Europe Construction Material Handling Machinery Market Future Prospects

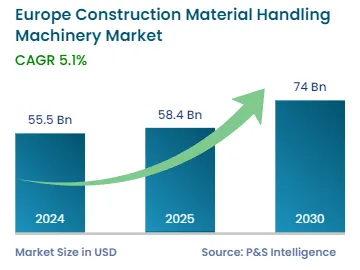

The European construction material handling machinery market size is estimated to have stood at USD 55.5 billion in 2024, and it is expected to advance at a CAGR of 5.1% during 2024–2030, to reach USD 74.0 billion.

Some of the major factors driving the industry include the increasing labor cost in the construction sector, rising demand for modular and offsite buildings, surging investments in infrastructure, and increasing development of smart cities in the region.

For instance, technologically advanced machinery increases productivity and minimizes the cost of a construction project. Other major factors that drive the industry include the increase in labor costs and the surge in demand for modular and offsite buildings.

In addition, several companies in this region, such as Liebherr-International Deutschland GmbH, KION Group AG, Kalmar Electric Reachstacker, Cargotec Corporation, and Jungheinrich AG, are strongly focusing on investing in the R&D sector and launching new products, which, in turn, contribute to the growth of the industry.

For instance, Kalmar Electric Reachstacker range includes eight models, six toplifts, and two combis, with lifting capacities of up to 45 tons and stacking up to six high and four rows deep.