Report Code: 12248 | Available Format: PDF | Pages: 637

Water-Based Adhesive Specialty Tapes Market Research Report: By Resin Type (Acrylic Polymer Emulsion, Styrene Butadiene Latex, Polyvinyl Acetate Emulsion, Polyurethane Dispersion, Vinyl Acetate Ethylene Emulsion) - Global Industry Trends and Growth Forecast to 2030

- Report Code: 12248

- Available Format: PDF

- Pages: 637

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

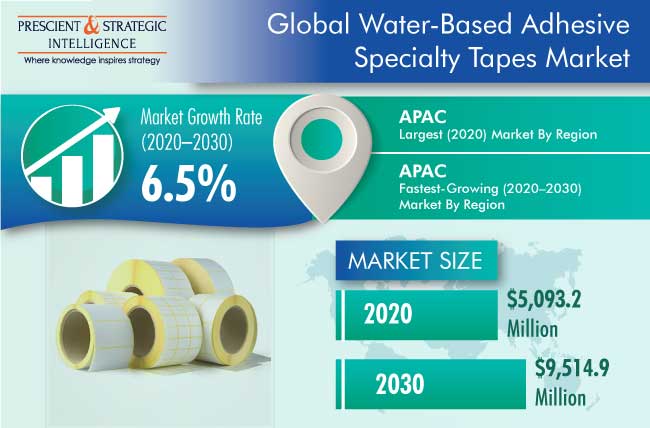

The global water-based adhesive specialty tapes market was valued at $5,093.2 million in 2020, and it is expected to grow at a CAGR of 6.5% during 2020–2030. The key factors responsible for the growth of the market include the expanding automotive industry, increasing product demand from the healthcare industry, and benefits of water-based adhesive specialty tapes over traditional bonding methods.

During the COVID-19 pandemic, the market for water-based adhesive specialty tapes has a neutral impact due to the implementation of lockdowns and sealing of international borders. Beyond transportation-related delays arising from travel restrictions and some driver shortage issues, COVID-19 hasn’t hugely impacted the supply of raw materials for adhesives and sealants. Besides, sectors that use adhesives and sealants are experiencing varying levels of demand for them due to both the pandemic and massive reduction in oil prices. For instance, the demand for these adhesive formulations has increased for residential projects and in the medical devices sector.

PVA Emulsion Held Dominating Share due to Its Better Weather Resistance

The polyvinyl acetate (PVA) emulsion category held the dominating share in the water-based adhesive specialty tapes market, both in terms of value and volume, based on resin type, in 2020. This is majorly attributed to the fact that PVA adhesives produce clear, hard films that have good weather resistance and can withstand water, grease, oil, and petroleum fuels. Additional properties are high initial tack, almost-invisible bond line, softening at 30–45 °C, good biodegradation resistance, and low cost.

Construction Industry Held Largest Market Share owing to High Durability Requirements of Buildings

The construction industry held the largest share of the water-based adhesive specialty tapes market for PVA emulsions in 2020, based on industry. This was majorly due to the rising demand for these adhesives for various applications, such as waterproofing, coatings, and mortar modifications. Moreover, the development of smart cities and affordable housing is expected to increase the demand for PVA-emulsion-adhesive specialty tapes in the construction industry.

Construction Industry To Witness Fastest Growth in APE Market due to APE’s Non-Flammable Property

The construction industry is expected to be the fastest-growing category in the market for acrylic polymer emulsion (APE) water-based adhesive specialty tapes during the forecast period. This will primarily be due to the large-scale consumption of APE-adhesive-based specialty tapes on account of their excellent performance and non-flammable property. Moreover, these can be formulated into overprint varnishes and inks to impart water resistance, rub resistance, alkali resistance, and high gloss.

Asia-Pacific (APAC) Region Dominated Market due to Rising Disposable Income

Geographically, the APAC region held the largest share in the global market for water-based adhesive specialty tapes in 2020, and it is also expected to lead the market during the forecast period. This can be attributed to the expanding automotive, healthcare, and electrical and electronics sectors, complemented by the economic growth and rise in the disposable income, in the region.

