Report Code: 10344 | Available Format: PDF | Pages: 462

Diagnostic Imaging Systems Market Research Report: By Product (X-Ray Imaging Systems, MRI Systems, Ultrasound Systems, CT Scanners, Nuclear Imaging Systems), Application (Cardiology, Oncology, Neurology, Orthopedics, Urology, Dentistry, Ophthalmology, Obstetrics/Gynecology), End User (Diagnostic Imaging Centers, Hospital)- Industry Dynamics and Competitive Benchmarking till 2030

- Report Code: 10344

- Available Format: PDF

- Pages: 462

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Diagnostic Imaging Systems Market Overview

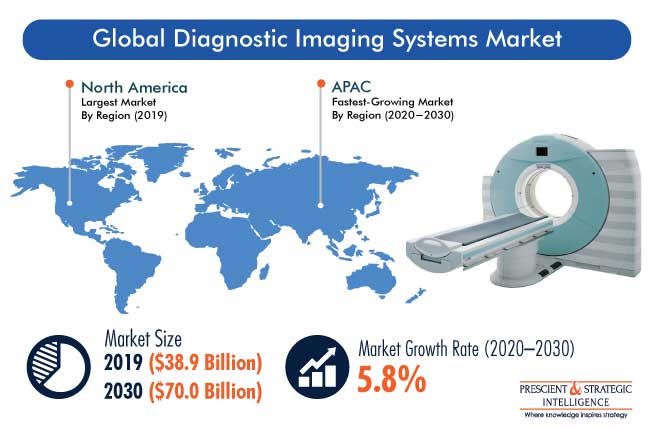

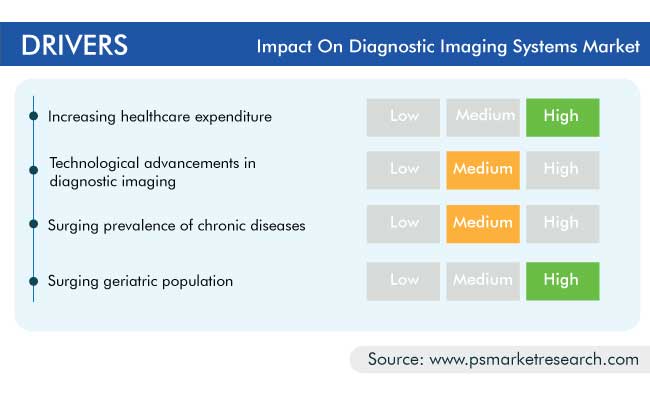

The global diagnostic imaging systems market was valued at $38.9 billion in 2019, and it is expected to witness a CAGR of 5.8% during the forecast period (2020–2030). The key factors responsible for the growth of the market are the increasing number of diagnostic imaging centers, rising healthcare expenditure, growing need for diagnostic imaging procedures, surging prevalence of chronic diseases, technological advancements in diagnostic imaging, and booming geriatric population.

During the COVID-19 pandemic, lockdowns and partial factory closures have negatively impacted the manufacturing facilities in the industry. Although the high usage of diagnostic procedures for infected and critical patients has resulted in a significant demand for the systems, the reduced trading activities have impacted product sales. Further, as COVID-19 continues to spread around the world, key market players have taken drastic steps to contain its spread and ensure employees’ safety. Due to this, slower growth in the market has been observed in the year 2020.

Demand for Nuclear Imaging Systems Is Supported by Their Usage In Cancer Treatment

The nuclear imaging systems category is expected to witness the fastest growth in the global diagnostic imaging systems market during the forecast period, based on product. This would primarily be due to the increasing adoption of nuclear imaging systems for cancer staging and treatment, due to the rising prevalence of the said disease.

Higher Application Areas Is Bolstering The Demand For X-Ray Imaging Products

The digital category dominated the X-ray systems market in 2019, based on technology. Additionally, the category is expected to witness the faster growth in the market during the forecast period. This is mainly attributed to the easy data storage, faster image generation and sharing, and ease of use over traditional analog systems, which have made the digital variants vastly popular in the major economies.

Similarly, the portable category is expected to be the faster growing in the X-ray systems market during the forecast period, based on portability. This would mainly be due to their higher convenience in terms of mobility and application and the rapid adoption of the point-of-care approach in disease diagnostics.

Higher Image Resolution At Lower Cost is Supporting The Demand of Magnetic Resonance Imaging (MRI) Products

The closed category dominated the MRI systems market in 2019, and it is further expected to dominate the market in the coming years, based on type. This is mainly attributed to the widespread adoption of these systems due to their higher image resolution.

Similarly, the mid-field category contributed the highest revenue in 2019 to the MRI systems market, based on field strength. This was primarily due to the low surface absorption rate (SAR), clearer images, and cost-effectiveness of mid-field MRI systems.

Fetal Organ Visualization and Heavy Deployment of Trolley/Cart-Based Systems Has Supported The Rising Adoption Of Ultrasound Systems

The 3D and 4D category are expected to witness the fastest growth in the ultrasound systems market during the forecast period, on the basis of technology. This is credited to the high adoption of 3D and 4D ultrasound systems for fetal organ visualization, for the detection of birth defects and accurate imaging of the heart.

Similarly, the trolley/cart-based category is expected to dominate the ultrasound systems market during the forecast period, based on portability. This would mainly be due to the high usage of trolley/cart-based ultrasound equipment at diagnostic centers and hospitals and wide availability of such systems in the market.

Superior Imaging Features Are Boosting The Demand for Computed Tomography (CT) Scanners

High-slice was the highest-revenue-generating category in the CT scanners market during the historical period (2014–2019), based on slice. This is mainly attributed to the superior-quality images produced by high-slice CT scanners, which help in better diagnosis, thereby resulting in the high adoption of such systems.

Diagnostic Imaging Systems Are Largely Used for Cardiological Applications

The cardiological category is expected to dominate the diagnostic imaging systems market in 2030, based on application, mainly due to the high prevalence of cardiovascular diseases (CVDs) across the world. According to the World Health Organization (WHO), CVDs are the leading cause of death (17.9 million annual fatalities) worldwide, mainly due to risk factors such as smoking, obesity, hypertension, and diabetes.

Increasing Patient Footfall Is Leading To High Revenues From Diagnostic Imaging Centers

The diagnostic imaging centers category held the largest share in the market in 2019, based on end-user. This is mainly attributed to the high adoption of these systems at diagnostic centers and increasing preference of people for these places for early disease diagnosis.

High Prevalence Of Chronic Diseases Supporting North America As The Largest Contributor to Industry

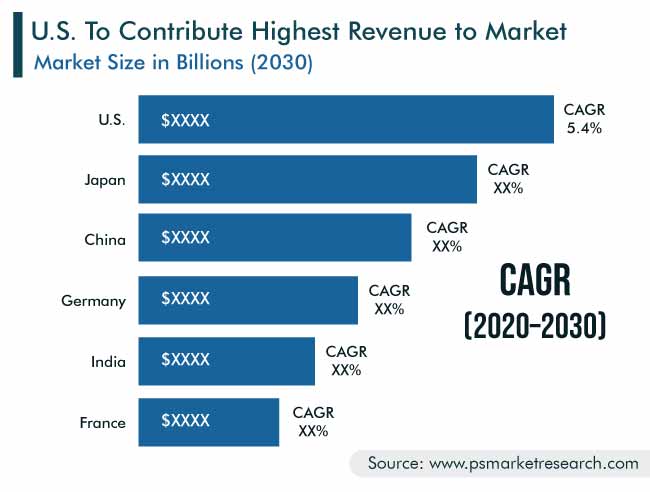

Geographically, North America was the largest contributor to the diagnostic imaging systems market in 2019. This is mainly attributed to the increasing prevalence of chronic diseases, presence of a large number of modern hospitals and diagnostic centers, and rising healthcare spending in the region.

The Asia-Pacific (APAC) region is expected to witness the highest growth rate during the forecast period in the market, owing to the growing cases of chronic diseases and increasing number of diagnostic imaging centers across the region.

Product Launches Are Key Trends in Industry

Product launches are bringing advanced diagnostic imaging technologies to the market, thereby facilitating high-quality imaging in healthcare institutions and access to advanced diagnosis with quick and accurate results to patients. For instance, in December 2019, Shenzhen Mindray Bio-Medical Electronics Co. Ltd. launched DC-90 with X-Insight, which is a comprehensive and dedicated solution to ultrasound imaging, which helps in enhancing the diagnostic capabilities and improving the clinical workflow.

Aging Population Is Leading To Surge in The Requirement Of Early Disease Diagnosis

According to the UN report World Population Ageing 2019, the population of people aged 65 years or above is growing at a high rate globally. Their number is expected to increase from 703 million in 2019 to 1.5 billion by 2050. Moreover, the older population requires extensive care, as it is more prone to illnesses, especially chronic diseases, owing to their low immunity levels, thus contributing significantly to the rising demand for imaging systems for diagnosis and therapy.

Growing Healthcare Expenditure Supports The Rising Adoption of the Diagnostic Imaging Systems

According to the WHO, the increasing healthcare expenditure is leading to the improving healthcare infrastructure. Governments are investing a significant portion of their gross domestic product (GDP) in improving the healthcare infrastructure. For example, according to the World Bank, the healthcare spending of the U.S., China, India, and Brazil in 2010 was 16.4%, 4.2%, 3.2%, and 7.9% of the GDP, which increased to 17.0%, 5.1%, 3.5%, and 9.4% in 2017, respectively. This, in turn, is boosting the diagnostic imaging systems market by leading to high product sales.

Growing Prevalence of Chronic Diseases is Giving Rise to The Sale of Diagnostic Imaging Systems

Globally, CVDs, cancer, chronic obstructive pulmonary disease (COPD), and type 2 diabetes are the most-prevalent chronic diseases, and the common biological risk factors for them are high blood pressure, high cholesterol, and obesity. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. have a chronic disease. Moreover, according to the International Agency for Research on Cancer (IARC), in 2018, the number of new cases of cancer was 18.1 million and that of cancer-related deaths was 9.6 million. Therefore, the rising prevalence of chronic diseases is leading to a huge requirement for regular check-ups and diagnostic services, and, in turn, the global diagnostic imaging systems market advance.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$38.9 Billion |

Forecast Period CAGR |

5.8% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Regional and Country Breakdown; Impact of COVID-19; Regulatory Scenario; Companies’ Strategic Developments; Company Profiling; Competitive Benchmarking |

Market Size by Segments |

By Product; By Application; By End-User; By Region |

Market Size of Geographies |

U.S.; Canada; Germany; France; U.K.; Italy; Spain; Russia; Netherlands; Switzerland; Sweden; Japan; China; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa |

Secondary Sources and References (Partial List) |

American Institute for Cancer Research; Centers for Disease Control and Prevention; Centers for Medicare & Medicaid Services; German Medical Association; National Institutes of Health; Organisation for Economic Co-operation and Development; U.S. National Library of Medicine; United Nations; World Bank Group; World Cancer Research Fund; World Health Organization; World Heart Federation |

Explore more about this report - Request free sample

Market Players Are Introducing New Products to Gain Competitive Edge

The global diagnostic imaging systems market has major key players such as General Electric Company, Siemens AG, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, FUJIFILM Holdings Corporation, Hitachi Ltd., Agfa-Gevaert N.V., and Canon Inc.

In recent years, players in the diagnostic imaging systems industry have been involved in product launches, in order to stay ahead of their competitors. For instance:

- In August 2020, Carestream Health Inc. launched the DRX-Compass X-ray System, which offers a flexible and scalable approach to digital imaging and helps in vertical auto-tracking and auto-centering, for hospitals and diagnostic imaging centers.

- In July 2020, Hologic Inc. launched the SuperSonic MACH 40 ultrasound system (a cart-based system) in the U.S. The system provides a high image quality, various imaging modes, and better efficiency and accuracy.

Some of the Key Players in the Diagnostic Imaging Systems Market Are:

-

General Electric Company

-

Siemens AG

-

Koninklijke Philips N.V.

-

Drägerwerk AG & Co. KGaA

-

FUJIFILM Holdings Corporation

-

Hitachi Ltd.

-

Agfa-Gevaert N.V.

-

Canon Inc.

-

Carestream Health Inc.

-

Shimadzu Corporation

-

Esaote S.p.A.

-

Mindray Bio-Medical Electronics Co. Ltd.

-

Analogic Corporation

-

Samsung Electronics Co. Ltd.

Market Size Breakdown by Segment

The global diagnostic imaging systems market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Product

- X-Ray Imaging Systems

- By technology

- Digital

- Analog

- By portability

- Stationary

- Portable

- By technology

- Magnetic Resonance Imaging (MRI) Systems

- By type

- Closed

- Open

- By field strength

- Mid

- High

- Low

- By type

- Ultrasound Systems

- By technology

- Three-dimensional (3D) and four-dimensional (4D)

- Two-dimensional (2D)

- Doppler imaging

- By portability

- Trolley/cart-based

- Compact/portable

- By technology

- Computed Tomography (CT) Scanners

- By slice

- High

- Mid

- Low

- By slice

- Nuclear Imaging Systems

Based on Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Urology

- Dentistry

- Ophthalmology

- Obstetrics/Gynecology (OB/GYN)

Based on End User

- Diagnostic Imaging Centers

- Hospitals

- Others

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Spain

- U.K.

- Netherlands

- Switzerland

- Sweden

- Asia-Pacific (APAC)

- Japan

- China

- India

- Australia

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws