Demulsifier Market Future Prospects

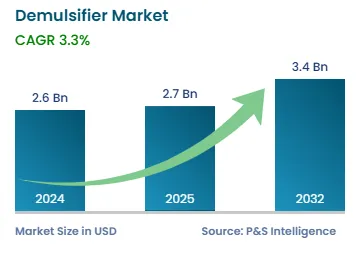

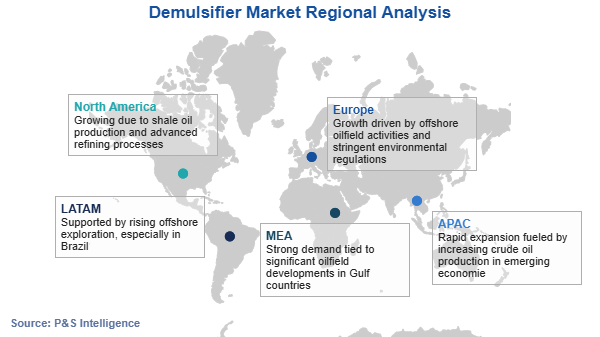

The global demulsifier market was valued at USD 2.6 billion in 2024, and it is expected to grow at a CAGR of 3.3% during 2025–2032, to reach USD 3.4 billion by 2032. This growth can be attributed to the surging demand for crude oil and oil derivative products and the growing end-use sectors, including oil sludge treatment, lubricant manufacturing, and pesticide manufacturing. Moreover, an increase in the number of oil discoveries and mature oil fields and the upsurge in refined petroleum demands are expected to offer lucrative opportunities for industry players.

Specialty chemicals called demulsifiers or emulsion breakers are used to separate water from crude oil. During the extraction of this oil from reservoirs, it is combined with either injection water or natural formation water. Therefore, failure to remove the maximum amount of water prior to oil refining might lead to serious problems.

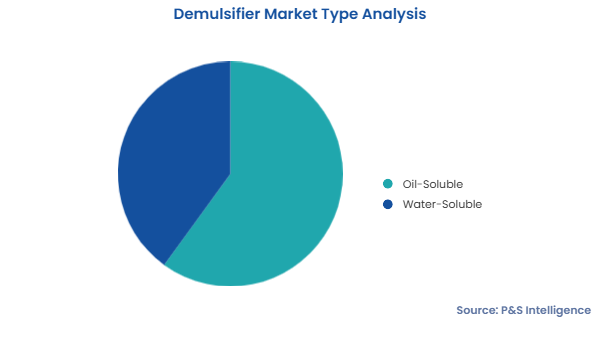

The demulsification of water-in-oil and oil-in-water emulsions is the main usage of demulsifiers in this industry. The need for these products is expected to rise throughout the forecast period, as global fuel refining, both onshore and offshore, increases. The effective and speedy separation of water from crude oil, which maximizes the value of the oil and lowers operating costs, is a crucial step in the refining process.

Moreover, the market will increase as a result of the surging demand for petroleum products, including kerosene, gasoline, diesel, and others. Additionally, the need for lubricants and premium engine oil for aircraft and automobiles is rising, which supports the demand for emulsion breakers. The petroleum industry utilizes emulsion breakers to separate oil and wastewater before disposal, in order to protect aquatic life and reduce environmental contamination.

Moreover, demulsifiers are highly needed, as the lubricant industry expands since failing to separate water may have a number of detrimental effects on a vehicle's parts, including rust and corrosion, component breakage, and viscosity loss. Therefore, emulsion breakers are used to separate water from lubricants. Furthermore, a key opportunity for players in the market is the rising amount of sludge produced by the petroleum industry, as a result of expanding refining operations.