Expanding Automotive Industry Is Driving Market Growth

Water-based adhesive specialty tapes find wide applications in the automotive industry, as such double-sided tapes, protection tapes, and foam tapes are easy to fix and remove. According to the International Organization of Motor Vehicle Manufacturers (OICA), automobiles sales numbered 77.6 million units in 2020, and it is expected to increase further in the upcoming years. Developments in the automotive technology and introduction of new automobiles, such as smart cars and aluminum trucks, are expected to drive the water-based adhesive specialty tapes market in the coming years.

Increasing Product Demand from Healthcare Industry Is also Propelling Market Growth

According to National Institution for Transforming India (NITI) Aayog, the Indian healthcare industry size is expected to touch $372 billion by 2022. Water-based adhesive specialty tapes in the healthcare industry find application as surgical tapes and waterproof tapes, for covering incisions and wounds. These tapes have antigenic properties, and they hold tightly onto the skin, bandage, or dressing material. Hence, the rise in the demand for medical products, advancements in technology, and growing investment in the healthcare industry are expected to drive the growth of the market for water-based adhesive specialty tapes during the forecast period.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$5,093.2 Million |

Market Size Forecast in 2030 |

$9,514.9 Million |

Forecast Period CAGR |

6.5% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Resin Type; By Industry; By Region |

Market Size of Geographies |

U.S.; Canada; Germany; France; U.K.; Italy; Spain; China; Japan; India; Australia; South Korea |

Secondary Sources and References (Partial List) |

3M Company, Nitto Denko Corporation, tesa SE, LINTEC Corporation, Avery Dennison Corporation, Intertape Polymer Group Inc., Shurtape Technologies LLC, Scapa Group plc, Lohmann GmbH & Co. KG, Nichiban Co. Ltd. |

Explore more about this report - Request free sample

Market Players Involved in Product Launches to Gain Significant Position

In recent years, players in the water-based adhesive specialty tapes industry have been involved in product launches in order to attain a significant position. For instance:

- In August 2020, Bostik SA launched a water-based adhesive, namely Aquagrip 3720, for automotive interior assembly applications. This product is ideal for bonding low-surface-energy, rigid substrates to closed-cell foam and foam-backed materials. The product improves process efficiencies and product performance, while reducing the environmental impact and enhancing worker safety. The one-component Aquagrip 3720 is formulated with no isocyanates, with no mixing.

- In April 2018, Shurtape Technologies LLC expanded its safety and marking product portfolio with the launch of Shurtape FM 200 flagging tapes, for use in various temporary applications, such as color coding, tagging, designating hazards, indicating survey boundaries, and marking trails.

Key Players in Global Water-Based Adhesive Specialty Tapes Market Are:

-

3M Company

-

Nitto Denko Corporation

-

tesa SE

-

LINTEC Corporation

-

Avery Dennison Corporation

-

Intertape Polymer Group Inc.

-

Shurtape Technologies LLC

-

Scapa Group plc

-

Lohmann GmbH & Co. KG

-

Nichiban Co. Ltd.

Market Size Breakdown by Segments

The water-based adhesive specialty tapes market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Resin Type

- Acrylic Polymer Emulsion (APE)

- Construction

- Automotive

- Electric vehicles (EVs)

- Styrene Butadiene (SB) Latex

- Construction

- Automotive

- EVs

- Polyvinyl Acetate (PVA) Emulsion

- Construction

- Automotive

- EVs

- Polyurethane Dispersion (PUD)

- Construction

- Automotive

- EVs

- Vinyl Acetate Ethylene (VAE) Emulsion

- Construction

- Automotive

- EVs

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of the World (RoW)

In terms of value, the 2020–2030 CAGR for the market for water-based-adhesive specialty tapes would be 6.5%.

PVA emulsion witnesses the widest sales in the water-based-adhesive specialty tapes industry.

The market for water-based-adhesive specialty tapes is dominated by APAC.

The water-based-adhesive specialty tapes industry is driven by the growing auto sector, rising healthcare spending, and benefits of such adhesives over traditional bonding materials.

The market for water-based-adhesive specialty tapes is fragmented.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws