Data Center Power Market Analysis

Explore In-Depth Data Center Power Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 12319

Explore In-Depth Data Center Power Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

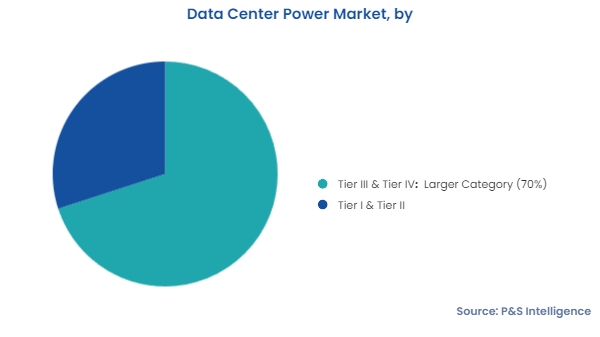

The tier III & tier IV category leads the market, with 70% revenue share, in 2024. It will also witness the higher CAGR, of 6.8%, during the forecast period. This is largely due to the fact that these categories offer N+1 and 2N redundancy, which means the architecture can sustain the entire IT load, while also including extra components for power backup, thus ensuring that performance is not harmed if a single component fails. During a disturbance, redundant systems take over, to ensure operations are not affected.

Some other benefits of tier III & tier IV variants include 99.982% and 99.995% uptime, respectively, a maximum of 26.3 minutes to 1.6 hours of downtime per year, N+1 fault tolerance, ensuring at least 72-hour power outage protection, and power-packed arrangement to deal with undesirable events, such as component failures, power fluctuations, and catastrophes.

Data centers of the following tiers have been analyzed:

UPS systems dominate the market in 2024, with 40% share. This is because they ensure the continuous operations of large data centers and protect critical equipment across the facility. They include multiple configurations and dual-bus capabilities to ensure critical systems continue to operate in the event of power outages, blackouts, sags, and surges. UPS systems for the modular creation of a fully redundant power and control system can be sized to meet the critical equipment's power requirement. When power needs change, the capacity may be simply added, without expanding the system footprint. Owing to such factors, the installation of UPS systems in the data center power infrastructure is significantly high.

The PDUs category will grow the fastest, with 7.2% CAGR, during the forecast period. They receive power from the grid and distribute it to various data center systems via individual sockets. Moreover, modern PDUs integrated with IoT provide real-time power consumption insights and operational data, allowing operators to predict malfunctions before they occur.

The following equipment types have been covered:

The large category is the larger in 2024, and the faster-growing over this decade, with 7.0% CAGR. Facilities over 25,000 square feet in floor area fall in this category, and they have multiple servers, network switches, lighting panels, HVAC systems, fire and intrusion alarms, and other electrical systems. Therefore, their electricity requirement is much more than that of small and mid-sized facilities. Additionally, the growing focus on hyperscale data centers, which are huge facilities that can operate more cost-effectively due to economies of scale, drives the market in this category.

The segment is bifurcated as follows:

The IT and telecom category is expected to dominate the vertical segment with a share of 35% in 2030. It will also witness the highest CAGR during the forecast period. Huge amounts of data are being generated as a result of the extensive use of advanced technologies, such as IoT, cloud computing, and AI. This data originates from mobile internet usage, personnel records, network equipment, server logs, billing activity, and social networks.

The report covers the below-mentioned verticals:

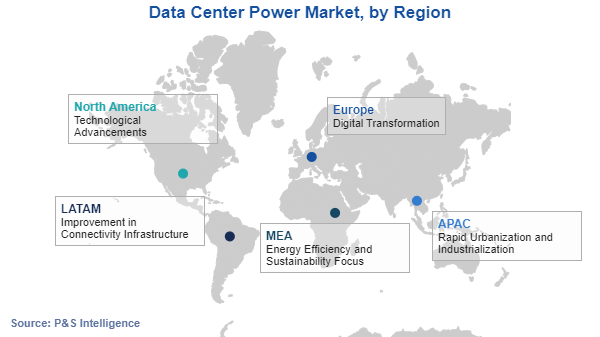

In 2024, North America holds the largest revenue share in the data center power market, of 40%. This is ascribed to the region's substantial investment in R&D, which is resulting in the establishment of next-generation facilities, which are more technologically advanced and efficient in terms of power management. It is also home to a number of data center developers, which is expected to have a positive impact on the market. The U.S. has a massive lead in the number of data centers around the world, with over 5,300, which is almost 10 times more than the next contender—Germany—which has around 520.

Moreover, APAC is projected to be the fastest-growing region in the coming years, with 7.5% CAGR, due to the deployment of edge computing locations across many countries, including India, Japan, and China. Furthermore, the government of these countries is promoting data centers, as well as investing heavily in infrastructure development.

In February 2021, under a 10-year plan aimed at developing Malaysia's digital economy, the Malaysian government planned to spend up to USD 13 billion (RM 56 billion) on infrastructure, for faster and wider internet connectivity.

In September 2020, India's Ministry of Electronics and Information Technology declared that it is working to increase the digital economy's contribution to 20% of the GDP in the next five years.

These regions and countries have been studied:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages