to the rising demand for emergency and stationary power backup across various end-use industries, namely marine, oil & gas, manufacturing, healthcare, construction, telecom, and automotive.

COVID-19 has created a negative impact on the global diesel genset market, with the shutdown of commercial and industrial establishments in order to curtail the spread of the disease. In view of this, the production of diesel gensets has temporarily been put on hold in several countries.

Backup Power Was Larger Power Requirement Category owing to Rising Installation of Diesel Gensets for Backup Power

In 2019, the backup power category accounted for the larger size in the diesel gensets industry, on the basis of power requirement. This was because of the rising installations of diesel gensets as a backup power source in individual houses, housing societies, data centers, manufacturing plants, retail outlets, telecom towers, and hospitality establishments. The demand for these gensets is further expected to rise during the forecast period on account of the increase in construction projects and manufacturing operations worldwide.

Stationary Diesel Gensets To Be Faster-Growing Mobility Category owing to Increasing Demand from Industries

The stationary diesel genset category, based on mobility, is projected to witness the faster growth in the global diesel genset market during the forecast period. This can be attributed to the high-volume demand arising for stationary diesel gensets for manufacturing operations in emerging economies, such as China, India, Brazil, and Indonesia. Furthermore, the rapid urbanization is leading to the increasing demand for all types of products, thus impelling industries to adopt stationary diesel gensets to provide a continuous supply of electricity and ensure uninterrupted operations.

Commercial Is Highest Revenue-Generating Application Category owing to Increasing Demand from Shops, Office Complexes, Malls, and Theatres

Historically (2014–2019), the commercial classification held the largest share in the application segmentation. This can be mainly attributed to the high adoption rate of diesel gensets in commercial areas, such as offices and retail establishments, including shopping malls, for both prime and backup power. The demand for such systems from the commercial sector is further expected to rise with the growing number of retail establishments, particularly in developing countries.

15–24 kVA Is Largest Power Rating Category, by volume owing to Rising Low-to-Medium Power Requirement across Sectors

15–24 kilovolt-Ampere (kVA) was the largest power rating category in the diesel genset market in 2019, in terms of sales volume. This is attributable to the high-volume demand for these gensets from residential facilities, small industrial complexes, commercial offices, retail outlets, and telecom towers. Power outage issues in emerging economies, such as China, India, Brazil, Thailand, and Indonesia, coupled with the aging transmission infrastructure, are further expected to propel the demand for these gensets for meeting the prime and auxiliary power requirements.

Asia-Pacific (APAC) — Largest Regional Market owing to Growing Construction Sector

During the historical period (2014–2019), APAC held the largest diesel genset market share due to the wide adoption of these systems in the commercial and residential sectors, increase in construction activities, and high demand for low-power diesel gensets at telecom towers. Furthermore, diesel gensets are majorly employed as an auxiliary power source in China and India by all kinds of users: residential, industrial, and commercial.

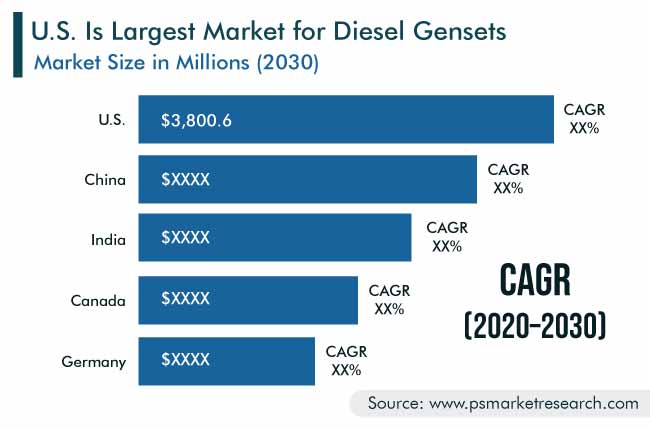

North America —Most Lucrative Regional Market owing to Rising Power Failure Instances and Increasing Power Demand

One of the major factors responsible for driving the market growth in the region is the increasing instances of power outages due to extreme weather conditions, including hurricanes. During such instances, diesel gensets provide power to a growing number of commercial and housing projects. As per reports by the International Monetary Fund (IMF), the U.S. and Canada are both expected to witness considerable growth in their gross domestic product (GDP) owing to the low mortgage rates, increasing population, and growing construction sector, as developers continue to shift their focus to suburban regions. The growth in the construction of residential and commercial facilities will continue to boost the demand for diesel gensets for meeting primary and backup power requirements during the construction and tenant occupancy of these facilities.

Strategic Initiatives among Players Are Key Market Trend

In recent years, major manufacturers in the diesel genset market have been fairly active, taking various steps to enhance their product portfolio, expand their customer reach, develop their brand identity in foreign markets, and ensure aftermarket services for their products. For instance, in February 2019, Cummins Inc. launched the new ignition-protected 7.5-kilowatt (kW) Onan marine generator in the U.S. The genset is designed to supply auxiliary power to marine vessels with gasoline propulsion engines. Hence, the market is expected to witness more such strategic activities during the forecast period, in the light of the growing market competition and increasing efforts of the companies to venture into higher-potential markets.

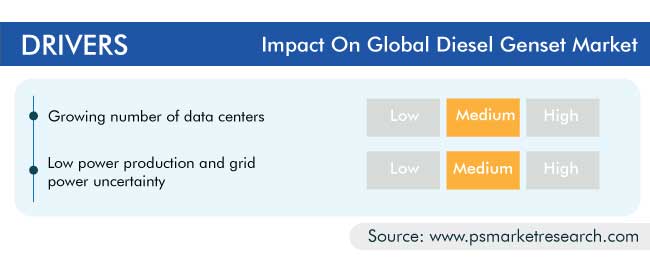

Number of Data Centers Growing owing to Hyperscale Creation and Consumption of Data

The increasing creation and consumption of data globally have led to the development of data centers as supportive infrastructure to store and analyze the data and provide related services. Furthermore, the advancements in technology, such as autonomous cars and intelligent personal assistants, and the growing application of the internet of things (IoT), cloud computing, and digital currencies are expected to create the need for more data centers, which, in turn, would drive the demand for diesel gensets to serve auxiliary and prime power requirements at these installations. Diesel gensets are employed to power critical and non-critical components, such as servers, backup controls, heating, ventilation, and air conditioning (HVAC) systems, and security systems, thereby contributing to the growth of the market.

Low Power Production and Grid Power Uncertainties Highlighting Necessity of Diesel Gensets

Several African nations, including Nigeria and Ghana, have an extremely weak power infrastructure, characterized by a high base power deficit and significant power transmission losses, which, in turn, are responsible for the high demand for alternative power sources, such as diesel gensets, in these countries. Additionally, from a global standpoint, factors such as the old infrastructure and insufficient capex for the development and maintenance of grids have led to an erratic power supply and, in certain countries, low power production. One of the best solutions to the conundrum of low power supply is the development of off-grid solutions or use of power generation equipment, such as diesel and gas gensets.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$13,773.0 Million |

Forecast Period CAGR |

6.0% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies’ Strategic Developments, Key Offerings of Key Players, Company Profiling |

Market Size by Segments |

By Power Requirement, By Mobility, By Power Rating, By Application, By Region |

Market Size of Geographies |

U.S., Canada, U.K., France, Germany, Russia, Italy, Spain, Poland, India, China, Philippines, Vietnam, Indonesia, Brazil, Mexico, Argentina, Turkey, Saudi Arabia, U.A.E., Nigeria, Algeria |

Secondary Sources and References (Partial List) |

Arab Petroleum Investment Corporation, Bureau of Indian Standards, European Commission, Federal Ministry of Finance, Budget and National Planning, Genset Manufacturers’ Association, India Diesel Engine Manufacturers’ Association, International Council on Clean Transportation, International Monetary Fund, International Renewable Energy Agency |

Explore more about this report - Request free sample

Product Launch Is Key Market Growth Strategy of Players

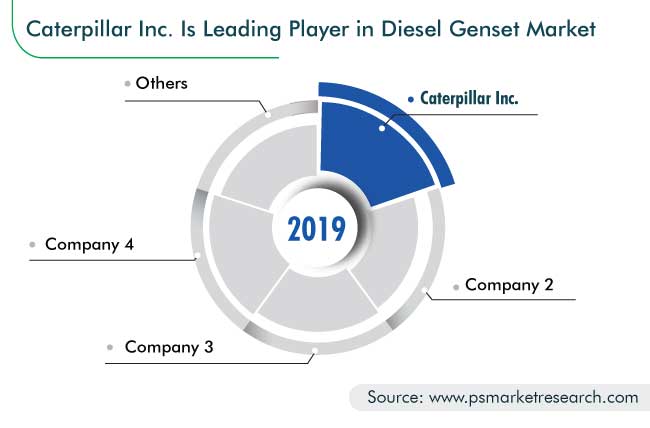

The global diesel genset market is consolidated in nature, with the presence of players such as Caterpillar Inc., Cummins Inc., Kohler Co., Generac Holdings Inc., General Electric Company, Denyo Co. Ltd., AB Volvo, Kirloskar Oil Engines Limited, Atlas Copco AB, Siemens AG, Yanmar Holdings Co. Ltd., Doosan Corporation, and Mitsubishi Heavy Industries Ltd.

In recent years, players in the industry have launched a number of new and advanced products in order to stay ahead of their competitors. For instance:

- In September 2018, Perkins, a subsidiary of Caterpillar Inc., announced the launch of its six-cylinder, 23-liter 4006 electronic engine. The genset is electronically controlled, compatible with the Perkins EST diagnostic tool, and generates 750 kVA of prime power. The product, manufactured at the company’s Aurangabad facility in Maharashtra, is serving a vast customer base in the Indian market.

- In March 2018, Mahindra South Africa, a subsidiary of Mahindra Powerol Ltd., launched a new range of 250 and 320 kVA diesel gensets at the BAUMA CONEXPO 2018, South Africa. The gensets are powered by Mahindra’s mPower series engines. With the addition of these generators, the company now offers a range of 10 kVA to 320 kVA gensets.

Key Players in Global Diesel Genset Market include:

-

Caterpillar Inc.

-

Cummins Inc.

-

Kohler Co.

-

Generac Holdings Inc.

-

General Electric Company

-

Denyo Co. Ltd.

-

AB Volvo

-

Kirloskar Oil Engines Limited

-

Atlas Copco AB

-

Siemens AG

Diesel Genset Market Size Breakdown by Segment

The global diesel genset market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Power Requirement

- Prime Power

- Backup Power

Based on Mobility

- Stationary

- Portable

Based on Power Rating

- 7–14 kVA

- 15–24 kVA

- 25–44 kVA

- 45–69 kVA

- 70–99 kVA

- 100–149 kVA

- 150–199 kVA

- 200–299 kVA

- 300–399 kVA

- 400–499 kVA

- 500 kVA and Above

Based on Application

- Commercial

- By user

- Retail establishments

- Commercial offices

- Telecom towers

- Hospitals

- Hotels

- By user

- Industrial

- By user

- Manufacturing

- Energy and power

- By user

- Residential

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Russia

- Italy

- Spain

- Poland

- Asia-Pacific

- India

- China

- Philippines

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Turkey

- Saudi Arabia

- U.A.E.

- Nigeria

- Algeria

In 2030, the diesel genset market will value $21,929.9 million.

Commercial is the largest category within the application segment of the diesel genset industry, in value terms.

APAC is the largest, while North America will be the fastest-growing diesel genset market.

The rapid construction of data centers and uncertain grid power supply in developing countries are propelling the diesel genset industry.

The majority of diesel genset market players are launching new generators for a larger industry share.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws