Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,798.8 Million |

| 2030 Forecast | 3,645.2 Million |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12778

Get a Comprehensive Overview of the Contact Adhesives Market Report Prepared by P&S Intelligence, Segmented by Technology (Water-Based, Solvent-Based), Resin Type (Neoprene, Polyurethane, Acrylic, SBC), End User (Construction, Automotive, Woodworking, Leather & Footwear), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,798.8 Million |

| 2030 Forecast | 3,645.2 Million |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global contact adhesives market revenue is USD 2,798.8 million in 2024, which is set to reach USD 3,645.2 million by 2030, growing at a CAGR of 4.5% during 2024-2030.

This can be attributed to the surging demand for these adhesives from the building & construction sector and increasing production of automobiles. The leather & footwear industry also use them extensively. Further, the technological innovations in these agents amidst the shift toward sustainable practices are fueling the market growth.

A contact adhesive, which is also called contact cement, is applied to all the surfaces to be joined, with a roller, brush, or spreader; it is then left to dry for a certain period. Upon the surfaces being pressed onto each other, a strong and permanent bond is formed. Keeping all the bondable surfaces dry, clean, and free of oils, dust, and other contaminants is crucial, so the adhesion happens without any problem.

Further, fillers, solvents, and various other kinds of additives are often mixed into them in order to modify the drying time, flexibility, bonding strength, and other characteristics. Moreover, they have a long ‘open time’, which is their ability to allow users to change the position of the surfaces being bonded during the cross-linking and drying phases. This makes the bond stronger and more durable.

Moreover, many types of contact adhesives are available, each possessing specific advantages and applications. For instance, neoprene variants create strong bonds, offer good temperature resistance, and enable high flexibility. They can be used on an array of materials, such as metals, wood, fibers, plastics, and leather. These agents, which carry a solvent, lead to great initial bond strength, quick drying, and high heat and moisture resistance, thus well suited for applications where fast and durable bonds are needed.

Additionally, water-based variants’ primary applications are projects involving paper, lightweight fabric, cardboard, and crafts. They are non-toxic and contain low concentrations of volatile organic compounds (VOC), which makes them safe and environment-friendly over solvent-based variants. They are also easy to clean, have weak odors, and provide great bonding strength for lightweight materials.

Further, contact adhesives that can withstand high temperatures are widely consumed in applications where heat resistance is a necessity, including automotive engines and industrial machinery. Moreover, polyurethane contact adhesives offer great flexibility and excellent heat, water, and chemical resistance. These features help them in providing strong and durable bonds even in challenging environments, such as a varying intensity of movement and stress.

The market for contact adhesives is driven by their surging usage in various industries, technological innovations in them, rising population, and surging awareness of these products. Emerging economies are contributing to a great extent as construction activities are underway on a large scale to cater to a booming population. The surging awareness of the advantages of contact adhesives in the automotive, woodworking, and leather & footwear sectors is also boosting the market growth.

Essentially, due to the expansion in the building & construction sector, the demand for furniture and wood flooring is surging, and these products employ contact adhesives in significant volumes. In this regard, the market is growing at a good rate in Asia-Pacific owing to the presence of India and China, which are witnessing noticeable population growth.

Moreover, these agents are used extensively in the automotive sector in interior trim installation, fabric & upholstery, rubber & weatherstripping, glass & rearview mirrors, and other applications. The demand for and production of automobiles have significantly increased in the previous few years owing to the surging rates of industrialization and globalization. Further, to meet the growing demand for low-emission automobiles, the industry is shifting from welding metallic engine parts to using contact adhesives on composite, fiber, and plastic components. This is being done in order to enhance fuel efficiency, by decreasing vehicles’ weight.

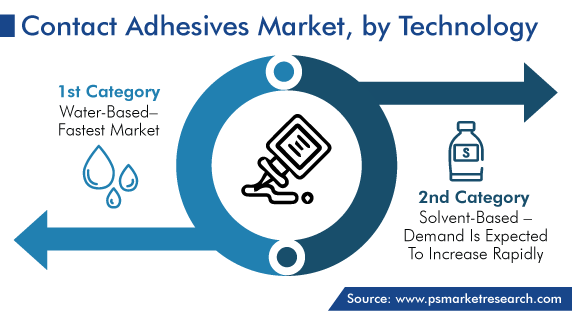

In the technology segment, the water-based category will experience the highest CAGR, of 4.8%, till 2030.

This is due to the surging demand for sustainable products and the added advantages of water-based adhesives over solvent-based ones. Among the most common of these products is produced using polyvinyl acetate and a synthetic polymer. It is clear, colorless, and non-toxic and emits less VOCs, which allows it to allay environmental concerns. These adhesives are also safer as they are less flammable and less likely to cause skin irritation. On similar lines, natural rubber adhesives are made using natural rubber, which is a renewable source, and they possess flexibility, robustness, and non-toxicity.

Moreover, there has been continuous development in the technologies used for producing water-based adhesives. This, in turn, has led to an improved performance and cost-effectiveness, which further contributes to the market growth.

The acrylic category will experience the highest CAGR, of 5.2%, in the forecast period, under the resin type segment.

This growth is ascribed to the surging demand for these variants from developing countries as a result of the massive infrastructure development underway. These adhesives are extensively used in the construction sector owing to their excellent bonding properties and durability with various materials, including wood, metals, plastics, and glass. Acrylate-based adhesives are produced by polymerizing acrylate and methyl methacrylate monomers. They feature appreciable sunlight and water resistance and stability amidst temperature fluctuations, which lead to their increasing application in numerous industries. With the surging demand for better performance, ease of use, and durability, the market for acrylic-based contact adhesives is growing.

Moreover, the neoprene category holds a considerable share, and it is expected to grow at a good rate during the prediction period. This is due to the flexibility, durability, and ease of use of these variants. Neoprene is also resistant to water, chemicals, and heat, which makes it perfect for multiple applications, especially construction and footwear, which entail constant exposure to these elements. It is a synthetic rubber that is produced by the combination of chloroprene rubber, resins, solvents, and additives.

Drive strategic growth with comprehensive market analysis

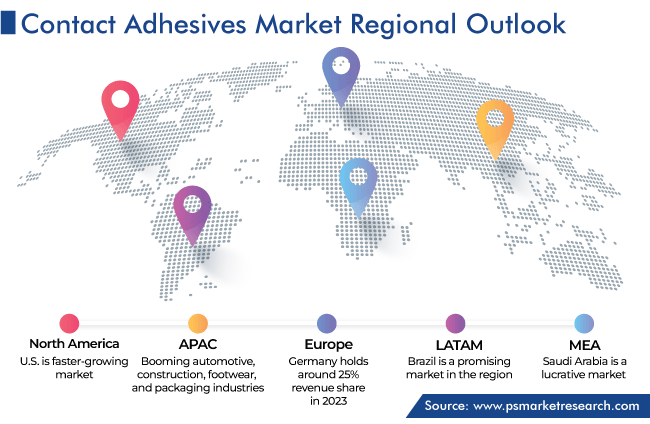

The Asia-Pacific region accounts for the largest market share, of 55%, and it will witness a considerable CAGR, of 4.7%, during the prediction period, primarily driven by the booming automotive, construction, footwear, and packaging industries. China, India, Pakistan, and Bangladesh have large populations, which leads to high requirements for every kind of product manufactured by using contact adhesives.

The Chinese government has declared plans to build megacities over the next few years in order to handle the increasing population. Multiple airport construction projects are also going on in China, as the government is planning to meet the future demand for air travel. In the same way, the Indian government has declared plans to build 100 new airports by 2032, which will further add to the demand expansion of contact adhesives.

Additionally, governments are providing support to the manufacturing sector in India, Indonesia, Malaysia, and Thailand. This is leading to a surge in the investments and production in the automotive sector. China is the largest vehicle manufacturer in the world, and automakers are moving in the direction of electric vehicles, in view of the rising environmental concerns.

Additionally, China and India are leading the global packaging industry, where contact adhesives are widely used. The increasing popularity of e-commerce, rising usage of online food delivery platforms, and innovations in packaging materials and technology are propelling the growth of the market in this regard.

This fully customizable report gives a detailed analysis of the contact adhesives market, based on all the relevant segments and geographies.

Based on Technology

Based on Resin Type

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages